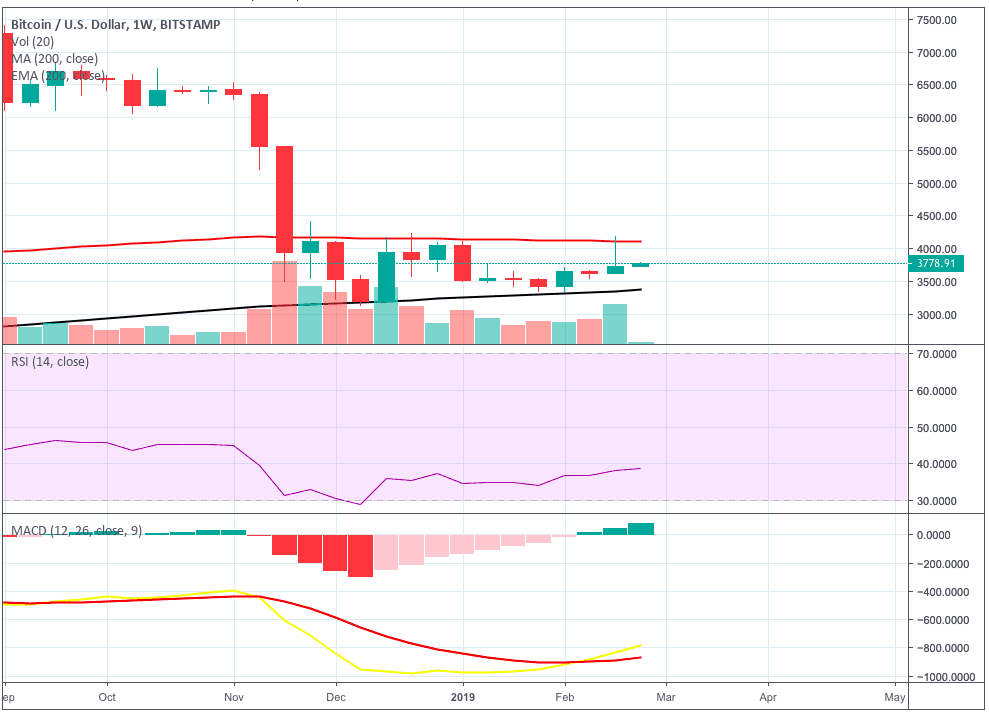

Bitcoin Monthly Chart – Source: Tradingview.com

Bitcoin has failed to overcome a number of key levels after the significant price decrease which took place yesterday.

Price had been meeting resistance at a number of points including the 50 EMA on the monthly, the 200 EMA on the weekly, and the point of the former high.

The price increase which preceded the significant price decrease brought price above the 50 EMA.

With a week to go until the close of the monthly candle, price failed to stay above and yesterdays dump in price brought the price back below.

It is also worth noting that the monthly RSI is trading near its all-time low.

The MACD continues to converge to the downside and continued bearish movements will bring the MACD to a centerline crossover which may spur a significant amount of selling.

