Few things in life are as appealing as free money. For that reason, few things set off as many alarm bells as the promise of free money! After all, if something sounds too good to be true, it probably is… Right?

We usually don’t post these type of posts but in this case, the offer of free money has been tested by our team to be genuine and safe! The amounts on offer are also worth your time, assuming you hold a fair amount of bitcoins.

Note: the sums mentioned in this article depend on the current market value of Byteball ($800), so your precise reward will vary over time… you can either keep your free altcoins or instantly convert them to Bitcoin, another altcoin, or fiat.

Does this still sound too good to be true? Well, there are a couple of minor strings attached:

1) Some manageable privacy risk, which we’ll show you how to mitigate, and

2) Performing a couple of moderately-advanced wallet functions, which we’ll guide you through in detail.

Why Are Projects Giving Away Free Money?

As bootstrapping is the hardest part of launching any new cryptocurrency, the successful distribution of coins to new users is critical. If nobody’s using a new coin, then it doesn’t matter if it has amazingly innovative technology, skilled developers, or a passionate core community.

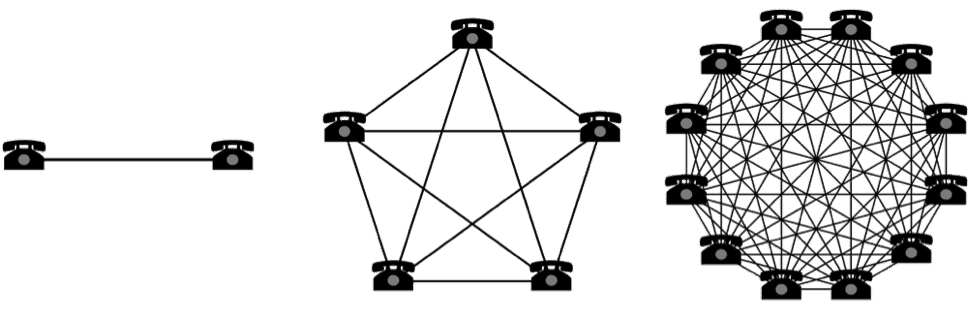

Metcalfe’s law states that the value of a (telecommunications) network is proportional to the square of its users, and this law is equally applicable to cryptocurrency.

2 users = 1 connection, 5 users = 10 connections, 12 users = 66 connections, etc.

It’s clear from the above diagram that the busiest network is the most useful, therefore the most valuable and most likely to attract ever more users in a positive feedback loop. As the altcoin market is beyond saturated – 756 and counting – competition for users is incredibly fierce…

Hopefully it’s starting to make sense why certain coins are just given away – and your “too good to be true” alarm is fading!

As a distribution method, giving away quantities of a new coin to Bitcoin holders – individuals with a proven interest in cryptocurrency – is perhaps the surest way to build an initial base of receptive users. If the new coin also delivers (in terms of technology, economy, interest and so on), it stands a great chance of gaining the initial traction necessary to rise above its competitors.

How to get free coins with Byteball

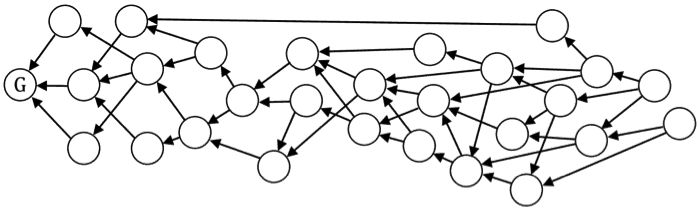

Byteball (GBYTE) was released in September of 2016 and is notable for not using a blockchain to order transactions, but rather a Directed Acyclic Graph (DAG). If you’ve ever mined Ethereum you may be familiar with this term. Indeed, Byteball is sometimes touted as the Ethereum-killer, as it offers lightweight peer-to-peer smart contracts. These contracts enable conditional payments, prediction markets, insurance, betting and various bot-operated markets from within the standard client. Byteball also provides a stealth-coin asset, known as Blackbytes.

