The crypto markets have been steadily shrinking for weeks following the incredible influx of new users and investors during the runup to Bitcoin futures trading on CBOE and CME in December.

Tether is known as a “stablecoin” or a “pegged currency”, a cryptocoin that claims to be backed on a one-to-one basis with real-world fiat; for every one USDT or EURT token, there is supposedly one USD or one EUR, respectively.

Tether has come under scrutiny in recent months as questions have arisen regarding whether or not the company actually has the funds to back up its tokens–more than a year has passed since Tether published an official audit.

The controversy surrounding whether or not $2.2 billion worth of Tether dollars are ‘funny money’ (as Ars Technica wrote) is certainly not the only scandal that Tether has found itself embroiled in over the past year. Many have found the relationship between Tether and Bitfinex, one of the world’s largest crypto exchanges by volume, to be a little too familiar with one another.

A Myriad of Scandals

For starters, Tether and Bitfinex share two of the same operators, Phil Potter and Giancarlo Devasini. Potter is both a director of Tether and chief strategy officer at Bitfinex; Devasini is a director of both Tether and Bitfinex. In December, Quartz reported that the relationship between the two firms “provides a key channel for tethers to enter cryptocurrency markets.”

In December, Professor of Northwestern University’s Kellogg School of Management Sarit Markovitch also wrote of her suspicions regarding the relationship of newly-minted Tether tokens on Bitfinex and the price of BTC: “what we observe is that once these USDT enter the Bitfinex exchange, the price of bitcoin jumps, as has happened multiple times recently.”

A chart detailing the relationship of the supply Tether dollars and the price of BTC in 2017.

Executives aren’t the only thing that Bitfinex and Tether share–the two entities seem to have a similar penchant for a lack of financial transparency.

In August of 2016, 120,000 BTC (worth roughly $70 million at the time) were stolen from Bitfinex. Because the exchange did not have enough savings to cover its users’ missing funds, losses were socialized across the exchange–each users’ account balance took a thirty-six percent haircut. In place of the thirty-six percent, Bitfinex distributed ‘BFX tokens’, IOUs that were exchanged for crypto overtime. Eventually, Bitfinex was able to repay one hundred percent of the stolen funds.

More than a year after the 2016 hack, however, Bitfinex still has not published an official audit. Immediately following the hack, Bitfinex announced that it was ‘in the process of engaging Ledger Labs to perform an audit of our balance sheet.’ A whopping seven months later, the exchange announced in a blog post that oops–Ledger Labs doesn’t actually do audits.

Just one month after that, Bitfinex said that it was hiring Friedman LLP to audit its accounts, but Friedman and Bitfinex disengaged last month when Tether disengaged with Friedman. Bitfinex has not yet announced a replacement firm to publish an official audit of its accounts.

The lack of an official audit is a factor leading many to believe that Bitfinex may be, in fact, insolvent. What sort of currency, then, could Bitfinex be using to ‘prop itself up’? You guessed it. (If you didn’t, here’s a hint–starts with ‘T’ and ‘D’ and rhymes with ‘heather hollers.’)

Further controversy arose when $31 million worth of Tether dollars disappeared from Bitfinex in late November in an anonymous hack. Following the November hack, the US Commodity Futures Trading Commission subpoenaed Bitfinex and Tether on December 6, 2017. The CFTC has not taken any further action since then.

As of January 1, 2018, Tether instituted a new policy that discontinued the issuance of USDT to ‘US persons.’

Shady Dealings of the Past

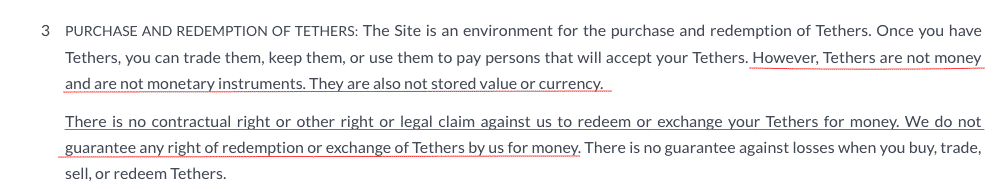

Before the hack, Tether had also been the subject of some controversy within the crypto community for the language of its Legal Policy. The policy has since been updated post-hack, but an archived version of Tether’s legal page reveals that the company’s policy essentially made a couple of things clear: first, that Tether tokens were not money or monetary instruments; second, that the company had no legal responsibility to redeem Tether tokens for money.

Tether’s legal policy has since been updated to say that ‘the right to have Tethers redeemed or issued is a contractual right personal to you,’ and goes on to outline specific cases in which Tether reserves the right to refuse to redeem USDT for fiat.

TheBitcoinNews.com – Bitcoin News source since June 2011 –

Virtual currency is not legal tender, is not backed by the government, and accounts and value balances are not subject to consumer protections. TheBitcoinNews.com holds several Cryptocurrencies, and this information does NOT constitute investment advice or an offer to invest.

Everything on this website can be seen as Advertisment and most comes from Press Releases, TheBitcoinNews.com is is not responsible for any of the content of or from external sites and feeds. Sponsored posts are always flagged as this, guest posts, guest articles and PRs are most time but NOT always flagged as this. Expert opinions and Price predictions are not supported by us and comes up from 3th part websites.

Advertise with us : Advertise

Our Social Networks: Facebook Instagram Pinterest Reddit Telegram Twitter Youtube