DeFi, short for “decentralized finance” (also known as open finance), refers to an umbrella of projects on Ethereum which came to prominence in 2018 and have since developed into a sprawling ecosystem of composable financial instruments and applications.

Some of them reproduce existing models and services from traditional finance (lending and borrowing), while others are unique to the decentralized/permissionless nature of the system (prediction markets, mutual insurance platforms).

Major fabrics of the DeFi Ecosystem – Ethereum and Maker DAO (Dai)

While Bitcoin’s ledger keeps track of stateless UTXOs and their ownership, making it impractical for anything more complex than simple math value transfers. Ethereum was conceived as a blockchain geared towards expanding the basic concept to allow for more sophisticated applications.

The Ethereum chain deals instead with stateful objects commonly referred to as smart contracts (immutable scripts), which hold state variables (such as balances and ownership) and executable functions (the ledger further equipped with a simple virtual machine as a runtime environment).

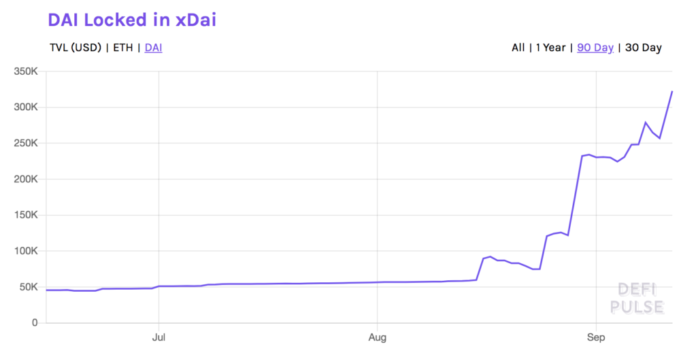

Central to the Ethereum DeFi stack is the Maker DAO responsible for managing Dai – the stablecoin numerarie of the ecosystem, algorithmically soft-pegged to the value of the US dollar.

Other stablecoin designs have gone about it with backing the tokens with corresponding reserves in bank accounts, which introduces centralization and the likelihood of systemic risk (as the notorious case of Tether USD).

Maker, on the other hand, calibrates the value of Dai via collateralized debt positions (CDPs) of other digital assets against which it generates Dai. The DAO of MKR token holders is responsible for setting technical parameters and managing risk in the system, calibrating the value of Dai against market forces of supply and demand.

Up until recently, the only type of collateral against which Dai was issued was Ether, but with the latest system upgrade to Multi-Collateral Dai (MCD). It diversified the kinds of accepted collateral to include REP, BAT, ZRX, OMG, DGD, and GNT.

With that, it also introduced the Dai Savings Rate (DSR) as an additional lever for control over the demand side of the supply and demand equation (while exerting control on the supply via the stability fee – from which the DSR is paid to Dai holders who lock their Dai in DSR mode of accruing interest).

Additional to the economic levers Maker also has emergency feedback mechanisms in place, automatically triggered upon Dai losing its peg (i.e., diluting MKR tokens and selling them on the open market to compensate/re-balance the value of Dai).

These mechanisms altogether can be generalized to include all kinds of standardized risk profiles in response to changing circumstances and market conditions, potentially even evolving to provide insurance against multi-shaded Black swans.

Other categories of DeFi products (as curated at defipulse.com) include non-custodial decentralized exchanges, peer-to-peer lending platforms (with fluctuating interest rates set against current supply and demand), derivatives and synthetic assets, customizable investment funds, mutual insurance services (against things like smart contract vulnerabilities and stolen login passwords) and prediction markets.

It mustn’t be forgotten, though, that finance is about efficient value management and optimization and allocative efficiency, not value creation. And traditional finance tends to be rather weaponized for value capture, with things like high-frequency algorithmic trading and splitting the second in scalping the cent – something DeFi as such is light years away from competing with, but neither is it its purpose.

Is DeFi worth the hype?

Whether or not DeFi is worth the hype is a matter of personal interest, competence, and affinities. And it may also be too early to tell.

Nonetheless, as a movement (and Ethereum’s DeFi preserves that somewhat clumsy democratic grassroots spirit characteristic of Ethereum) it certainly holds a lot of promise and potential, likely to become increasingly useful in practice and, as such, more widely adopted, possibly even making itself indispensable to the workings of overlapping actor-networks across diverse domains in the future to come.

Another major advantage that comes with decentralization and permissionless open access is the resilience to systemic risk and cascading failures as well as the reach of how the system absorbs and makes use of diverse distributed expertise and information (something prediction markets design for) rather than being centrally governed by panels of narrowly specialized experts often following formal textbook rules and axioms that often lose sight of dynamic reality, making them not adequately responsive to changing circumstances.

