Each quarter, publicly listed companies share their earnings reports with their investors and the general public. These reports provide insights into each company’s performance and more often than not, impact their stock prices. Over the next six weeks, companies will be sharing their reports for the fourth quarter of 2018 (Q4), with major banks kicking off the earnings season.

Reporting earnings in a challenging market

This earnings season has a very meaningful backdrop, as Wall Street has been heavily impacted by external forces recently. Firstly, the Fed’s drive to hike rates over the past year, with four rate hikes in 2018, has put pressure on the market.

Perhaps the most important factor causing Wall Street to struggle recently has been the rising yield of 10-year bonds. These bonds, issued by the US Treasury, present a relatively low-risk investment option and produce steady returns twice a year. When the interest produced by these bonds is high, it could push investors away from the stock market, as the safer option is now also high yielding. Recently, 10-year bond yields have been giving investors interest rates of 2.73%.

Entering this earnings season, many companies face the challenge of remaining a lucrative investment option for their shareholders. For some companies in the financial sector, this season might be especially crucial, as they have to recover from less-than-impressive results last quarter.

Banking on earnings

The last time around, several large financial institutions disappointed their investors by displaying subpar performance. Wells Fargo is one of the companies that is hoping for a turnaround. The financial powerhouse has been in a slump over the past several quarters, still trying to recover from a scandal of two years ago, in which it was revealed that its employees created fake accounts for clients, in order to meet sales targets. Last July, the company experienced a 1.3 % increase in its stock price, following the Q3 earnings report that exceeded expectations.

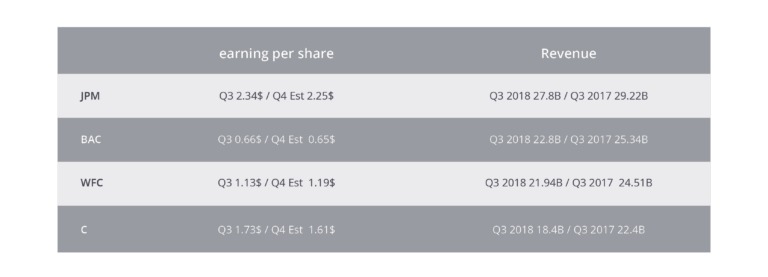

Indicative prices for illustration purposes

Another financial institution that is looking to make a comeback is Citigroup, which experienced a 2.5% increase in stock price following its Q3 earnings report. However, the financial sector was not all negative last quarter. Morgan Stanley was able to beat market expectations and its share price spiked 5% following better-than-expected results. These financial institutions, alongside other major players, such as JPMorgan Chase and Bank of America, have a lot to prove this quarter.

Investing in the financial sector on eToro

TheBigBanks CopyPortfolio is one of eToro’s first Market CopyPortfolios, offering investors a thematic investment opportunity in a fully allocated portfolio comprised of leading banks and financial institutions. Like all CopyPortfolios, TheBigBanks was created and is managed by eToro’s Investment Committee. The Portfolio is rebalanced periodically by the committee in an attempt to optimise performance.

The upcoming earnings season will no doubt impact markets, and since the financial sector is the first major segment to report, investors will be watching it closely over the coming weeks. To stay posted on recent and upcoming earnings reports, follow the eToro Earnings Reports Calendar.

Past performance is not an indication of future results. Data presented is less than 5 years old and may not suffice as a basis for investment decisions. This is not investment advice. Your capital is at risk.

The post Big banks, big opportunity? Earnings season kicks off appeared first on Global Coin Report.

Read more at https://globalcoinreport.com/big-banks-big-opportunity/

Globalcoinreport.com/ is author of this content, TheBitcoinNews.com is is not responsible for the content of external sites.

Our Social Networks: Facebook Instagram Pinterest Reddit Telegram Twitter Youtube