The Securities and Exchange Commission (SEC) Chairman Gary Gensler proclaimed the crypto space to be the “Wild West” while calling for regulations to protect crypto investors. In fact, he is not the only one. Since the early days of Bitcoin, the crypto ecosystem was something close to the California Gold Rush days. Times that presented opportunities for making large amounts of wealth but many at times at the expense of a vulnerable few; no rules or regulations in place to protect the ones being exploited.

Governments in both big and small countries around the world have been brainstorming for a few years to regulate the crypto ecosystem. Crypto-regulation talks are heating up in countries like the USA, the UK, India, and more. Countries like Japan and China are ahead in the regulatory implementations but are poles apart in their approach.

Some nations have made progress in regulations, many are still holding talks, while a few have taken the route to ban. In all these three cases, there are a few key themes that have emerged: stopping cryptocurrency crime and tax evasion, stablecoin regulation, and the potential for investment vehicles like crypto ETFs and other funds.

However, the crux of these themes, where most governments have the hardest-hitting case for harsh regulation on cryptos, lies in Crypto’s anonymous nature.

They have two cases to make in this aspect, the first one being money laundering and the use of anonymity for illicit activities. The second point is that in some ways a decentralized global monetary structure can be a threat to a country’s sovereign fiat currency.

Whatever the motivation for regulation might be for the government, the investors need to recognize that the crypto ecosystem will slowly but surely get monitored and they have to be prepared for it.

There are a few approaches that crypto businesses and investors can take to reduce their risk exposure to regulatory uncertainties.

Owning the Private Keys

Owning one’s private keys is an important aspect of any truly decentralized platform, whether it be an exchange, wallet, or intermediary. In some ways, leaving the private keys in a location that doesn’t let people own their private keys is like leaving a house to be taken care of by a caretaker. Sure, they may guard and maintain it, but it depends on them. There is a chance of failure from a single point.

A few ways to own private keys is using online wallets like MetaMask or Atomic Wallet. One of the most popular ways to get complete control of your cryptos is to use a Hardware wallet like Ledger.

Use Decentralized Exchanges

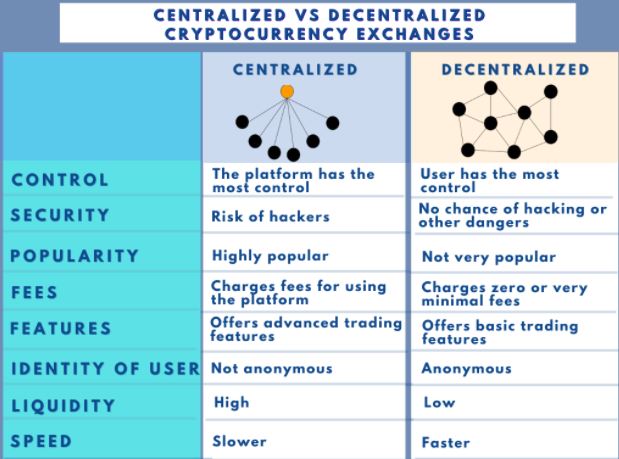

In the air of regulatory uncertainty, depending on centralized exchanges might be the worst mistake to make. If a government plans to clamp down on cryptocurrencies, one of the targets will be centralized exchanges. It can already be seen happening with Binance’s ban in countries like Hong Kong and Malaysia.

Decentralized exchanges (DEX) seem to be a better way to trade and transact crypto. Unlike centralized exchanges, DEXs don’t need all the information to go through a single point. Instead, it’s more like a peer-to-peer network where many points connect. This in turn offers privacy and control over the assets by taking power away from market makers and leaders like banks, lawyers, and brokers.

Register a Crypto Business in a Crypto-Friendly Jurisdiction

For large investors and crypto business owners, it makes sense to move to an already crypto-friendly jurisdiction rather than gambling on a particular country’s lawmakers. The initial cost of moving the business set up might be high and time taking, but it is a small price to pay if the decision-makers in the country don’t plan to be friendly towards crypto businesses. Some of the most crypto countries currently are Portugal, Malta, Australia, Singapore, Vanuatu, Estonia, Sweden, Switzerland, and El-Salvador.

Partnering with Institutions

There is a case to be made that institutionally supported cryptocurrencies will be better than cryptocurrencies without institutional support. This is mainly because most large institutions already have the desired financial clearances from the regulators. Additionally, they might have lobby power that can help with desired crypto regulations if necessary.

As an investor, it might make sense to invest in cryptocurrencies that already have a good amount of institutional partnership or have a roadmap for it.

Cooperative Business Model

To achieve true decentralization, a company can not just depend on one particular nation’s jurisdiction. This is where a cooperative business model comes in. A co-operative is an association of people and organizations united voluntarily to meet their common economic, social, and cultural needs and aspirations through a jointly-owned enterprise. Basically, through a co-operative, firms can diversify the legal risk quotient from one single jurisdiction.

Privateum, a privacy-focused cryptocurrency launched in 2021, is taking this route to bring privacy to people. They are not only using decentralized technology but also bringing structural decentralization legally and organizationally. Privateum initiative system provides integrations for Fintech companies under the legal partner’s umbrella. The business model of the Union of cooperatives is designed to extend financial services and asset management in the rest of the world.

This mix of both legal and technical decentralization can be seen as one of the most innovative approaches to undertake the problems of bringing privacy to the masses while being compliant with the laws of multiple countries.

People might not be able to control what exactly their regulators do but they can be in charge of their actions. Investing and building on projects that can adapt to regulations, whichever way they go.

TheBitcoinNews.com – Bitcoin News source since June 2011 –

Virtual currency is not legal tender, is not backed by the government, and accounts and value balances are not subject to consumer protections. TheBitcoinNews.com holds several Cryptocurrencies, and this information does NOT constitute investment advice or an offer to invest.

Everything on this website can be seen as Advertisment and most comes from Press Releases, TheBitcoinNews.com is is not responsible for any of the content of or from external sites and feeds. Sponsored posts are always flagged as this, guest posts, guest articles and PRs are most time but NOT always flagged as this. Expert opinions and Price predictions are not supported by us and comes up from 3th part websites.

Advertise with us : Advertise

Our Social Networks: Facebook Instagram Pinterest Reddit Telegram Twitter Youtube