“Bitcoin is not alone.” A recently published paper analyzed the dynamics and pattern of the cryptocurrency markets. The scientists discovered several formulas to describe the market’s behavior – and explained it with a theory of evolution. Everybody who likes both cryptocurrencies and interdisciplinary science will have fun with the paper.

It is perfect timing. While the altcoin markets reach new highs every day, five scientists from London, Leipzig, and Barcelona publish the first paper about the cryptocurrency markets as a whole. The title says it all; “Bitcoin is not alone: Quantifying and Modelling the long-term dynamics of the cryptocurrency market.” The paper was published in the May edition of SSRN Electronic Journals.

The scientists are mathematicians, economists, and evolutionary anthropologists. They take a look at the cryptocurrency markets as a whole, from April 2013 to May 2017, and search for patterns and dynamics. The most important base for data they use is the website coinmarketcap.com, which uses the data of 300 cryptocurrency exchanges. The scientists applied this data to build several calculations and models, which aim to show how the crypto markets evolve. And actually – they found some thrilling knowledge demonstrating, that cryptocurrencies do neither gain market share randomly nor for technological innovation, but that they follow laws known from several other spheres.

Exponential Growth

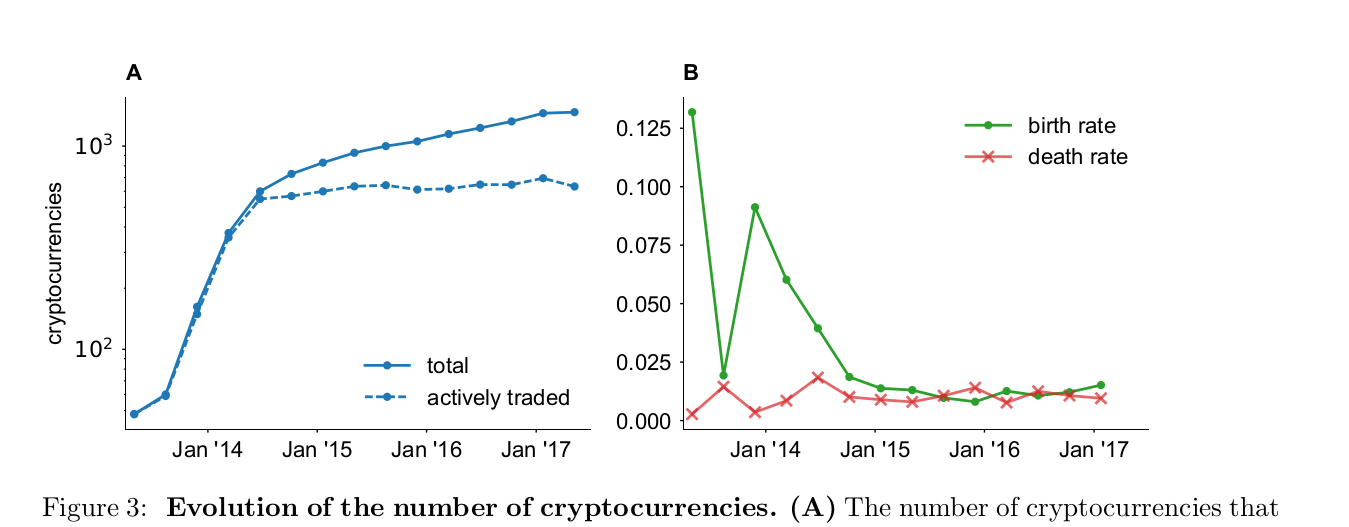

The scientists begin with giving an overview of the whole market. They count 1,452 cryptocurrencies born since April 2013, from which around 600 are still alive. The whole capitalization of the market did more or less stagnate in 2014 and 2015 until it started to grow since late 2015 with a growing vehemence. Between May 2016 and May 2017, the market value quadrupled, representing an exponential growth which, the authors explain, follows the formula exp(λt) with the coefficient λ = 0.30±0.02. Mathematicians might understand this formula, while non-specialists might find it fascinating, that a formula can catch this move.

