Business Insider reports that Cboe is telling its trading firm clients that it is getting close to launching a market for Ether futures. Bitcoin bull Tom Lee, however, believes that futures will pose problems for Ethereum. Lee explains that Ether futures will provide an easy outlet for crypto bears to bet against the coin. As previously reported by Unhashed, many speculate that the introduction of Bitcoin futures played a detrimental role in the world’s leading cryptocurrency’s 70 percent fall from its December 2017 highs.

While Lee has maintained his prediction for Bitcoin reaching $25,000, he is concerned that the introduction of ETH futures will spell trouble for Ethereum. Somewhat ironically, he projects that Ether futures will end up helping Bitcoin as it will drive away crypto bears.

“Since December of this year, if one was bearish on any aspect of crypto but did not want to own the underlying, they could short btc,” Lee said. “They can now short eth, means the net short on btc in futures would fall.”

As it did with Bitcoin, Cboe plans on basing its Ether futures on Gemini’s underlying market. Gemini, the New York-based cryptocurrency exchange headed by Cameron and Tyler Winklevoss, has been making headlines recently following rumors of a joint venture that will allow Nasdaq, in partnership with Gemini, to list top market coins for global trading. These rumors were confirmed by a secret source within Nasdaq, who claims that a “Nasdaq coin exchange” could be launching as early as Q2 2019.

Cboe is currently waiting on the Commodities Futures Trading Commission “to get comfortable with the product before its launch,” reports a source from Business Insider.

Suggested Reading : Learn more about Gemini in our Gemini exchange review.

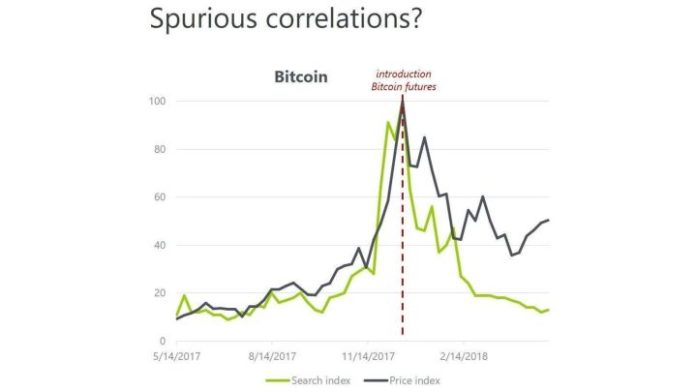

Earlier this week, economist Joost van der Burgt published research showing a near perfect correlation between Bitcoin’s price fluctuations and “Bitcoin” Google searches. This trend had remained consistent for several years up until the time Bitcoin futures were introduced in late 2017. Van der Burgt has put in a great deal of time trying to determine if Bitcoin is currently in a bubble, but he told CNBC that the introduction of Bitcoin future’s muddied his analysis.

“My take on it is that because of the introduction of futures, that might have deflated the bubble before it got to a level where it might burst completely,” said van der Burgt.

Source: Joost van der Burgt

Unhashed.com is author of this content, TheBitcoinNews.com is is not responsible for the content of external sites.

Our Social Networks: Facebook Instagram Pinterest Reddit Telegram Twitter Youtube