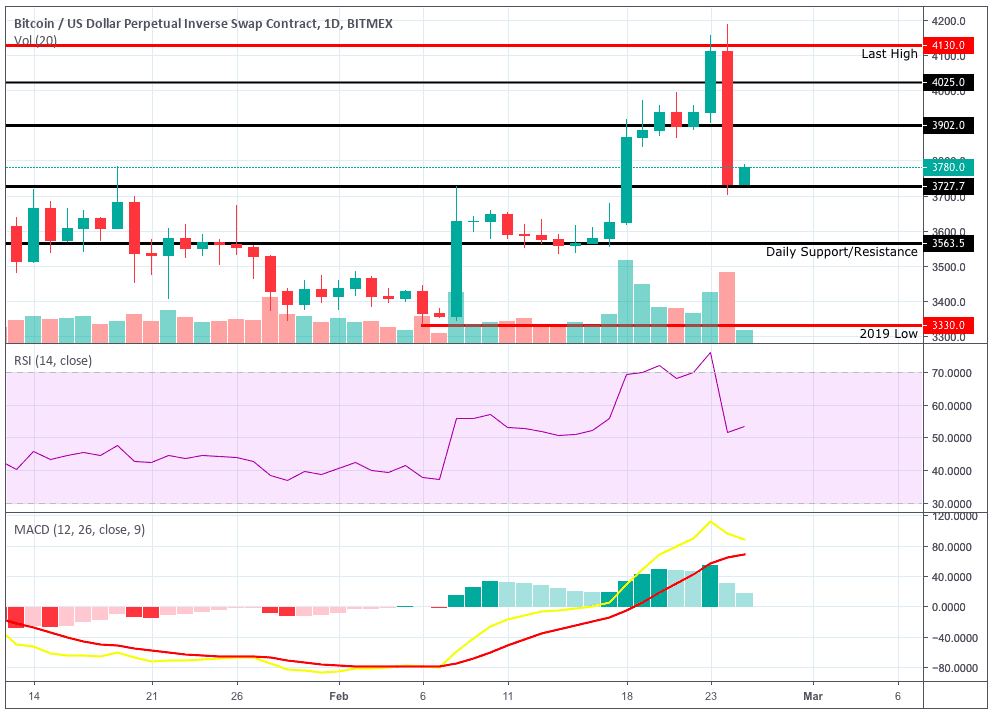

Bitcoin Weekly Chart – Source: Tradingview.com

Bitcoin Weekly Chart – Source: Tradingview.com

Price has already tested the weekly 200 EMA a number of times.

The test yesterday actually seemed very bullish with each test making the level weaker.

Another increase to the point of the 200 EMA would have a greater likelihood of breaking above.

Bitcoin Daily Chart – Source: Tradingview.com

Bitcoin Daily Chart – Source: Tradingview.com

Most of the week’s gains were erased with yesterdays decline.

The decrease is an extremely bearish move for Bitcoin.

It shows Bitcoin failing to form a higher high on the weekly chart and also results in a lower low forming on the daily chart.

$3900 will be the next likely point of resistance for price and price has already met support at $3724.

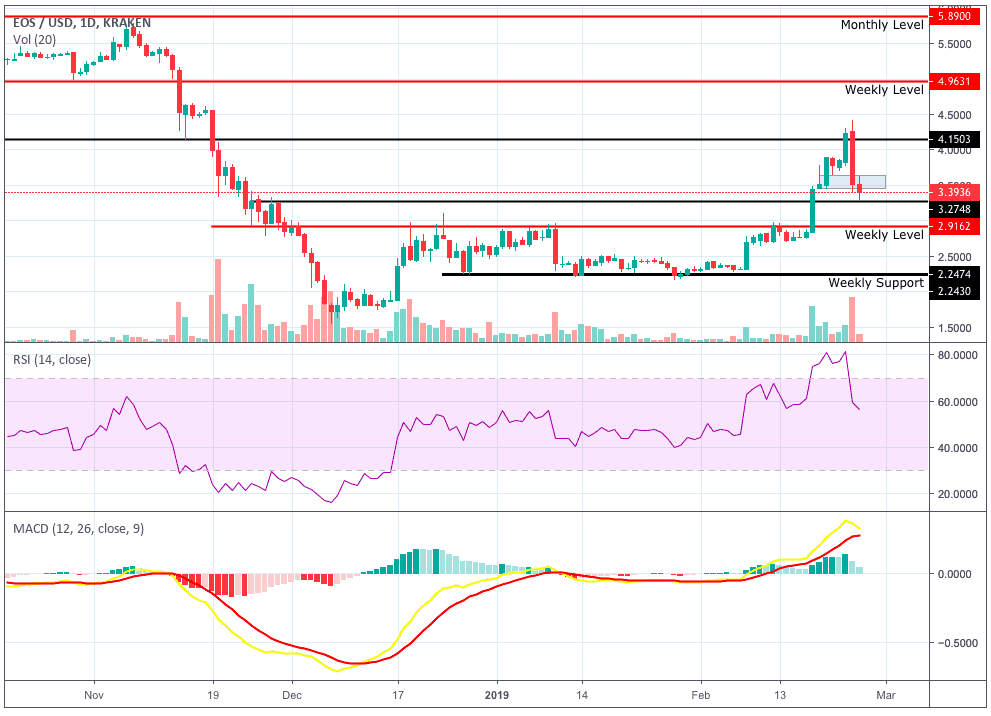

EOS Daily Chart – Source: Tradingview.com

EOS Daily Chart – Source: Tradingview.com

The price decreases yesterday marketed a return to Bitcoin outperforming in relation to altcoins.

