What is Veritaseum?

“At it’s [sic] simplest, Veritaseum is the gateway to peer-to-peer capital markets,” the project’s website proclaims. The platform opens investor access to smart contracts and financial machines that allow them to manage their investments and transfer values with other Veritaseum users.

The platform’s goal is to eliminate brokers, financial advisors, banks, and other middlemen from the capital markets ecosystem, and its team would actively reject any labels that accuse Veritaseum of acting as these roles in their stead. Rather, they believe that Veritaseum is merely a vendor of services, a “distributed, serverless software” that allows its users to act both as the consumer and the middlemen the software is replacing.

How Does Veritaseum Work

On a fundamental level, Veritaseum offers its users the tools and software to engage in a peer-to-peer capital market. Using VERI, the platform’s utility token, users can purchase access rights to the smart contracts that manage the platform’s services.

These products range from self-custody escrow services to financial analytics/research data and even asset tokenization. All of these services make up the collective Veritaseum platform, and each can be accessed independently from each other.

At the time of this writing, only one product, VeADIR, has an active beta.

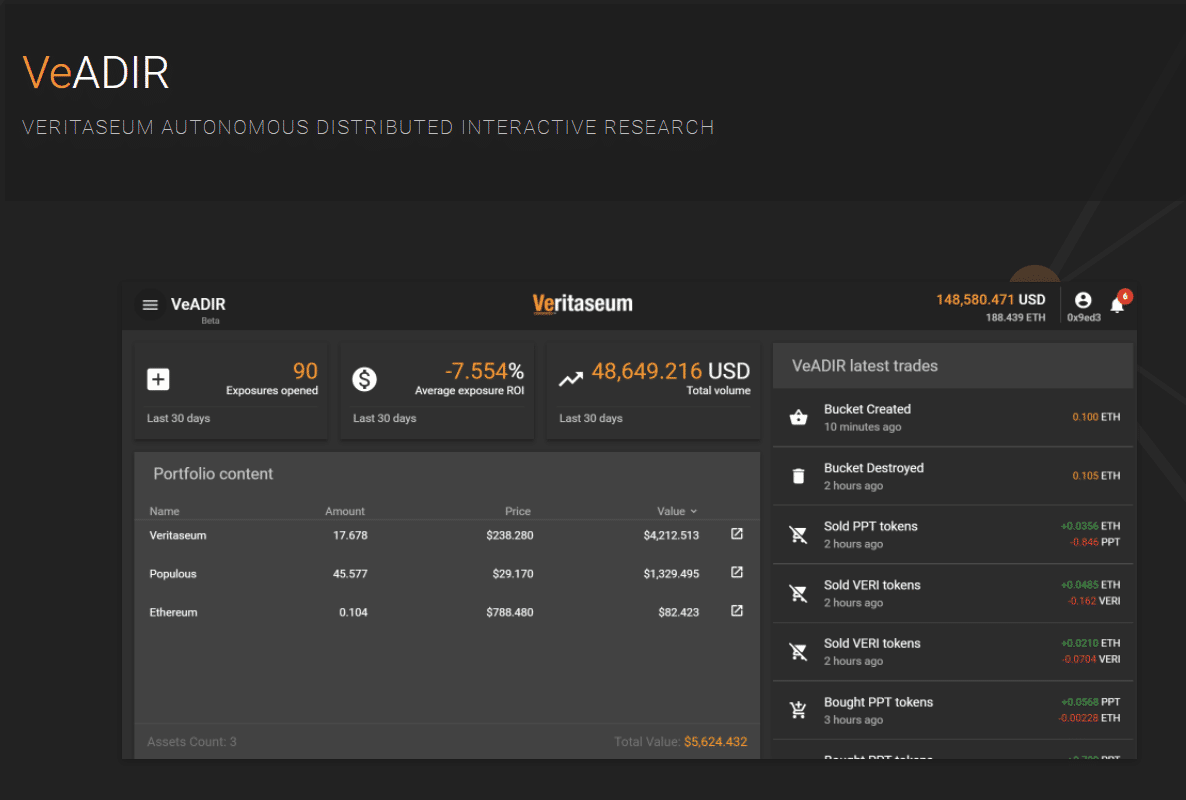

VeADIR

Short for Veritaseum Autonomous Distributed Interactive Research, VeADIR is the platform’s research muscle. VeADIR pulls data from Veritaserum in exchange for VERI, and interested parties, in turn, can pay for these research findings. All of the findings are presented in machine language algorithms, though, so users will have to use a smart contract to translate them into a common vernacular.

In addition, users can request data by asking VeADIR questions on a pay-per-query basis, and this feeds the research models. If users request research on a certain organization, VeADIR pays this organization VERI for this information. On the flip side, an entity can petition VeADIR to be analyzed and compensated in VERI, as well.

