Those of you who have been following markets closely these last few weeks have noticed that in addition to me travelling around a lot, a few of the emerging markets have been experiencing turbulence.

The US economy has been performing phantasmagorically, which in turn is causing the Federal Reserve to tighten the screws on the economy, which in turn, despite Donald Trump’s best wishes, is causing the Dollar to surge, especially against it’s much weaker counterparts.

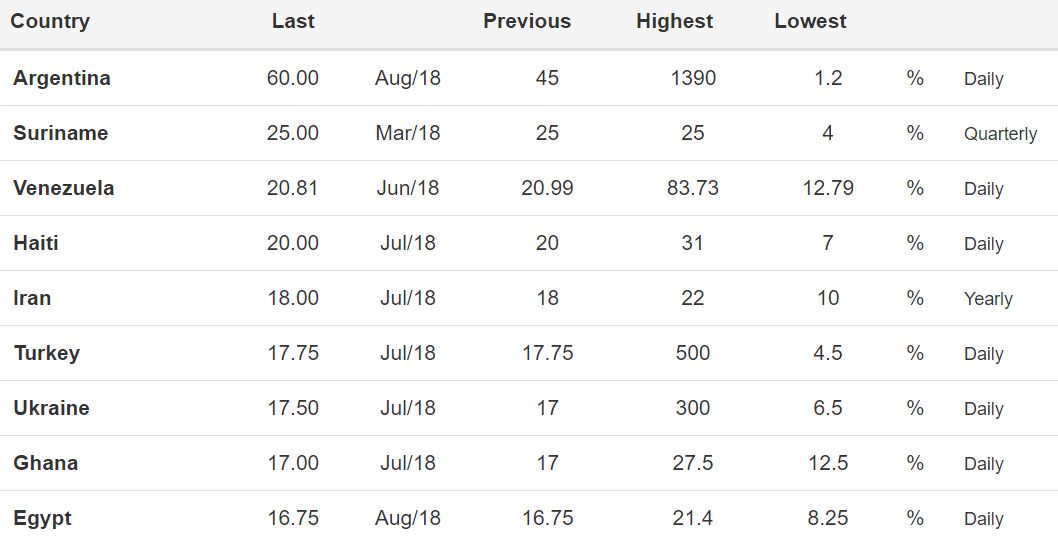

The Turkish Lira has been a main focus for many. Erdogan is doing his best to sweet talk the currency upwards this morning and has seen some mild success but the Lira is still on track to see its worst monthly performance in 17 years.

What really shocked global onlookers today was the announcement from Argentina’s central bank…

The Peso has dropped more than 100% against the US Dollar since the beginning of the year, prompting the Central Bank of Argentina to introduce what is currently the highest interest rate in the world…. by far.

It is in these countries where economic stability is lowest that cryptocurrencies could help most. Argentina, in particular, has turned to bitcoin several times in the last few years during times of economic distress and it seems that with the current curency depreciation, they have every incentive to do so again.

Please note: All data, figures & graphs are valid as of August 31st. All trading carries risk. Only risk capital you can afford to lose.

Traditional Markets

As far as it seems, we may see a new trade deal for North America today, or sometime this weekend. This ramps up pressure on China as Trump’s consideration of new tariffs on $200 Billion worth of trade looms.

