The crypto insurance market underwent huge developments over the last two years. In the past, insurance companies were hesitant to enter the crypto market due to security and volatility concerns. Ironically, market instability is one of the main reasons crypto startups, exchanges and investors seek insurance in the first place.

Thankfully, the market has seen some stabilization over the last year. Nowadays, both individuals and corporations can insure their digital assets with confidence. While products do exist to protect your crypto, there is still a huge disparity in the amount of coverage available versus the total crypto market.

Dangerously Low Coverage

A recently published report places the crypto insurance market at around $5 billion. If you consider that the crypto space has a total market cap of around $115 billion, it’s easy to see that most people’s crypto isn’t protected against loss or theft.

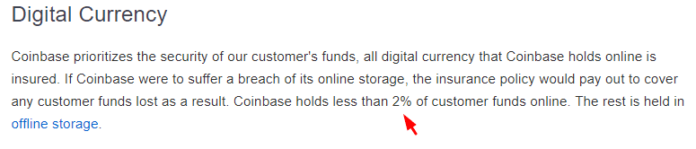

This lack of coverage isn’t just relegated to personal crypto investors either. Crypto exchanges are dangerously under covered. Even North America’s biggest crypto exchange, Coinbase, only insures 2 percent of their total crypto holdings according to their company’s guidelines. In the past, this lack of coverage has led to exchanges handling customer losses in a variety of ways.

Coinbase Insurance Policy via Coinbase

A perfect example of exchanges taking customer losses into their own hands is the January hack of Coincheck. According to reports, the hackers gained access to the company’s hot wallet and were able to make off with around $5oo million in NEM. Hot wallets stay connected to the internet. In most cases, exchanges keep the majority of their funds offline, in cold storage.

Coincheck personally reimbursed around $500 million in crypto to users. The company didn’t release details of the inner workings of the heist. However, they did acknowledge the error of keeping the majority of their funds in a hot wallet. In this scenario, regular traders didn’t lose out, but this isn’t the norm.

Crypto Losses

Take the infamous Mt. Gox hack for example. The exchange suffered huge losses after multiple hacks. Eventually, the exchange filed for bankruptcy and was hit with a flurry of lawsuits. This left Mt. Gox users holding the loss for years. It wasn’t until a Japanese court ruled Mt. Gox’s bankruptcy revoked in June 2018, that users got a glimmer of hope of ever seeing their lost Bitcoins again.

Crypto Insurance Types

Crypto insurance falls into two types of coverage: commercial crime and specie market. Commercial crime, or D&A coverage, relates to funds in use. Traditionally this coverage includes armored cars, ATMs and your hot wallet.

In contrast, specie market insurance covers items such as your vault full of gold bullion or that Picasso you keep in your living room. Cold and paper wallets fall under this type of crypto insurance. Reputable exchanges will possess both types of coverage.

Winklevoss Twins: Gemini Exchange

In October 2018, the New York-based Gemini Exchange became one of the first major crypto exchanges to fully insure user’s funds. The exchange is owned by crypto billionaires, and creators of the Winkdex blended index, the Winklevoss twins. In order to achieve this task, company officials sought out coverage from a consortium of leading providers including the London-based insurance giant Aon.

The Winklevoss Twins via New York Post

The move prompted exchanges around the world to seek coverage. Notably, Upbit, South Korea’s largest exchange by daily trading value, obtained insurance from both Samsung and Kyobo directly following Gemini’s announcement.

ICO Insurance

Aside from exchanges, ICOs are another area of the crypto space that requires more crypto insurance coverage. Insurance coverage for ICOs can cover a wide range of losses. Ideally, an ICO’s coverage will include protection against hackers, hard thefts and the actions of government regulators. FounderShield is an example of an insurance firm that offers this type of coverage to businesses.

Personal Crypto Wallet Insurance

Acquiring crypto insurance for your personal wallet was not an option for the average crypto trader until recently. The costs associated with such a venture were too high to make sense to anyone except whale investors. Thankfully, some blockchain developers stepped in with some cost-effective solutions.

Etherisc

The Etherisc platform offers a full range of crypto insurance products, including protection for your wallet, smart contracts, risk funds, collateral damage and payment channels. The developers seek to modernize the insurance market via blockchain integration.

InsurePal

The InsurePal platform promises to allow users to both provide and acquire peer-to-peer protection for their crypto investments. The firm integrates a Social Proof protocol. This protocol provides users with a moral compass rating. This rating, coupled with a user’s past financial commitment, allows users to verify an insurer’s commitment level. Below are some other examples of top crypto insurance providers worth researching.

Marsh & McLennan

The US-based firm of Marsh & McLennan specializes in insurance for blockchain startups. The company was founded in 2003 and is subsidiary of Marsh. Today, Marsh & McLennan is one of the most successful crypto insurance providers. The company recently formed a ten-person blockchain development team to further their exposure in the sector.

Aon

Aon is the largest providers of crypto insurance globally. According to a recent study, the company is responsible for over 50 percent of the total crypto insurance issued in the marketplace. The company recently streamlined an underwriting process in an attempt to attract even more clientele. As mentioned earlier, the firm is now the insurer for the Winklevoss Twins’ Gemini exchange.

Mitsui Sumitomo Insurance

Mitsui Sumitomo Insurance provides Japanese crypto firms with a myriad of coverage. The firm offers clients coverage that includes protection from employee theft, unauthorized access and even mistakes. The company even offers security audits to legitimize the space. These audits include everything from system inspections, all the way to employee background checks.

Japan is a strong supporter of the crypto space. The county officially made Bitcoin a legal form of payment in 2017. Japan’s straight forward approach towards the crypto market makes it ideal for insurance providers to flourish.

Crypto Insurance: Protecting Your Satoshis

Now that crypto insurance is available, it may be time for you to reconsider your level of protection. Digital assets create unique challenges in terms of protection. One thing is for sure, with exchanges such as Gemini and Upbit providing their users with coverage, the rest of the market is sure to adjust to remain competitive.

The post Crypto Insurance: Are Your Satoshis Protected? appeared first on CoinCentral.

Coincentral.com is author of this content, TheBitcoinNews.com is is not responsible for the content of external sites.

Our Social Networks: Facebook Instagram Pinterest Reddit Telegram Twitter Youtube