“DAG-chain” example from the Byteball white paper, G being the genesis unit.

Byteball’s Offer

Every full moon, you’ll get free byteballs and blackbytes for every full bitcoin over which you can prove ownership – fractions don’t count. The next drop will occur at around 4:07 AM (UTC) on July 9th 2017. Each bitcoin will earn you 0.0625 byteballs (currently worth around $50) and 0.132 blackbytes (currently worth around $2.50). These Byteball drops will continue through 2017 and perhaps into 2018, until all GBYTE is awarded. Roughly 25% has been distributed thus far, so this is a medium-term, repeating opportunity!

How to Claim Your Byteball

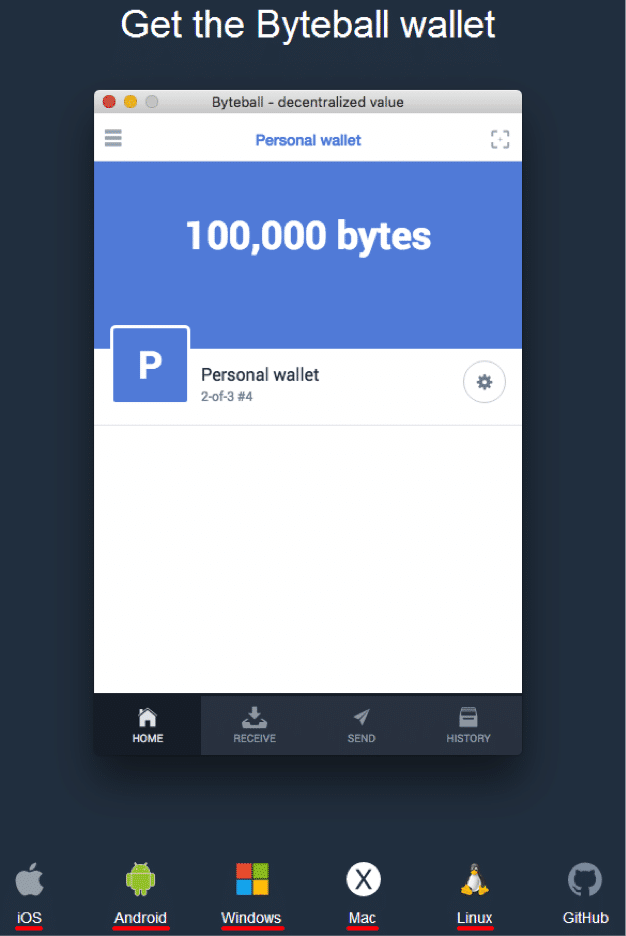

Step 1 – Wallet Installation

Download and install the correct Byteball wallet for your system. All major platforms, including mobile, are supported. Opt for the light / quick wallet if prompted. If running on a 32-bit version of Windows, you can try this 32-bit test version of the Byteball client software.

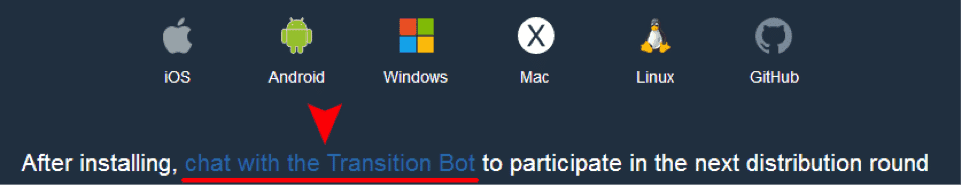

Step 2 – Initialize the Bot

After installation, open the wallet and click this link on the Byteball wallet page:

This will add the “Transition bot” to your Byteball wallet. This bot handles the assignment of new byteballs and blackbytes to your wallet, based on your bitcoin holdings (as well as any existing byteball or blackbyte holdings – we’ll cover this aspect later).

Step 3 – Talk to the Bot

An initial address will be automatically created by your wallet. Now it’s time to talk with the bot!

If the bot’s window isn’t already open, click the “Chat” tab

at the bottom right corner of the wallet interface.