VeADIR also makes purchases based on this research, such as investing in a platform token or distressed credit. It then constructs a “model portfolio” dictated by its findings, and platform users can likewise purchases these portfolios on a periodic basis.

To give you a rundown of how this would work, here’s a quick example:

Jim Bob Cooter’s Bourbon Street Investment Group wants to put money into an ICO, but they want comprehensive data on this ICO, the industry they’re trying to disrupt, and other relevant investor information.

Jim Bob et al then submit a request to VeADIR and fill out a questionnaire with the data they would like to receive. VeADIR pools this information from the ICO and sends it to Veritaseum for processing.

After Veritaseum crunches the data, VeADIR retrieves the completed research, and Jim Bob Cooter’s Bourbon Street Investment Group then pays for the information and converts it from machine language to English (or French if they’re those kind of Cajuns).

VeRent

VeRent is the platform’s economic rent facility. The concept here is simple: it’s the tool with which users can participate in peer-to-peer token transactions.

Basically, you make an offer on the platform, setting how much of a coin/token you’re listing, the price you’ll trade for it, and the duration of the offering. It’s unclear the range of offerings that VeRent will accommodate, but as of now, it appears that VERI, ETH and a handful of ERC20 tokens are available on the service.

The team denies that VeRent functions as an exchange, but to be blunt, it facilitates currency trades between users so it’s unclear (to this author at least) how this deviates from any other exchange platform.

VeResearch

The human counterpart to VeADIR, VeResearch is the platform’s research vehicle driven by man made modules.

With VeResearch, the Veritaseum analytics team constructs investment models for any crypto asset the platform analyzes. These models are meant to work in tandem with those built by VeADIR, though investors will likely be able to purchase them separately (the website is not clear as to how users may go about accessing these models, though).

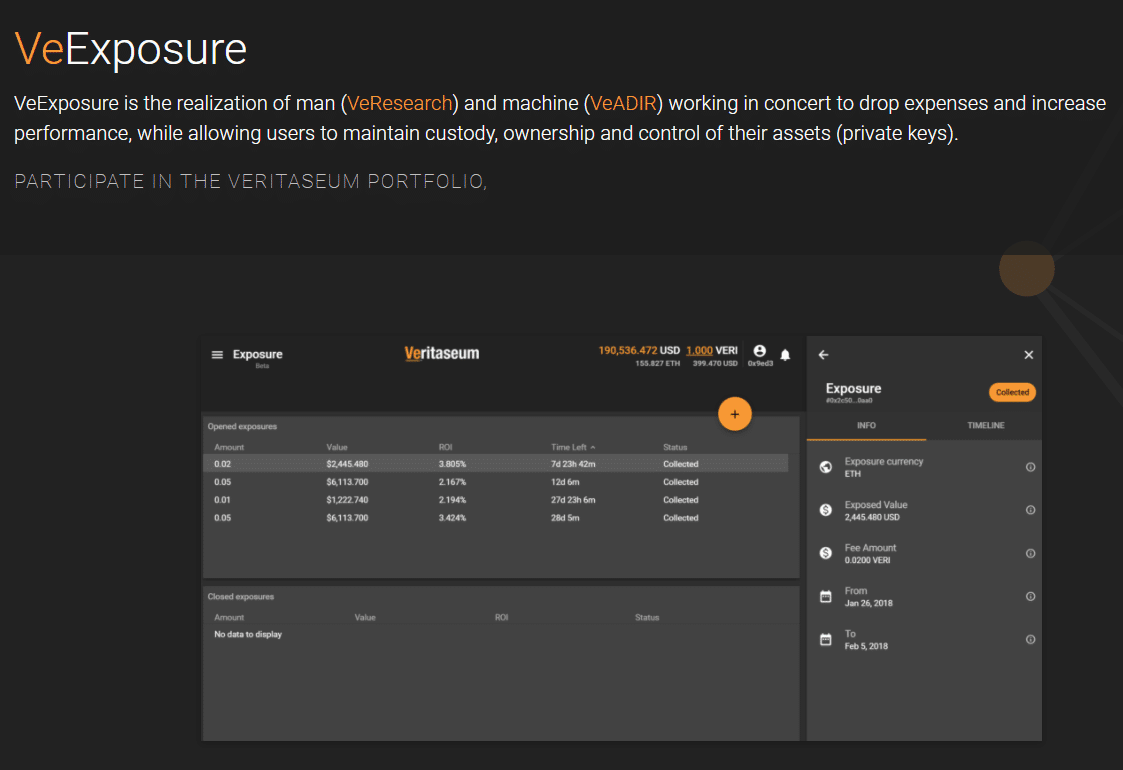

VeExposure

“VeExposure is the realization of man (VeResearch) and machine (VeADIR) working in concert to drop expenses and increase performance, while allowing users to maintain custody, ownership and control of their assets (private keys),” according to Veritaseum’s website.

