When you measure the relative strength (RS) of Bitcoin vs. gold or other metals and major financial markets, you witness a bias-free view of its comparative strength (or weakness). These stats can help you make critical investment decisions. They can even help you forecast major market turning points, allowing you to time more accurate trade entries (or exits).

This article will reveal the RS of Bitcoin vs. gold (ticker: GLD, the SPDR gold shares) over six key time periods. You’ll view how BTCUSD fared against GLD over the past 3-, 6-, 12-, 24- and 36-month periods. You’ll also see how Bitcoin has consistently outperformed GLD over the past five years.

You’ll see that Bitcoin even outperformed the stocks of two of the world’s largest gold mining companies. Finally, you’ll gain insights on why including Bitcoin and gold in your trading and investing portfolios may be a good idea.

Bitcoin vs. Gold: Key RS Stats

The Bitcoin (BTCUSD) vs. GLD RS stats since December 2017’s blowoff top are heavily stacked in favor of GLD. For the moment, anyway. It’s true that BTCUSD is in a bear market, but bullish signs of life continue to appear for this coin. As for GLD, it may be setting up for a powerful multi-month (or year?) rally, one that could also surprise to the upside in 2019.

Near-Term Stats (One Year or Less)

3-month BTCUSD performance: (39.16) percent

3-month GLD performance: + 7.36 percent

RS winner: GLD

6-month BTCUSD performance: (30.97) percent

6-month GLD performance: + 2.40 percent

RS winner: GLD

12-month BTCUSD performance: (71.82) percent

12-month GLD performance: (1.46) percent

RS winner: GLD

GLD, monthly: With key cycle oscillators in bullish mode, look for GLD to attempt a breakout in early-to-mid 2019. The chart’s 50- and 200-month moving averages are also in a bullish configuration. Image: NinjaTrader 8

Clearly, there’s been no contest in the near-term RS rankings. GLD beat BTCUSD in all three short-term time periods. Easily. However, once you move up to the 2- to 5-year RS measurements, BTCUSD simply mops the floor with GLDs comparatively mediocre performance numbers:

Long-Term Stats (Two Years or More)

24-month BTCUSD performance: + 311.02 percent

24-month GLD performance: + 11.20 percent

RS winner: BTCUSD

36-month BTCUSD performance: + 860.84 percent

36-month GLD performance: + 18.37 percent

RS winner: BTCUSD

5-year BTCUSD performance: + 466.16 percent

5-year GLD performance: + 3.29 percent

RS winner: BTCUSD

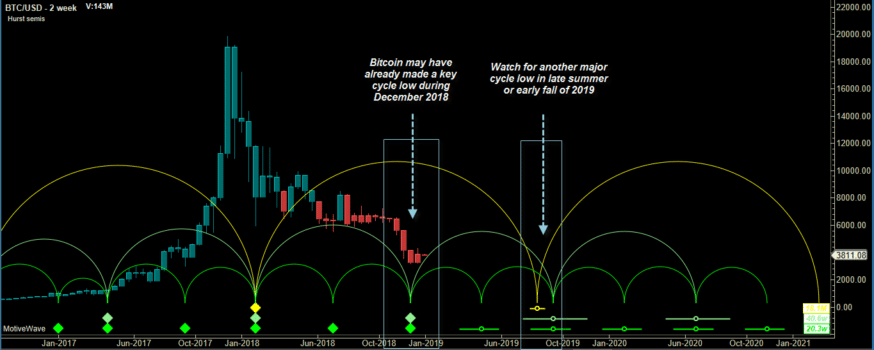

BTCUSD, 2-week chart: It’s possible that Bitcoin’s December 2018 cycle lows will lead to significant upside in 2019. Image: MotiveWave Ultimate

Key Gold Stocks: Bitcoin Also Wins

If you had invested in shares of Barrick Gold (ABX) and BTCUSD on December 28, 2015, your crypto units would be up significantly more than your ABX shares:

36-month BTCUSD performance: + 860.84 percent

36-month ABX performance: + 74.24 percent

RS winner: BTCUSD

Here’s a look at the 3-year performance comparison of Newmont Mining Corp. (NEM) vs. BTCUSD:

36-month BTCUSD performance: + 860.84 percent

36-month NEM performance: + 92.46 percent

RS winner: BTCUSD

All data via TradingView.com The final data cutoff date was December 28, 2018, for ABX, BTCUSD, GLD and NEM. Commissions, slippage and stock dividends not factored in.

Not Necessarily Either Or

Yes, Bitcoin has greatly outperformed both GLD (and spot gold, gold futures) over the past 2-, 3- and 5-year periods. On the other hand, GLD has handily beaten out Bitcoin since late December 2017. If you gain one insight here it’s this: never bet the ranch on any market, no matter how bullish (bearish) you may feel about it. Markets are not rational, and most of the fundamentals factors affecting prices are likely factored into your technical charts.