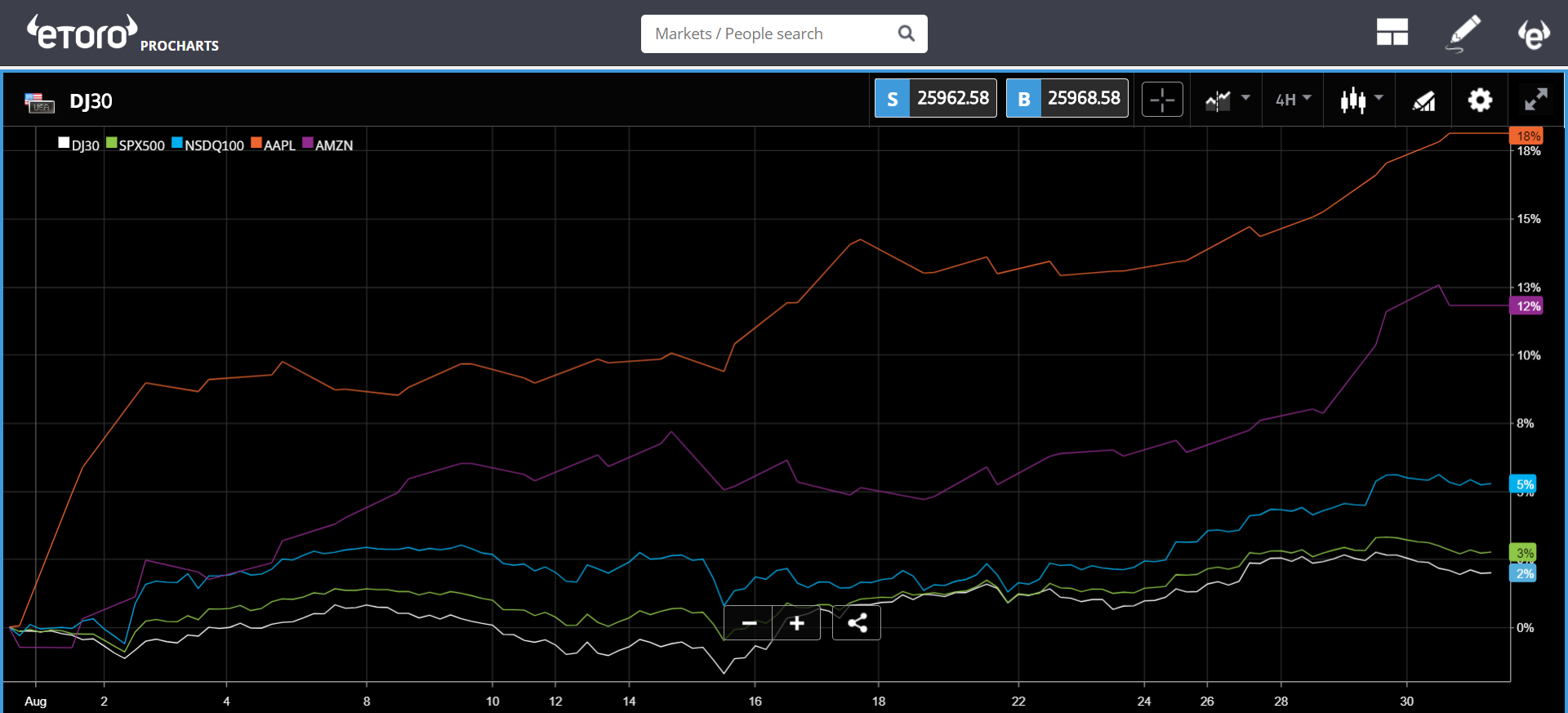

Asian and European stocks have been running red for the better part of the week and the United States joined them yesterday. Sill, even with yesterday’s down-tick Wall Street is still sitting pretty for the month.

