One of the biggest questions a potential business must ask itself before going for the cryptocurrency is whether it is worth it at all.

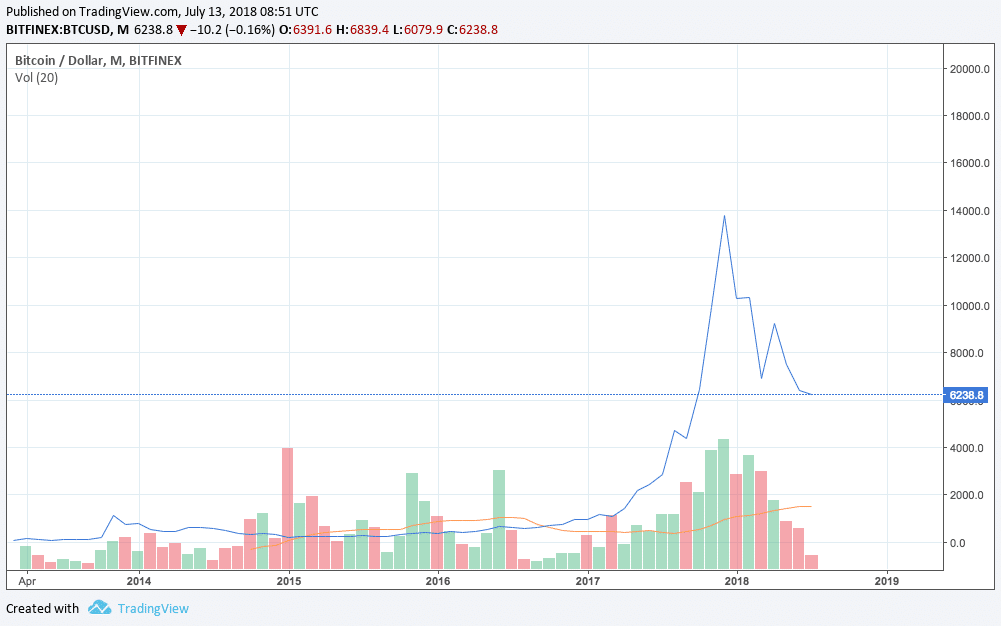

After all, despite Bitcoin‘s rising popularity there are still some question which need to be addressed before making the call on whether this is the payment method you want to use. Bitcoin has seen its value plummet at the turn of the year, and has not currently regained its position at the level at which it was before. In this regard, there are several factors to consider before starting to accept Bitcoin Payments

Should My Business Accept Bitcoin?

One advantage offered by accepting Bitcoin payments is the fact that all the transactions are “push” transactions which means that they’re kickstarted by the customer. As such, any hint of problems like chargebacks goes out the window. What’s more is that because these transactions are done in this way, there is no need to store customer data. Therefore, there is no incentive for individuals to hack into your accounts to attempt to gain the customers’ sensitive information.

Using a decentralised payment network cuts out third-party payment intermediary services and could allow you to to be more efficient the the processing of transactions.

On the other hand, there are certain issues when offering Bitcoin payments that are worth being aware of. For a start, there are undertones of the black market within the cryptocurrency space due to the currency being a popular trading token on the dark web. While Bitcoin has come a long way since its dark web days, these associations may “put off” certain customers.

The Supreme Court announced this morning that it will not reconsider the conviction and life sentence without parole of Ross Ulbricht, convicted for various crimes associated with founding and operating the darkweb site Silk Road.https://t.co/1T3y4BGIOF

— Bitcoin (@Bitcoin) June 29, 2018

Given these associations, you may want to ensure that customers are aware that all transactions via Bitcoin are legal and appropriate for all customers. Customers would also desire for you to be the regulator given that the currency is not regulated by a central bank or government. Ensuring that your website’s SSL certificate is vaild would go some way toward ensuring your customers that they are safe to use your website.

Additionally, scalability on the Bitcoin network is still a massive problem. While tools have been developed to speed up Bitcoin transactions, waiting for a Bitcoin transaction to be confirmed can still take anywhere from a few minutes to a few hours.

Deciding How Your Bitcoins Will Be Stored

Once you’ve decided that you do indeed want to utilise Bitcoins, you will need to look at methods of storing Bitcoins on your platform and conducting the transactions.

Ultimately, the custody of your Bitcoin is extremely important because you want both you and consumers to be safe from hacking of your coins.

It is imperative that when conducting Bitcoin transactions and storing Bitcoins, you are undertaking all the security precautions possible. This protects everyone’s interests. Whilst nothing is fully hack-proof, there are some steps which you can take to minimise the risk.

