Bitcoin has surpassed the $7,500 psychological level as on-chain analysis shows that retail bitcoin investors are buying huge sums of bitcoin daily.

The famous “Black Thursday” event that happened on March 12, 2020, saw bitcoin lose so much value in the space of hours. Bitcoin dropped from a little over $8,000 to $3,800 on Black Thursday.

Since then, bitcoin has barely returned to similar levels of value and has struggled to find a stable price range during the ongoing global pandemic.

However, this week bitcoin saw a glimpse of hope as the top cryptocurrency recorded a 7 percent increase, surpassing the $7,500 psychological level.

Data from analyst might provide more hope as more retail investors stack bitcoin ahead of the halving.

Long Term Investors Are Adding $500M Worth of Bitcoin Daily

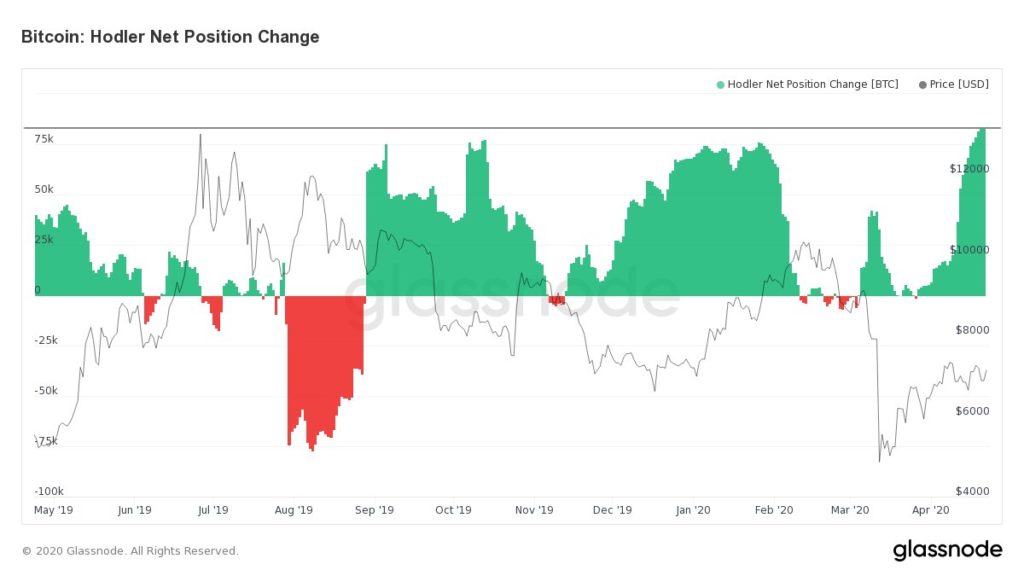

According to data from on-chain market analysis hub, Glassnode, long-term investors are adding up on their Bitcoin stock.

In a tweet, Glassnode indicated that the net position change of HODLers is reaching yearly highs.

“Long term investors are increasing their positions – and they’re accumulating more $BTC each day,” Glassnode tweets.

The same research also shows that long term bitcoin investors are adding at least 75,000 bitcoin to their positions every day.

At the current price of $7,500 per bitcoin, 75,000 bitcoin is worth $562.5 million. Although no particular reason may be attached to this strategy by investors, it seems FOMO is kicking in the right before the halving.

Fear of missing out (FOMO) is is a psychological mechanism that causes traders to buy large sums of an asset due to concern that they may miss out on upcoming profits.

It usually leads to an increase in the assets price as several traders troop to exchanges to make a purchase before a major event. In the case of bitcoin, this event is the bitcoin halving scheduled to take place in less than 20 days (at the time of writing this piece).

Hobby investors and amateur traders are also adding to more bitcoin to their portfolio. For instance, on the African continent, data from UsefulTullips shows an increase in trading volume on P2P platforms in the last seven days.

On Paxful, Nigeria has seen an increase in trading volume to $3.9 million compared to 3.2 million last week. Kenya and Ghana have also recorded significant jumps this week.

If this trend continues, it may have a positive impact on the bitcoin price after the halving as the supply of bitcoin drops and demand increases.

Speculation on the possible price movements after the halving continues to pour in; it will be interesting to see what the market looks like in the coming weeks.

What are your thoughts on the effects of the halving on the bitcoin price? Let us know what you think in the comments section below.

The post Bitcoin Surpasses $7.5K As Longterm Investors Buy $500 Million Bitcoin Daily appeared first on BlockNewsAfrica.

TheBitcoinNews.com – Bitcoin News source since June 2011 –

Virtual currency is not legal tender, is not backed by the government, and accounts and value balances are not subject to consumer protections. TheBitcoinNews.com holds several Cryptocurrencies, and this information does NOT constitute investment advice or an offer to invest.

Everything on this website can be seen as Advertisment and most comes from Press Releases, TheBitcoinNews.com is is not responsible for any of the content of or from external sites and feeds. Sponsored posts are always flagged as this, guest posts, guest articles and PRs are most time but NOT always flagged as this. Expert opinions and Price predictions are not supported by us and comes up from 3th part websites.

Advertise with us : Advertise

Our Social Networks: Facebook Instagram Pinterest Reddit Telegram Twitter Youtube