Crypto trading can be tricky due to the sudden fluctuations that occur within the market. So, your crypto portfolio needs to be chosen with great care. Learning how to increase your crypto portfolio like a pro can help to buffer your losses in times of market downswings. Stronger coins tend to hold less risk than obscure coins. You’re going to want to follow a strict regimen when considering what new coins to add to your portfolio as long-term holds.

Bitcoin vs. Altcoins

Many crypto traders choose to only invest in Bitcoin. Bitcoin has many unique aspects. It was the first successful cryptocurrency in the world, and it makes up 42.2 percent of the crypto market. Much of the market’s fluctuations are closely linked to BTC’s activity due to its large market size. This substantial market share makes BTC one of the safest cryptos to invest in. Most analysts agree that the probability of Bitcoin collapsing is less than that of altcoins.

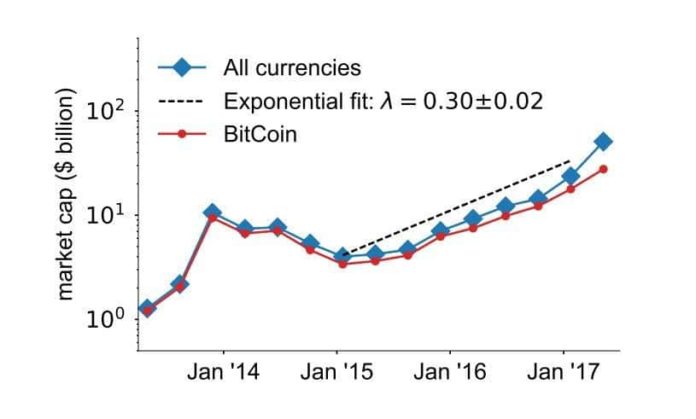

Chart Showing Cryptomarket’s Exponential Growth via MIT

Altcoins are any coin other than BTC. Altcoins can be powerful investment tools when used correctly. The explosive growth of the crypto market can be largely attributed to the success of major altcoins such as Ethereum, Ripple, and Litecoin. There are now thousands of altcoins to choose from. While this gives you unlimited freedom in the market, it can also make choosing the right altcoin overwhelming.

Poorly managed cryptocurrencies can crash and burn in an instant, as with Bitconnect. This is why you will want to do your due diligence prior to making your selection. Let’s get familiar with some market basics that will help you increase your crypto portfolio.

Total Supply vs. Circulating Supply

You need to understand how a coin’s total supply versus its circulating supply can affect the coin’s market value if you want to increase your crypto portfolio like a pro. It’s simple supply and demand. The more demand for an item, the higher the price. If the demand outweighs the supply, the price will always increase.

For example, BTC has a total supply of 21,000,000 BTC. There will be no more Bitcoin created after the 21,000,000th BTC is mined. There are already 17,136,912 BTC in circulation. This means that there are less than 4,000,000 BTC left to mine. Since the circulating supply is approaching the total supply, it would be safe to assume that the price of BTC will rise with the scarcity.

You can apply this principle to altcoin investments as well. A project is less likely to see substantial price movement with strong demand when its supply is high. It’s the old expression, “it’s like trying to sell ice to Eskimos.” If there are billions of the coins to be made, then that increase in demand is easily satisfied without necessarily driving the coin’s price up in the long term.

Decentralized Platforms

There are some distinct differences in the management sector of projects as well. Decentralized projects have no CEO and are community driven. Their code bases are open-source, and most will have an active GitHub where you can go and evaluate the code for yourself.

Decentralized platforms are the backbone of the crypto market and many consider decentralization to be a core belief of the crypto space. There is no BTC office. BTC is simply a mathematical formula that exists on the crypto space. This makes BTC truly “a peer-to-peer electronic cash system” as described in Satoshi Nakamoto’s white paper.

There are also some disadvantages of decentralized projects you should consider if you want to increase your crypto portfolio in the safest manner possible. Primarily, there is no recourse if you are scammed or accidentally missend your crypto. There is no office to send your complaints to, and there are no refunds provided. Blockchain mistakes can be costly when dealing with decentralized cryptos such as BTC.

Centralized Platforms

Centralized cryptocurrencies are run like traditional businesses. There is usually a CEO and a main office that you can contact. Centralized cryptocurrencies tend to try to fit into regulatory standards. NEO and Ripple are two examples of centralized cryptocurrencies which are designed to adhere to possible future regulations.

Ripple’s Office via Homepolish

There are some disadvantages of centralized cryptos as well, mainly that the developers have total control over the creation and destination of your coins. There have been instances where networks were hacked and rather than take massive losses, the developers chose to hard fork the crypto into a new currency to void out the old currency. This is exactly what happened to ETH in June 2016. This led to the creation of Ethereum (ETH) and Ethereum Classic (ETC).

Evaluate the Project

Read your potential investment’s white paper. You should never invest in a project that is not clearly and concisely explained in its white paper. Never invest in a project that doesn’t have a white paper. This is a serious red flag, and the riskiest way to increase your crypto portfolio.

The white paper will give you a brief market assessment, which will include why there is a true need for the platform. There should also be a technical specifications section outlining the platform’s flow and logistical functionalities. Experienced investors know to stick with projects which have an open-source code. This means that the community is free to evaluate and contribute towards making the code more efficient and secure.

A good white paper should include a roadmap that explains the company’s timetable for development. There will also be a team section where you will find the leadership and development aspects of the project. Reach out to team members on social media with your questions. If they are responsive, it is a good sign that the project is being actively developed.

Stay Informed on Market Updates

Crypto media coverage can have a strong effect on the price of a particular coin. The best coins will maintain a strong media presence by actively publishing stories surrounding the development of their projects. Always verify any news which could prove to be profitable. This can include the addition of a particular coin to a major exchange.

Increase Your Crypto Portfolio with Confidence

Blockchain technology is fueling a technological renaissance across all sectors. There is considerable room for growth in the coming months as cryptocurrencies continue to gain popularity. Follow the steps in this guide and you can increase your crypto portfolio responsibly, with the odds in your favor.

The post How to Increase Your Crypto Portfolio Like a Pro appeared first on CoinCentral.

Coincentral.com is author of this content, TheBitcoinNews.com is is not responsible for the content of external sites.

Our Social Networks: Facebook Instagram Pinterest Reddit Telegram Twitter Youtube