But the most interesting parts of the study just start. After they gave this overview, the scientists begin to research patterns, logic, and dynamics. They found some in three areas.

Bitcoin is Losing Market Share

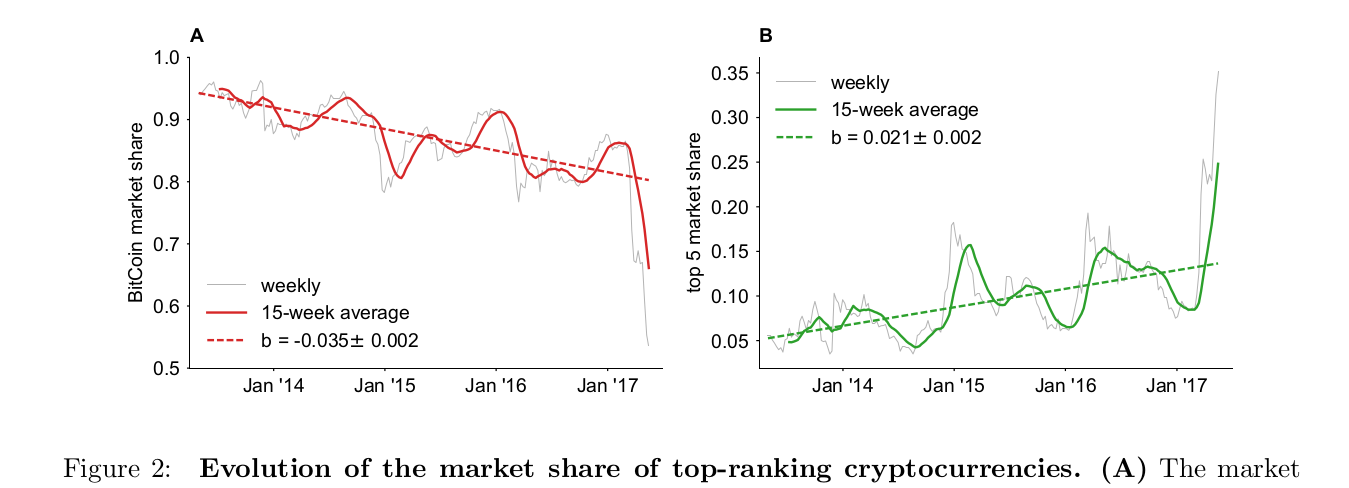

The most eye-catching recognition might be the significant loss of Bitcoin’s market share. The scientists tell that the, “first-mover advantage makes Bitcoin the most famous and dominant cryptocurrency to date. However, recent studies analyzing the market shares of Bitcoin and other cryptocurrencies reached contrasting conclusions on its current state.”

Some studies say, yes, Bitcoin is the clear winner of the recent rally, while others say, no, Bitcoin is losing its dominant position. While not taking a clear position, the five authors note that obviously, Bitcoin did lose significant shares of the market last years.

If you ignore the short-term oscillations of the line, you see that the share of Bitcoin is in a constant downtrend. The scientists describe this as a linear formula f(t) = a + bt, with the coefficient b = −0.035±0.002. Taking this formula, they predict:

“Bitcoin’s market share to fluctuate around 50 percent by 2025, although of course, very likely non-linear effects will modify this picture.”

As fascinating it is to find a formula exactly describing a year-long trend – this point demonstrates more than everything else that mathematics have limits in describing reality. As early as June 2017, eight years too early, Bitcoin fell below 50 percent market share. You could speculate if the further unsolved block size problem, the high scalability of the centralized Ripple network and the magic of Ethereum’s smart contracts serve as “black swans” – unpredictable and unlikely events which destroy every statistical prediction. At the same, time you can speculate if Bitcoin will go back to the path the scientists describe if only the block size problem is solved.

Birth and Death of Altcoins

Less vulnerable to black swans is the broader data about birth and death of cryptocurrencies. All in all, there are 1,500 cryptocurrencies from which roughly 600 are actively traded. The scientist analyzed the rate of birth and death of the coins. Interestingly they discovered a constant rate for this and some kind of market saturation.