Institutional storage of Bitcoin is an option that you may want to consider if you have a large amount of cryptocurrency to be stored. In fact you could utilise the services of companies like Coinbase, who offer custodial services for crypto.

It is very important not to store your cryptocurrency on an exchange for any significant amount of time. This approach can be extremely dangerous as cryptocurrency exchanges are historically very prone to being hacked. Leaving your coins on an exchange could ultimately leave yourself and your customers exposed.

Always Follow Best Practices

As such, one of the more secure options to consider would be to utilise a hardware wallet. A hardware wallet allows you to be in full control of your private keys; your currency is stored offline which makes it significantly harder to hack.

The biggest reason $BTC #Bitcoin may not go under $5000 is that so many people are expecting it to

— Cheds Trading [Cancer Fighter] Not giving away ETH (@BigCheds) July 13, 2018

Of course, you will need to keep your hardware wallet in a secure place, particularly if you’re conducting transactions which utilise large amounts of Bitcoin. It would be extremely frustrating if lax security or carelessness caused your businesses to lose money. Be vigilant and selective when choosing your storage platforms. Ultimately, offline wallets would clearly provide safer options than online ones.

Cryptocurrency is still a very new thing, and as such, there is no concrete solution available as to which platform is most effective.

You need to consider factors such as the platform’s interaction with fiat currencies, its regulatory frameworks and the costs involved in utilising the platform. Ultimately, as this is a new area for business and technology, it could be useful to select a platform which provides extensive customer support, 2-Factor Authentication security levels, and the experience of the members which are running the service. It cannot be stressed enough how important choosing the right place to store Bitcoin is.

Ultimately, the landscape for storing Bitcoin is one that is constantly evolving, and as such you will need to be savvy in keeping up with the newest developments. It is likely that even this time next year, there will be new players in the storage market who will offer you certain things that current companies cannot. It is important to involve yourself in the process as much as you can, and think long and hard about providing access to your private keys to third parties, especially if you’re dealing with a large volume of transactions in Bitcoin.

Which Payment Processor Should I Use?

Once you’ve tackled the issue of storage, and decided on the method that you will utilise it is important to find a platform for the actual processing of Bitcoin transactions. This can be done in multiple ways depending on how you desire to approach Bitcoin as well as the size of your business. It also depends on whether you’re looking for coins to be exchanged physically in a shop or online.

For example, if you’re a smaller business or one that has a limited volume of users that may potentially use Bitcoin, it can be possible to have users pay directly into your Bitcoin wallet by providing them with your public address. In order to convert these funds into fiat, you will need to link your wallet with your bank account or credit card. It would also mean having to provide your customers with a guide on how to make payments with the currency.

Suggested articles

Moving Past High Transaction Fees – Cryptopay Taking on CompetitionGo to article >>

This time last year the price of #bitcoin was $2300 and we were pretty damn happy about it. #throwbackthursday

— Needacoin (@needacoin) July 12, 2018

On the offline front, there is also the potential of using screen applications with QR codes in order to process certain transactions. At a checkout you would be able to to scan the codes and receive the Bitcoin in your wallet. This method is quite simple, and all it requires is customers to have their smartphones ready.

A Growing Number of Methods

Finally, there are hardware terminals which functions akin to card machines but look to process transactions in Bitcoin. Depending on the company behind the terminal, the ability of these can be limited or vast, though clearly the more complex machines will also cost more.

If you’re looking to conduct Bitcoin transactions via online means, then your approach would need to be a little different. You can look to create a button on your site which will allow you to make payments in Bitcoin. Through a platform such as Coinbase you will be able to signup for the service, after which you will be provided with HTML code to implement on your website. It obviously important to have someone with a degree of experience in programming to implement this option.

Popular crypto payment processor, Bitpay, announced formal agreement with Florida’s Seminole County Tax Collector, Joel M. Greenberg. Bitcoin Core (BTC) and Bitcoin Cash (BCH) can now both be used for tax payments, beginning this summer. https://t.co/o0ygtXM0ZX

— Bitcoin (@Bitcoin) May 15, 2018

If your business processes its payments through invoices, the issue may be a little more complex as the value of Bitcoin is in a state of constant flux, and it can potentially see you or your customer incurring losses, as ultimately individuals tend to convert their Bitcoin into fiat currency. It is worth providing some suggested amounts of BTC on the invoices as well as detailed descriptions of your public address on where you would like to be paid.