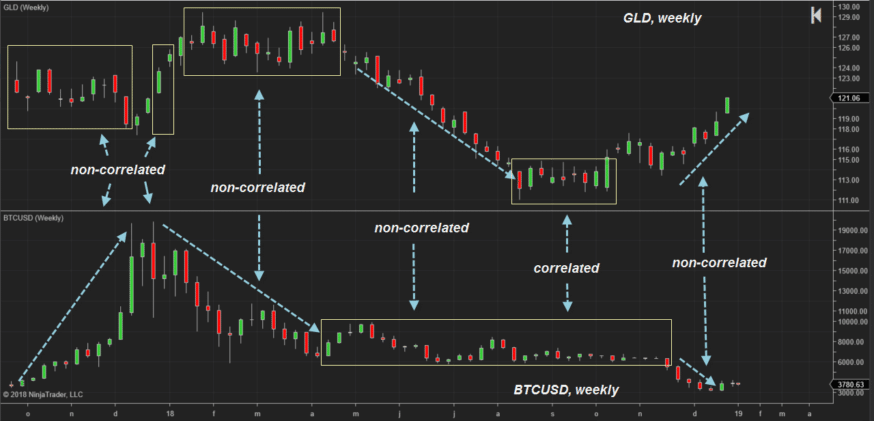

GLD and BTCUSD, weekly: Gold and Bitcoin tend to transition from non-correlated to highly-correlated phases. Presently, a shift to the latter scenario may be underway, with big gains possible for both markets in 2019. Image: NinjaTrader 8

Regardless of the cryptos, stocks, or ETFs you trade, there are market forces at work that no one can accurately comprehend 100 percent of the time, much less derive perfect price forecasts from.

Therefore, use some sort of a rational asset allocation plan (perhaps across five to eight non-correlated financial markets, including Bitcoin and gold), especially if you’re a long-term investor. This will give you much better odds of surviving whatever monkey wrenches that Mr. Market will inevitably toss in your investment portfolio’s direction.

Intrinsic vs. Extrinsic Value

A Bitcoin analyst recently suggested that Bitcoin is a store of value:

“(Bitcoin) is the greatest store of value ever created.”

– Lou Kerner of CryptoOracle, November 21, 2018, CNBC interview

Like the US Dollar (USD), Bitcoin has an intrinsic value of zero. The USD isn’t backed by gold and silver as was previously required (before August 15, 1971) by the US Congress. The USD has an arbitrarily assigned unit of value or extrinsic value. The government says a dollar of currency will buy a dollar of goods and services, and you simply accept that truth and go about your business. Of course, the USD fluctuates in value against other sovereign currencies, but that doesn’t affect your day-to-day transactions in USD.

Bitcoin, like the USD, isn’t backed by any tangible commodity like gold or silver. You transact in Bitcoin for goods and services, fully aware that its value can rapidly change. Bitcoin traders agree on its fair value throughout the trading session. In December 2017 traders agreed it was worth $19,870, yet in December 2018, that point of agreement plunged to $3,215. Bitcoin’s price is all extrinsic value. It’s worth whatever a buyer and seller on an exchange can agree upon.

Time-Honored Store of Value

Gold, however, has for centuries been recognized as a tangible store of value. In ancient times, gold was always regarded as real money, with intrinsic value. You can conceivably barter gold for food, land, clothing, medicine, oil, collectibles, motor vehicles, houses, etc. It’s also a tangible item you can put away in a bank vault, your home safe, or even bury in a coffee can in the backyard.

Bitcoin, by way of contrast, is an electronic, intangible currency. Even apart from the fact that it holds zero intrinsic value, it seems unlikely that it could be used to barter for goods and services in an offline setting. Imagine if the electric grid were shut down due to an EMP attack. All forms of communication might be disrupted. The internet could go dark. Crypto exchanges could temporarily close, along with all other financial markets.

Bitcoin, all other cryptos and stocks would be useless as a form of real-world currency. Even your bank debit and credit cards would be lifeless plastic. Gold needs no electricity nor communications network to back up its inherent worth. In such an apocalyptic scenario, having physical gold would seem to be preferable to owning Bitcoin. Even fiat currency would be preferable, barring a hyperinflationary economic backdrop.

Inflation Hedge

During the inflation-plagued 1970s, gold soared from $35 per ounce to $875 per ounce (in less than eight years) even as consumer prices (commonly termed inflation) doubled in the US (1970 thru 1979). In fact, the $35 gold of 1972 is now worth more than $1,275 per ounce, having easily outpaced consumer price inflation over the past 46 years.

Consumer prices have risen by 501 percent since 1972 (basis: 1972 = 100 and 2018 = 600.71). Yet, gold is up by a factor of 39.84 times or 3,884 percent over the same time span ($1,275 divided by $32). Therefore gold has outperformed the inflation rate by a ratio of 7.75 to 1 (3,884 divided by 501). Gold absolutely has proved to be a long-term store of value against the ever-rising cost of living.

The Best of Both Worlds

Perhaps Bitcoin will be regarded as a store of value one day. Maybe not. Really, who cares? All that matters right here and right now is that you can trade Bitcoin. All day and all night. Long and short. You can buy and sell Bitcoin futures contracts. You can even buy some Bitcoin every month, anticipating yet another run to all-time highs.

Even better, you can run your Bitcoin trading and investing activities with clear risk control and profit-taking objectives. You might even net a better long-term return than those who hold gold as a hedge against inflation. However, remember that Bitcoin has zero intrinsic value. Gold does possess that inherent value, and may always be regarded as a go-to investor haven.

Utilizing Both Gold and Bitcoin

Consider trading them:

- Swing trade Bitcoin (cash, leveraged, or futures) with a proven mechanical system

- Swing trade gold (GLD, GLD options, futures, and futures options) with a similar, 100-percent objective methodology

Put some away as investments:

- Dollar-cost average (DCA) into a long-term Bitcoin investment

- DCA into a long-term gold (physical gold from a broker or use GLD as a proxy) investment

- Never use leverage or futures contracts for long-term investments

The Turnaround Twins?

Based on their respective chart patterns, 2019 could be a major turnaround year for both Bitcoin and gold. Create a sound trading and investing plan that can put their potentially powerful reversals to work in your own portfolio.

The post Bitcoin vs. Gold: A Relative Strength Comparison appeared first on CoinCentral.

Coincentral.com is author of this content, TheBitcoinNews.com is is not responsible for the content of external sites.

Our Social Networks: Facebook Instagram Pinterest Reddit Telegram Twitter Youtube