Markets Consolidating

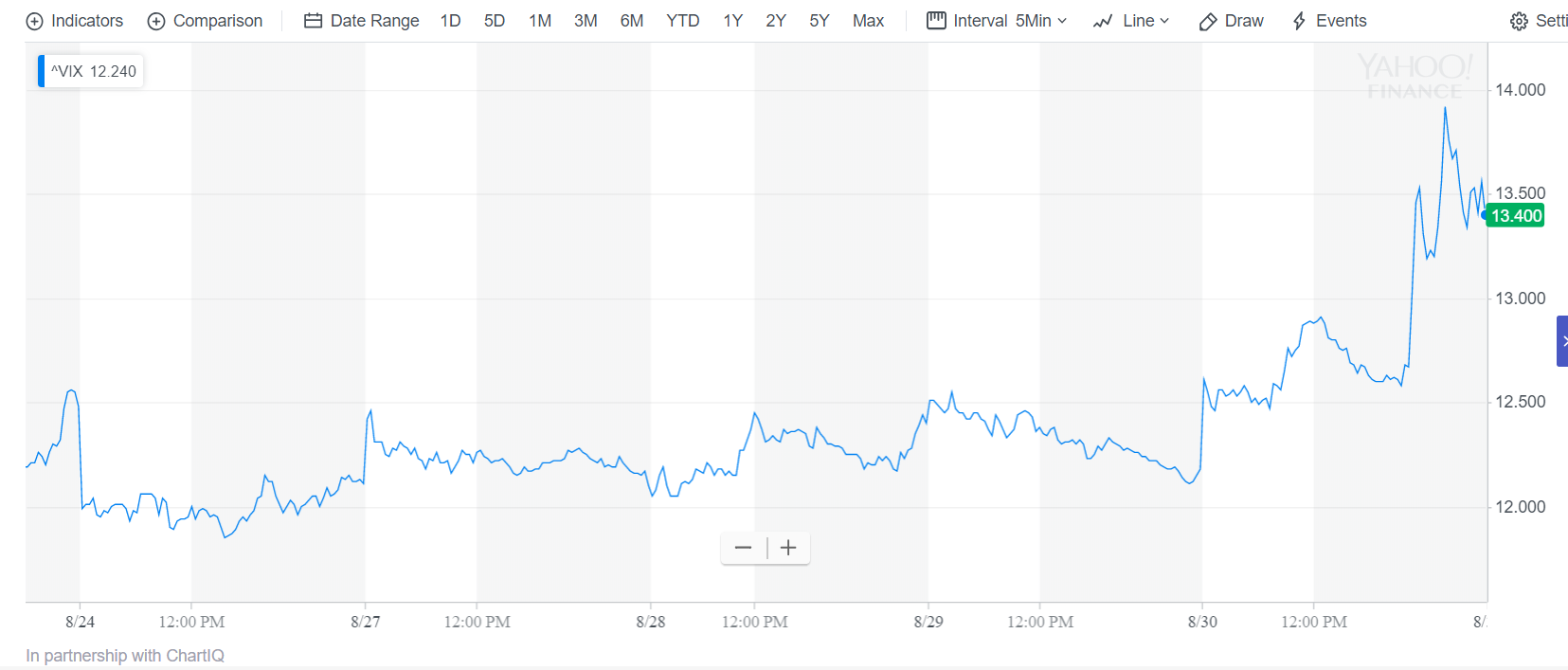

With the Dollar at a decision point, we’re seeing many markets in a period of consolidation. This shouldn’t be confused with relaxation though.

The VIX volatility index has spiked during yesterday’s session indicating that volatility is prevalent at this time.

Crypto As Well

The crypto markets also seem to be in consolidation mode. The two main outliers are EOS and IOTA, which are both up about 5% over the last 24 hours.