Then select the “Transition Bot” as your new conversation partner

(don’t expect scintillating repartee but you can look forward to some free coins!)

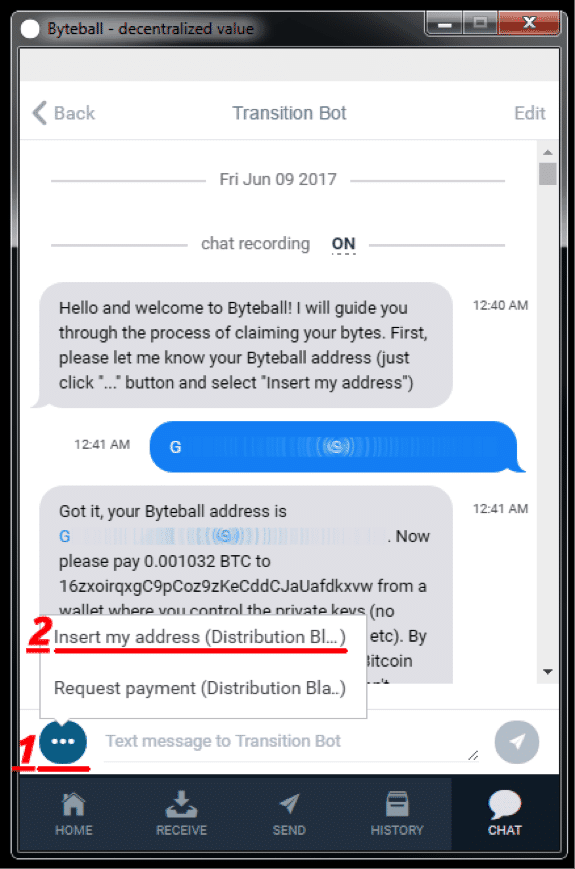

Step 4 – Link the Bot with Your Receiving Address

An interaction with the bot is now initiated. The first step, as the bot explains, is to give the bot your Byteball address. This address was automatically generated and named by your wallet previously. Click the ellipsis bubble next to the text input bar and then select “Insert my address…”

32 character wallet addresses is blurred for privacy reasons.

Step 5 – Prepare to Sign for Your Bitcoin Addresses

The bot then requests a small Bitcoin payment to a Bitcoin address controlled by the Byteball team. While this is a viable method to prove ownership, there’s another method which is both faster and free – message signing.

At this point, familiarity with the functions and features of your Bitcoin wallet will be extremely helpful. As there are so many Bitcoin wallets available, it’s impossible for this guide to cover all of them. We will demonstrate how to sign for an address using the Bitcoin Core full wallet and the Electrum light wallet. If using a different Bitcoin wallet, please consult its documentation for help on the following 3 steps…