After the number of cryptocurrencies steeply rose over 2013 and 2014, at the end of 2014 the number of actively traded – living – currencies leveled off around 600. Since then, this figure has not significantly changed. But not just this; since this time every week roughly seven cryptocurrencies are born – while the same quantity is dying. After the markets had reached saturation, birth and death rates of 1.16 and 1.06 respectively were established. After two and a half years of observation, you can almost say that this rate is a law of cryptocurrency.

Mobility in Coin Ranking

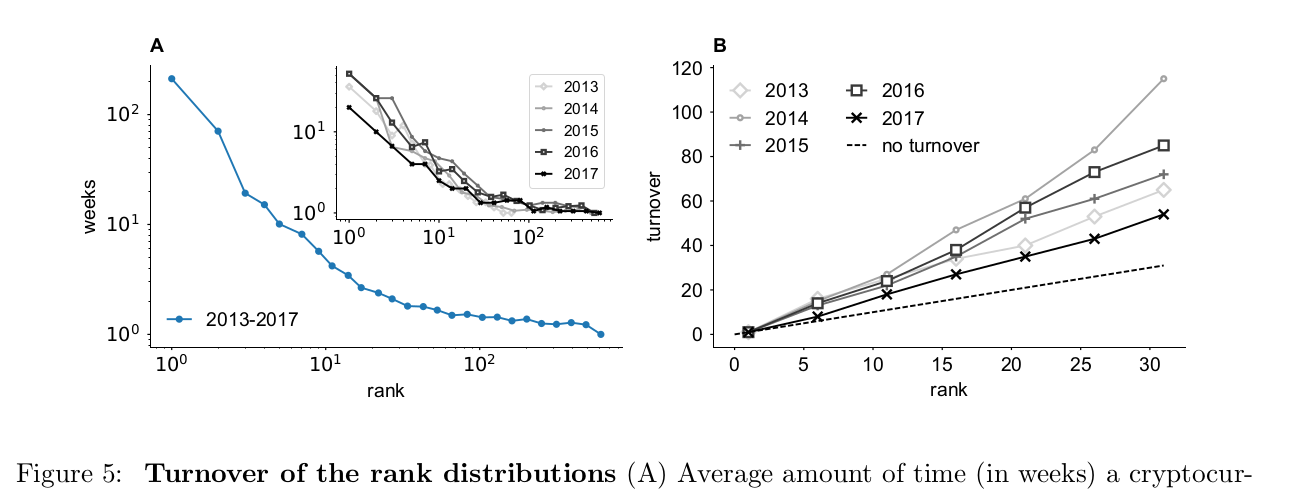

Less surprising, but still highly interesting is the third pattern the scientists disclose; there is a hard rule how cryptocurrencies keep and change their place in the ranking of cryptocurrencies.

“The first rank has been always occupied and continues to be occupied by Bitcoin, while the subsequent five ranks have been populated by a maximum of 16 cryptocurrencies with an average lifetime of 15 weeks. These values rapidly change when we consider the next set of ranks from seven to 12 to reach 24 cryptocurrencies and an average lifetime of five weeks. At higher ranks, the mobility increases and cryptocurrencies continuously change position.”

By itself, it is no surprise that the low-capitalized, highly volatile coins do change ranks more often than the larger cryptocurrencies. But again it is fascinating that this pattern can be clearly represented by mathematics and charts.

Evolution Theory and Cryptocurrency

Last, but not least, the scientists put the dynamics of cryptocurrency markets in the context of evolution theory. This is the maybe most exciting part of the paper.