All of that to say, VeExposure essentially serves as the app that gives users access to the “exposures” (i.e., data) that VeADIR offers. Using the app, users can send VERI to can exposure to any research offered on the platform.

VeManagement

VeManagement is Veritaseum’s portfolio management component. The app gives users a chance to view the model portfolios produced by VeResearch, allowing them to make adjustments or accept a portfolio by signing off on it with their private keys.

VeTokenization

Perhaps one of Veritaseum’s more notable services, VeTokenization permits anyone to submit a new tokenized asset to the platform by creating a new contract address on the Ethereum blockchain. Users can then view and manage tokenized assets using the product’s admin app.

With this function, you could theoretically produce a tokenized asset for anything (real estate, a government-issued bond, precious medals, even another cryptocurrency). So long as Veritaseum approves the asset, it can be tokenized and traded on the platform.

Veritaseum Team and Roadmap

Project founder Reggie Middleton is an entrepreneurial investor who has experience advising or managing hedge funds, traders, investors, and global banks. He’s also a self-proclaimed augur of “the fall of Bear Stearns, Lehman Brothers, GGP (2nd largest US retail REIT), and the European sovereign debt crisis amid nearly 100 successful macro and investment calls.”

Patryk Dworznik, the project’s full stack developer, has 15+ year of software engineering experience and is responsible for creating the Veritaseum java client. Manish Kapoor, Reggie’s right-hand man, has management experience in such companies as Deloitte and S&P India.

As of this writing, Veritaseum has no visible roadmap online, but you can keep up with project developments on the project’s blog.

Veritaseum Trading History

Currently, VERI is ranked 57th on CoinMarketCap, its usually ranking fluctuating within the 50-60 range.

baseUrl = “https://widgets.cryptocompare.com/”;

var scripts = document.getElementsByTagName(“script”);

var embedder = scripts[ scripts.length – 1 ];

(function (){

var appName = encodeURIComponent(window.location.hostname);

if(appName==””){appName=”local”;}

var s = document.createElement(“script”);

s.type = “text/javascript”;

s.async = true;

var theUrl = baseUrl+’serve/v3/coin/chart?fsym=VERI&tsyms=USD,EUR,CNY,GBP’;

s.src = theUrl + ( theUrl.indexOf(“?”) >= 0 ? “&” : “?”) + “app=” + appName;

embedder.parentNode.appendChild(s);

})();

Where to Buy Veritaseum

Impressively, VERI’s most active market is ForkDelta (formerly EtherDelta) with over 50% of the coin’s 24/hr volume in ETH/VERI trading pairs. You can also find it for BTC and ETH on Mercatox and HitBTC.

Where to Store Veritaseum

As an ERC20 token, VERI can be stored in any Ethereum compatible wallet (see the usual list: MyEtherWallet, Ledger Nano S, Trezor, Parity, MetaMask, etc.).

Conclusion (and Scam Allegations)

Before we wrap this article up, I’ve got to address the elephant in the room: Veritaseum’s laundry list of scam allegations.

Just go ahead and Google “Veritaseum scam” and you’ll see what I’m talking about. Crypto enthusiasts have accused Veritaseum of plagiarizing financial reports and Reggie Middleton of overplaying his expertise, and most all critiques involve attacking the official website for being unprofessional and lacking crucial information for understanding the makeup of the platform.

While writing this article, the website was frustrating to pull information from. There’s no white paper, no roadmap, and the platform’s operational explanations are, at times, obtuse and unclear. Now, calling a project a scam for this may be overblown, as it could be the simple product of ineptitude or over-hyping a product. That said, over-hyping might not be a sin, but it does call the team’s intentions into question per the quality of their product: are they trying to milk money from unsavvy investors who are looking for quality investment advice only to receive a substance-less report by unqualified analysts? Maybe. Buy hey, we haven’t purchased any of these services so we don’t know for sure.

One last thing. VERI has a circulating supply of ~2,000,000, but the total supply is 100,000,000. Damn right that’s a huge discrepancy–a 98% difference. This contributes to VERI having one of the lowest 24/hr trading volumes of any top 100 coin. Well, that and its largest market coming from ForkDelta, but these two go hand in hand as larger centralized exchanges haven’t listed the currency (perhaps for the same qualms Veritaseum critics have raised).

Call it FUD, call it unfounded, it’s up to the individual to decide whether these allegations be foul or fair. Our advice? Do your own thorough research before deciding whether or not Veritaseum is right for you, as there’s enough doubt here to raise some healthy skepticism.

The post What is Veritaseum (VERI)? A Beginner’s Guide appeared first on CoinCentral.

Coincentral.com is author of this content, TheBitcoinNews.com is is not responsible for the content of external sites.

Our Social Networks: Facebook Instagram Pinterest Reddit Telegram Twitter Youtube