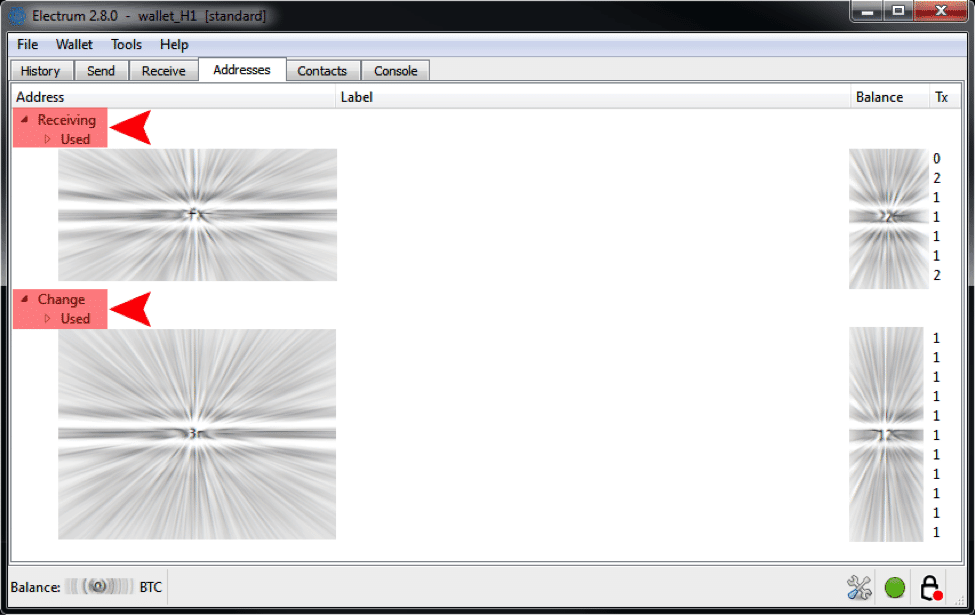

Step 6 – Display Address Balances

In order to know which addresses to give the bot and sign for, it’s necessary to examine all the addresses contained within your Bitcoin wallet addresses. Note that so-called change addresses may not be displayed by default within your wallet.

Unless all your Bitcoin payments were received by a single address (which is not recommended for privacy reasons), your wallet’s balance will be composed of amounts held within various addresses under your wallet’s control.

It’s necessary to inform the Transition bot of every address containing a significant amount of Bitcoin. These amounts will be totalled by the bot to determine how many byteballs and blackbytes you’re eligible to receive.

Bitcoin Core:

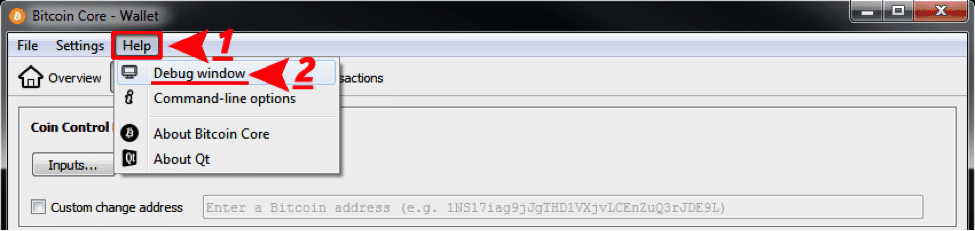

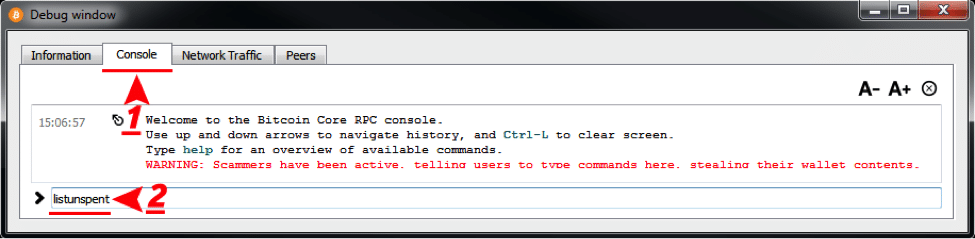

You may display all your Core addresses which hold value by opening the Console and entering the listunspent command:

Click “Help” then select the “Debug window”.

Select the “Console” tab then enter the listunspent command.

Core will then list non-empty addresses and their values. Note down which addresses contain funds (copy-pasting the info into a text file is the easiest way). This list is especially useful for finding change addresses not automatically listed by the Core wallet in Step 8.

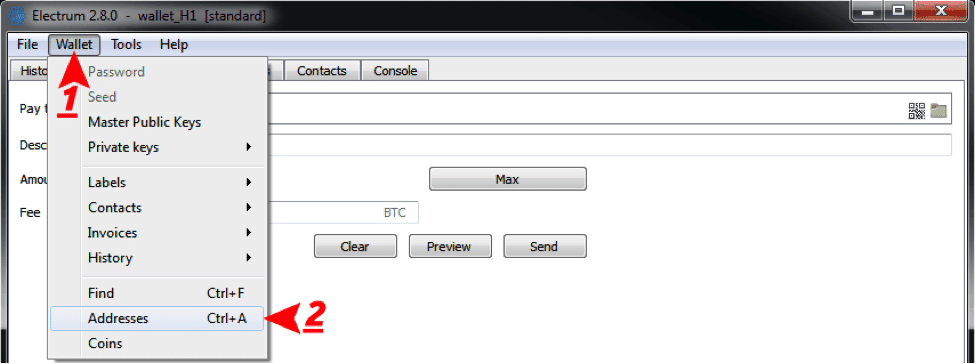

Electrum:

If the “Addresses” tab isn’t visible, click the “Wallet” menu and then click “Addresses.”