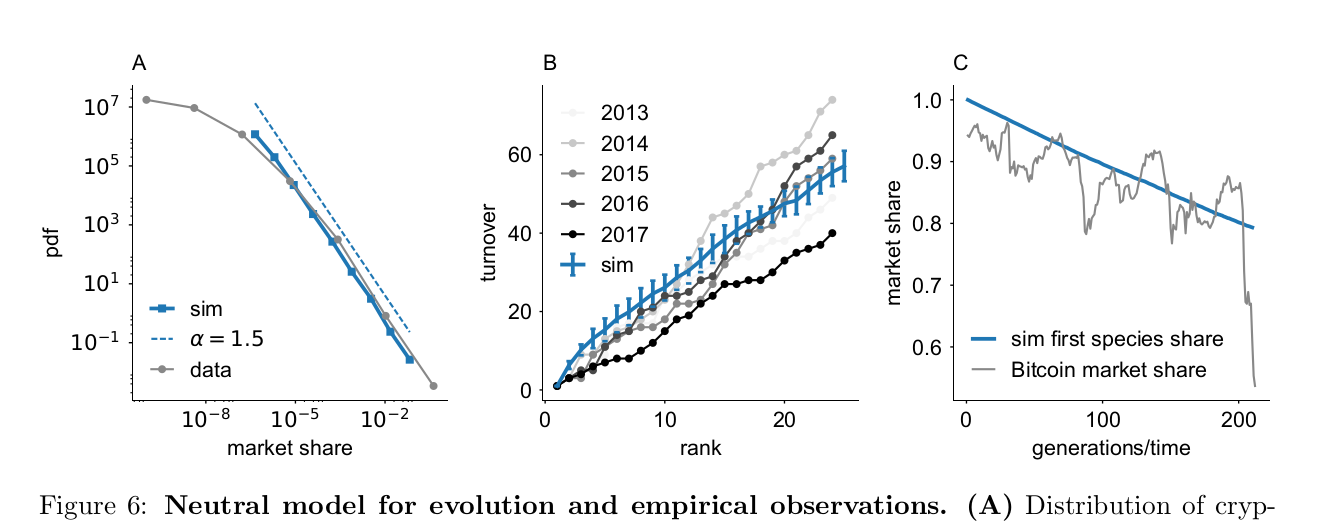

The authors try to explain the market dynamics with the “Neutral Model of Evolution.” This theory was developed by the Japanese Biologists Motoo Kimura in the 1960s. Is assumes that the genetic change of the evolution does not benefit the individual creature, but is the result of random changes of the genes, the so-called ‘gene drift.’ In this theory, evolution is not structured by the requirements of the environment, but by the random mutation of genes.

The scientists noted that “the neutral model describes a fixed size population of N individuals and m species. At each generation, the N individuals are replaced by N new individuals. Each new individual belongs to a species copied at random from the previous generation.” At this step however the models introduces chance, as with every new generation, there is the probability μ that a new species replaces an old. μ is the parameter of mutation.

Surprisingly the model is not only capable of describing biological systems, but also cultural drifts, language development, quote of technical patents and more. Can it also explain the cryptocurrency markets? The scientists try – and find some surprisingly hard evidence.

“In our mapping of the ecological model to the cryptocurrency market, each individual corresponds to a certain amount of dollars, while species correspond to different cryptocurrencies. The copying mechanism accounts for trading, with μ representing the probability that a new cryptocurrency is introduced.” μ is defined with 7/N, to represent the fact that each week seven new cryptocurrency are born in average.

The result is that the scientists are able to use the theory to map three dynamics; the distribution of market shares, the mobility of ranks, and the fall of Bitcoin’s market share.

Interesting, but no Defense against Black Swans

For many, these results might be as interesting as fascinating. While the mathematical models are surprisingly accurate in describing the market dynamics, they are weakly protected against unpredicted events. Especially the “Black Swan” of Bitcoin’s rapidly sinking market share demonstrates, how easily these models and theories shatter when they hit reality.

Nevertheless, the authors know about this limitation:

“In the immediate and mid-term future, legislative, technical and social advancements will most likely impact the cryptocurrency market seriously. How the self-organised use of cryptocurrencies will deal with this tension is an interesting question to be addressed in future studies.”

Btcmanager.com is author of this content, TheBitcoinNews.com is is not responsible for the content of external sites.

Our Social Networks: Facebook Instagram Pinterest Reddit Telegram Twitter Youtube