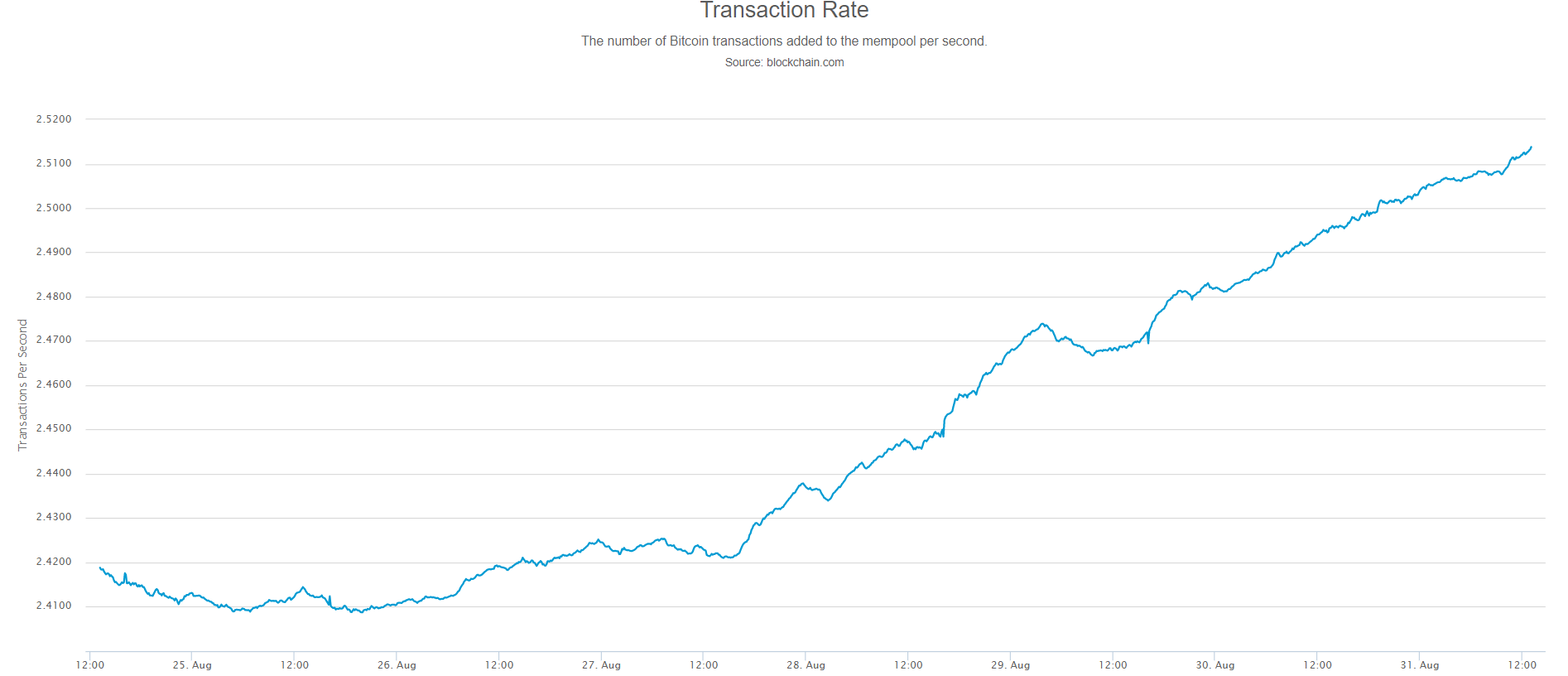

As in the traditional markets at this time, just because the price is experiencing little movement, don’t be fooled. There’s a lot going on under the surface. For example, check out Bitcoin’s transaction rate creeping up over the course of this week.

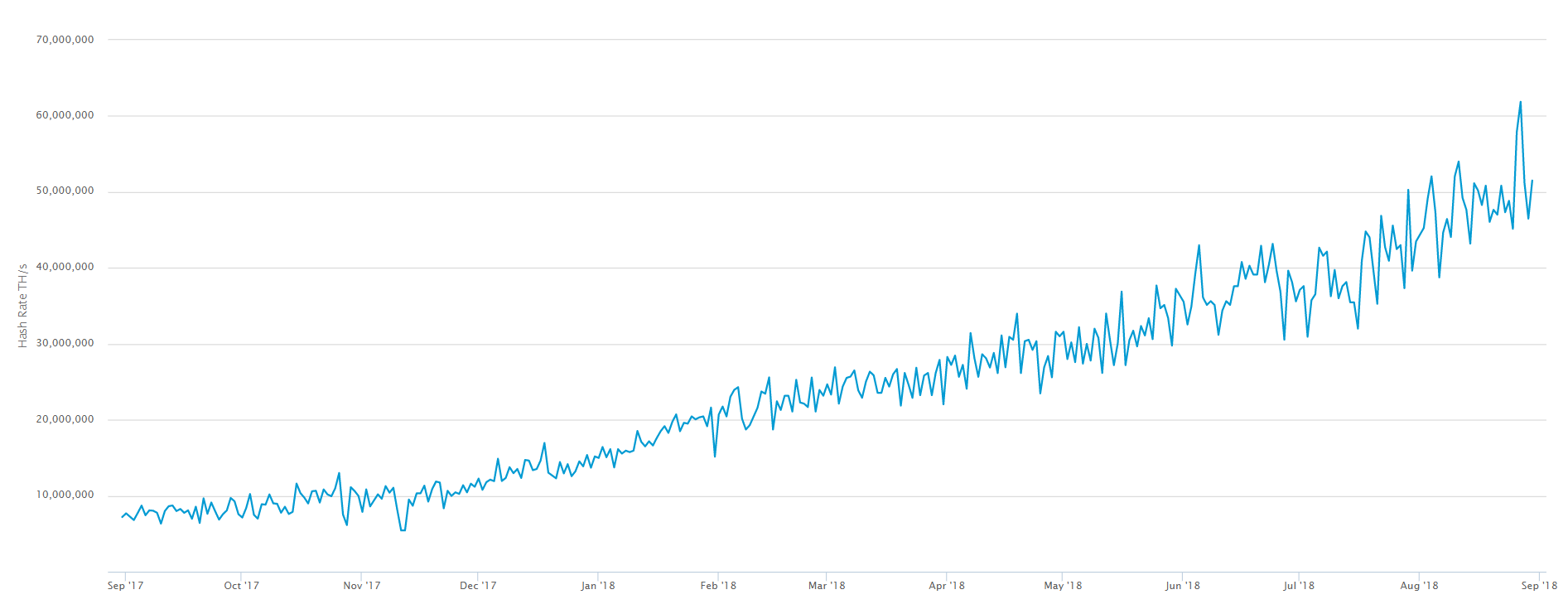

And, as we highlighted yesterday, the hashrate is starting to pick up.

The post Time for Intervention appeared first on Global Coin Report.

Read more at https://globalcoinreport.com/time-for-intervention/

Globalcoinreport.com/ is author of this content, TheBitcoinNews.com is is not responsible for the content of external sites.

Our Social Networks: Facebook Instagram Pinterest Reddit Telegram Twitter Youtube