Bitcoin (BTC-USD) and most of the other cryptocurrencies are under pressure this week, continuing the multi-day downward trend. The leading cryptocurrency has lost 14% of its value on Tuesday over the 24-hour period and around 30% from the recent high. During 18th July Asia Session bitcoin is trading 23% lower than it was a week ago, around $9,700.

According to Coindesk’s Omar Godbole, if the events of 2016 would repeat, $7,500 could become a new support price. Bitcoin dropping to $6,100 while still maintaining its parabolic formation is also possible.

As one would expect, Bitcoin-related, altcoins, which are dependent on Bitcoin, also have a drop in price.

Ether (ETH) fell slightly less than BTC, shedding 10.4% to hit $203, while Litecoin (LTC) and Binance Coin (BNB) mirrored the behavior.

Bitcoin currently accounts for just over 66% of the total cryptocurrency market cap, a near two-year high.

There could be several major factors standing behind bitcoin’s current volatility: International Exchange’s new futures exchange Bakkt is about to start its beta-testing, and Fidelity Digital Assets, the crypto-focused branch of a major asset manager, will offer crypto trading to soon.

Various industry experts state that recent U.S. officials comments regarding bitcoin could have contributed to the price fall. Generally speaking, governments still view cryptocurrencies as a realm for money laundering and other illegal activities.

What more has added to investors skepticism is that now it’s obvious it’s not just the Trump administration and congressional Republicans who express concerns about cryptocurrencies.

No one knows what will be the consequences of US officials stating their position, but for sure uncertainty about industry doesn’t make investors confident.

Some industry executives, like Digital Currency Group CEO Barry Silbert and Ikigai Fund founder Travis Kling, have said that the remarks on Bitcoin by President Trump and Secretary Mnuchin can be acknowledged as a bullish sign in long-term perspective: Silbert said that Trump’s and Mnichin’s comments were “complete and total validation of bitcoin.”

To bitcoin price growth could contribute oncoming bitcoin halving. Many major miners have secured sufficient capital to sustain their operations for an extra 12 months. When demand hits short supply, price rises.

During the period of volatility many investors choose margin trading, the essence of which is a possibility to gain profits not only when BTC price grows, but also when it falls. To make a good trade, you just need to properly predict price direction.

Bexplus Grants Each User a 10% Cashback

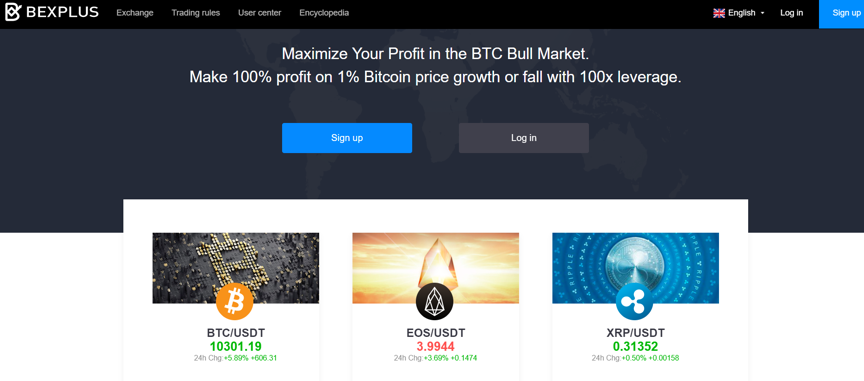

Bexplus is a fast-growing crypto exchange with 100x leverage. On Bexplus investors gain profits by trading BTC, ETH, LTC, and other crypto futures. Our advantages are simplicity, lack of spread, availability of simulation mode, security, quick and simple withdrawals, as well as additional activities (for example, we offer an annual interest rate for a deposit) and responsive 24-hour tech support.

This July Bexplus grants every user deposited more than 0.05 BTC with 10% withdrawable cashback. Amount of cashback for each user is unlimited!

Make a deposit on Bexplus and win iPhone XS Max

This July, Bexplus users can get a valuable gift by making deposits: gifts vary from Amazon Gift Cards to iPhone XS Max!

Start gain profits with Bexplus today!

Follow Bexplus on:

Website: www.bexplus.com

Facebook: https://www.facebook.com/Bexplusglobal/

Telegram: https://t.me/bexplusexchange

Twitter: https://twitter.com/BexplusExchange

The post Bitcoin Plunging… but Possibilities for Investors Still Available appeared first on Global Coin Report.

Read more at https://globalcoinreport.com/bitcoin-plunging-but-possibilities-for-investors-still-available/

Globalcoinreport.com/ is author of this content, TheBitcoinNews.com is is not responsible for the content of external sites.

Our Social Networks: Facebook Instagram Pinterest Reddit Telegram Twitter Youtube