Bitcoin outperformed altcoins for the vast majority of 2018 as prices spent the entire year in a downtrend.

The same was the case yesterday. Data from Messari shows Bitcoin declining 8.51% over the past 24 hours whereas EOS declined 22.11%.

EOS briefly found some buyer liquidity at a former area of consolidation for the price but has continued to drop below this point and has met support at $3.27.

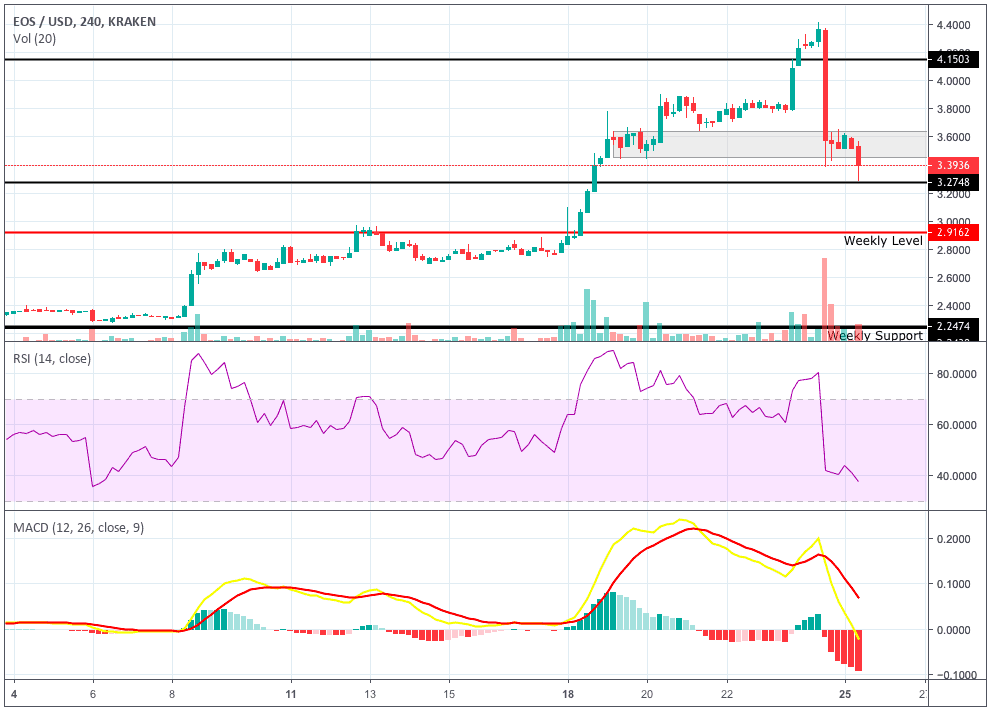

EOS 4-Hour Chart – Source: Tradingview.com

EOS 4-Hour Chart – Source: Tradingview.com

$3.27 was a former area of resistance for the price and is now acting as support.

$3.45 to $3.65 was the former area of consolidation for the price.

This area may now provide some seller liquidity as price approaches the area once again.

Key takeaways:

- Market leader Bitcoin fails to overcome key resistance levels and sharply declines.

- Key levels for Bitcoin were the monthly 50 EMA, weekly 200 EMA, and the point of the former high.

- Bitcoin outperforms in relation to altcoins during yesterdays drop.

- EOS briefly found buyer liquidity at an area of prior consolidation but has since dropped to support.

- EOS may find seller liquidity as it approaches the area of consolidation once again.

Latest Bitcoin & EOS News:

| DISCLAIMER: Investing or trading in digital assets, such as those featured here, is extremely speculative and carries substantial risk. This analysis should not be considered investment advice, use it for informational purposes only. Historical performance of the assets discussed is not indicative of future performance. Statements, analysis, and information on blokt and associated or linked sites do not necessarily match the opinion of blokt. This analysis should not be interpreted as advice to buy, sell or hold and should not be taken as an endorsement or recommendation of a particular asset. |

RELATED ARTICLES

MORE FROM OUR PARTNERS

Advertisement

blokt.com is author of this content, TheBitcoinNews.com is is not responsible for the content of external sites.

Our Social Networks: Facebook Instagram Pinterest Reddit Telegram Twitter Youtube