Although crypto markets are still down over the past month, most of the top ten coins are in the green today, June 7.

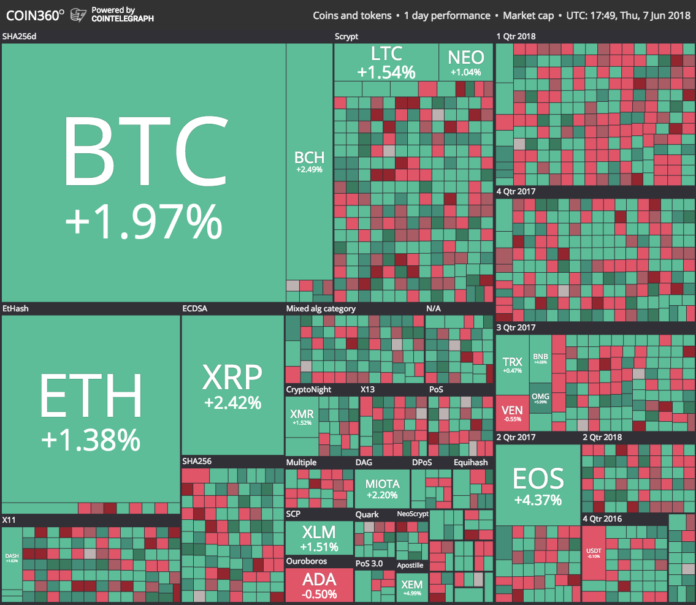

Market visualization from Coin360

Bitcoin (BTC) is comfortably holding above the $7,600 threshold and inching to a new price point of $7,700, trading at around $7,690 at press time. The leading cryptocurrency, up almost 2.3 percent over a 24-hour period, saw an intra-weekly low just above $7,400, but has since stemmed its losses.

Yesterday’s official clarification from the chair of the U.S. Securities and Exchange Commission (SEC) that Bitcoin is categorically not considered to be a security under U.S. law may have gone some way to bolster market confidence.

Bitcoin’s regulatory status is evidently more clear-cut than major altcoins Ethereum (ETH) and Ripple (XRP), both of whose representatives have emphatically rejected security classifications, although their regulatory status in the eyes of the SEC remains unclear.

Bitcoin price chart from Cointelegraph’s Bitcoin Price Index

Leading altcoin Ethereum (ETH) has seen a slightly lower gains of just over 1.3 percent on the day, trading around $606 to press time. Having recovered from its low of $571 earlier this week, the coin has for now reclaimed its ground above the psychological price point of $600.

Ethereum price chart from Cointelegraph’s Ethereum Price Index

Most of the top ten coins by market capitalization are showing minor fluctuations of within a 2-3 percent range over a 24-hour, as data from CoinMarketCap shows. Of the top ten coins, only Cardano (ADA) is in the red, down less than 1 percent, trading at about $0.21 to press time.

Altcoin EOS is seeing the most growth of the top ten coins over the past 24 hours, up over 4.5 percent on the day, trading at $14.20 a coin at press time. EOS is currently ranked in fifth place on CoinMarketCap, with a market capitalization of over $12.7 bln.

Yesterday, stock analytics firm Trefis announced they have lowered their Bitcoin year-end price forecast from $15,000 to $12,500, according to their analysis of fundamentals of supply and demand in BTC markets. Trefis pointed to significant recent losses in total BTC transaction volumes across crypto exchanges, and attributed a surplus in supply and subsequent drop in price to Mt. Gox dumping BTC onto exchanges earlier this spring.

As of press time, CoinMarketCap data indicates BTC trade volumes of 4.69 bln, down from 7.41 bln one month ago.

While markets remain sluggish, institutional actors are making significant headway with their foray into the crypto sphere. Yesterday, one of the largest financial firms in the world, Susquehanna International Group, revealed it would be opening cryptocurrency trading to its clients, initially in the form of Bitcoin futures.

The week has also seen news of significant advances among major crypto industry players to bring their operations under the purview of financial regulators. Yesterday, peer-to-peer payments platform Circle Internet Financial Ltd., revealed it is pursuing both a federal banking license and registration as a brokerage and trading venue with the SEC. The news followed hot on the heels of leading U.S. crypto exchange Coinbase initiating its own process to become a fully SEC-regulated broker dealer, through its acquisition of three financial firms.

Overall market capitalization of all cryptocurrencies is $346 bln to press time, up about $10 bln on the week.

Cointelegraph.com is author of this content, TheBitcoinNews.com is is not responsible for the content of external sites.

Our Social Networks: Facebook Instagram Pinterest Reddit Telegram Twitter Youtube