It is also important to consider the regulatory status of using Bitcoin payments. Not all countries are accepting towards cryptocurrency, so you need to ensure that you’re up to date on all of your jurisdiction’s regulations in relation to crypto. It would make little sense to look to accept Bitcoin payments if it turns out you’re breaking the law, as you will not only put yourself and your customers in jeopardy, but can also significantly tarnish your brand image.

Advertising for Bitcoin Acceptance

Once you’ve gone through all the technical aspects of setting up the acceptance of Bitcoin for your business, you need to tackle the issue of how to spread the word about the fact that your site is Bitcoin friendly. After all, what would be the point of going through the effort of setting up for the acceptance of Bitcoin, if no one is aware that your business is compatible with the cryptocurrency?

There are some simple things that can be done, but they can go a long way in helping spread the word. For example, you can put a Bitcoin logo on your website’s homepage in either the header or footer of the webpage. Obviously, the more visible and larger the logo is, the more likely it will be that people know that you do indeed accept such a form of payment.

Another simple method would be to promote this concept on your social media channels. Whether using Facebook, Twitter or Instagram by constantly mentioning it in your posts, you can help make more and more people aware of the fact that your site accepts the currency. This option is particularly useful as it costs absolutely nothing and if you have a significant social media reach it can be very effective.

Using the Tools at Hand to Get the Word Out

You can also provide links to your site on website that are related to Bitcoin. On forums which are populated by loyal Bitcoin followers you can provide word of mouth advertisement at no cost. Places such as Yelp or the Bitcoin sub-reddit are extremely popular and if customers know that your business accepts Bitcoin when they’re specifically looking for this option you can help solve a problem and gain potential new customers for whichever product or service that you’re providing.

Finally, if your business does not have a major online presence, or if it does but also has a physical store, then there’s a very useful old-fashioned way of going about this. Simply get a sign outside your shop which advertises the fact that you accept Bitcoin payments. Put a sticker or sign outside your shop window. Make sure it’s notable and visible, and it may even be useful to place the sticker near the checkout at your shop before the customer makes a payment. Whilst you do not want to overwhelm users with this information, you can raise awareness effectively by reiterating the point.

Reuters

Reuters

Ultimately, choosing the method with which you advertise is completely dependent on you and how persistent you are with it would depend on the importance you would place on Bitcoin’s being as a major payment form.

If your business offers Bitcoin as a quirky alternative to other payments, then perhaps spending lots of money on adverts would be counter-productive. On the other hand, if you’re looking for Bitcoin to be an integral part of your business payments, and are optimistic on Bitcoin’s adoption by consumers globally, then it may be worth to exploit as many of the aforementioned channels as possible.

Paying Taxes–It’s the Law

Sometimes, individuals may think that just because they’re using Bitcoin then taxes may be bypassed given the fact that the currency is not regulated by a central authority. Even though there are no regulations on the token itself as of yet, paying taxes on this currency is vital as your business is ultimately regulated by the authority of where you’re located.

The same taxation principles that apply to regular transactions are applied to crypto transaction as well. Ultimately, the value of the cryptocurrency will be measured in the same way as that of the national currency of a given country. As such, when it comes to tax your Bitcoin will essentially be worth the same amount as a dollar or euro amount.

Other important things to keep track of for tax purposes:

– Forks

– Airdrops

– Mining

– Gifts you give

– Gifts you receive

– ICOs

– Crypto received as payment

– Crypto sent as payment

– Hacked/stolen/lost coins

– Tips receieved

– Crypto donations to charity— Crypto Tax Girl (@CryptoTaxGirl) July 11, 2018

Matters become a little more complicated due to the fluctuations in the price of Bitcoin and as such, governments are currently keenly looking at ways to regulate cryptos in order for there to be an effective taxation system to tackle these issues.

You also have to remember that it is your responsibility to declare your Bitcoin earnings for taxation purposes and to monitor the data. Whilst services like Coinbase do provide data, it only does so after you have made gains of over $20,000 and processed over 200 transactions. Even with this help, you have to be the one who has to figure out how to tax your income. It is a good idea, to keep a detailed log of your transactions so that you can fully monitor what is happening and not get into hot water with the taxation regulators of your country.

Never attempt to hide your transactions or put off your record keeping. Whilst it may be possible in the short-term to cover up your transactions, ultimately this will not pay off in the long-run as governments become more savvy with cryptocurrencies.

Financemagnates.com is author of this content, TheBitcoinNews.com is is not responsible for the content of external sites.

Our Social Networks: Facebook Instagram Pinterest Reddit Telegram Twitter Youtube