Thus, decentralization is a crucial precondition for the structuring of efficiently functioning markets (but in the case of DeFi, also requiring a degree of actively engaged participation and not just simply orienting oneself around the one-dimensional greed/fear vertical of centralized exchanges).

Is DeFi the future of Finance?

With DeFi, one can freely tinker with possibilities and put together all kinds of financial instruments from existing composable building blocks, making use of existing liquidity pools, data providers and oracles, etc. all perfectly affordable and at a negligible cost compared to what such services cost in the world of legacy finance (Bloomberg terminals, licensed providers, complex institutional matrices and regulatory barriers, etc.)

But as such, DeFi is also geared towards the more sophisticated lab coat derivative trader types, risk researchers, and fintech oriented nerds.

It is, in a way, an experimental sandbox set to gradually expand in complexity in a manner that makes complexity manageable (since, as we remember, the 2008 subprime mortgage crisis was above all a case of failure in organizational complexity gone out of control).

As running on Ethereum’s underlying architecture as so standing at present, DeFi is not all that scalable (can only fit that much in a block on a single lane) neither as fast and subject to fluctuating gas fees which makes it not all that reliable for many financial applications where efficiency, reliability, predictability, and speed are of priority. A reason why, despite the risks associated, people have been trading decentralized assets on unregulated and outright shady centralized exchanges.

With the gradual Ethereum 2.0 upgrade in the next 1-2 years and the migration to Proof-of-Stake on a sharded blockchain, a lot of these issues are expected to be resolved, localizing shards and validators where they best specialize in providing specific services and dramatically speeding up the transactions capable of being processed while further minimizing fees and frictions.

As for compliance, DeFi is highly experimental and existing in a regulatory grey zone. As institutional technology, distributed ledger-based systems are supposed to evolve their self-regulatory capacities organically. However, there are still laws and regulations which apply to different jurisdictions.

Other DeFi blockchains – Cardano and Tezos

Cardano, another very finance-oriented blockchain technology founded by Ethereum co-founder Charles Hoskinson, addresses this very problem by separating computation (smart contracts) from the basic accounting (Bitcoin type UTXO) in distinct logical layers so that smart contracts can reside within computational environments designed to be regulatory compliant to the jurisdictions they operate in (instead of having it all together in a single layer as in Ethereum).

Tezos is another DeFi oriented platform, but where the Ethereum DeFi is more about the open source ethos of permissionless innovation (and its governance style reflecting that) and a movement, Tezos aligns around formal governance procedures driven by the stakeholders (making it itself a DAO) such that it makes it unforkable, more reliable and as such more appealing to financial institutions and hedge funds.

Another important aspect that sets Cardano and Tezos apart from Ethereum is functional-style programming and formal methods in the former (Haskell in Cardano and OCaml in Tezos) crucially important to mission-critical operations where a lot of value is at stake.

Functional programming is increasingly being adopted in finance for a good reason, as it is more like mathematics than programming and tends to optimize for speed, efficiency, and reliability while being easy to formally verify and prove code correctness before deploying on-chain (Maker DAO actually run a Haskell reference implementation parallel to the Solidity one for those reasons).

Either way, DeFi is just picking up steam, and as value accrues in the system, other issues arise, and it’s important to not lose sight of things and allow for the repeating of the same mistakes (but on the blockchain).

Instruments such as decentralized prediction markets may prove especially valuable in that endeavor and in crystallizing reliable economic signals which capture information while cutting through the noise.

And complex systems such as these require a more heuristic and inter-disciplinary approach, an attitude of learning how to learn since there are no readymade recipes and solutions there.

The post A Dive Into DeFi – Is It Worth the Hype? Is DeFi the Future of Finance? appeared first on BlockNewsAfrica.

TheBitcoinNews.com – Bitcoin News source since June 2011 –

Virtual currency is not legal tender, is not backed by the government, and accounts and value balances are not subject to consumer protections. TheBitcoinNews.com holds several Cryptocurrencies, and this information does NOT constitute investment advice or an offer to invest.

Everything on this website can be seen as Advertisment and most comes from Press Releases, TheBitcoinNews.com is is not responsible for any of the content of or from external sites and feeds. Sponsored posts are always flagged as this, guest posts, guest articles and PRs are most time but NOT always flagged as this. Expert opinions and Price predictions are not supported by us and comes up from 3th part websites.

Advertise with us : Advertise

Our Social Networks: Facebook Instagram Pinterest Reddit Telegram Twitter Youtube