Ensure that the “Receiving” and “Change” lists are expanded.

Now you can view all the addresses which hold your bitcoins, not just the receiving addresses which your wallet regularly displays. We’re getting under the hood of your Bitcoin wallet here; understanding how change addresses work will help you to improve your privacy in future.

Step 7 (Optional) – Consolidating Multiple Bitcoin Addresses

Combining multiple addresses into a single address can save a lot of time, depending on the number of addresses you intend to sign for. It takes about one minute to complete the signature process for each address, so decide accordingly.

To consolidate your addresses, simply send all your bitcoins to an address under your control. This should be a new or existing receiving address within a wallet you own.

Caution: perform this step well in advance of the next Byteball drop – at least a week in advance to be on the safe side. If your consolidating transaction isn’t confirmed by the time the drop occurs, you’ll miss out on the opportunity. Wait for a lull in Bitcoin network activity – these usually occur over weekends – and consult our guide for info on setting an appropriate fee.

Step 8 – Sign Text Messages Using Your Bitcoin Wallet

The same private key used to authorise payments from a Bitcoin address may also be used to create an un-forgeable cryptographic proof which links that text with that particular address. This process is known as signing and it’s entirely secure – see the below section, “A Note on Signing Security Concerns”.

Unfortunately, some personal wallets and most exchange wallets don’t feature signing functionality. If your wallet doesn’t support signing, you’ll either have to send the suggested micropayment to the Transition bot’s Bitcoin wallet or transfer your bitcoins to a wallet which does support signing.

This BitcoinTalk forum post, although slightly out-dated, provides a lot of helpful information on which wallets support signing, as well as how to sign with them. Here’s how the process works, in 3 simple steps:

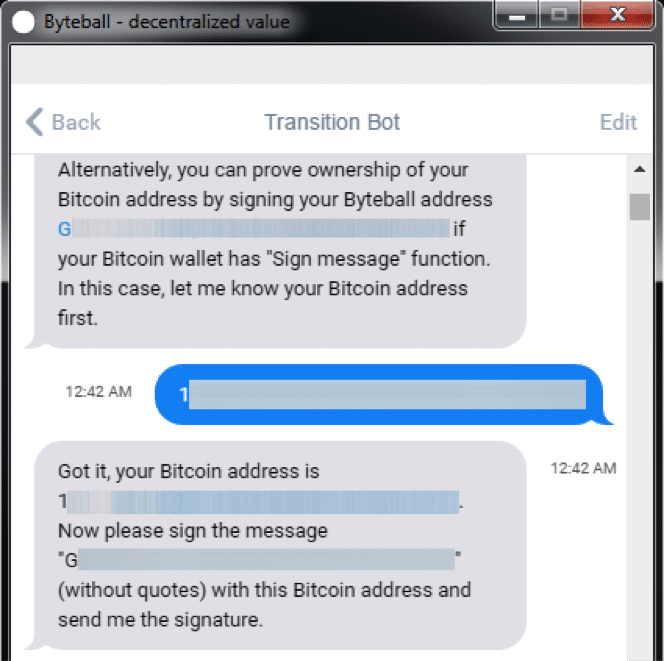

1) This first step requires a little copying-and-pasting of addresses between your Byteball and Bitcoin wallets.

The Byteball bot asks for a Bitcoin address. Give it one which contains BTC. The bot will then ask you to sign your auto-generated Byteball address, using the provided Bitcoin address.

2) Here’s how to sign your Byteball address using your Bitcoin address(es):

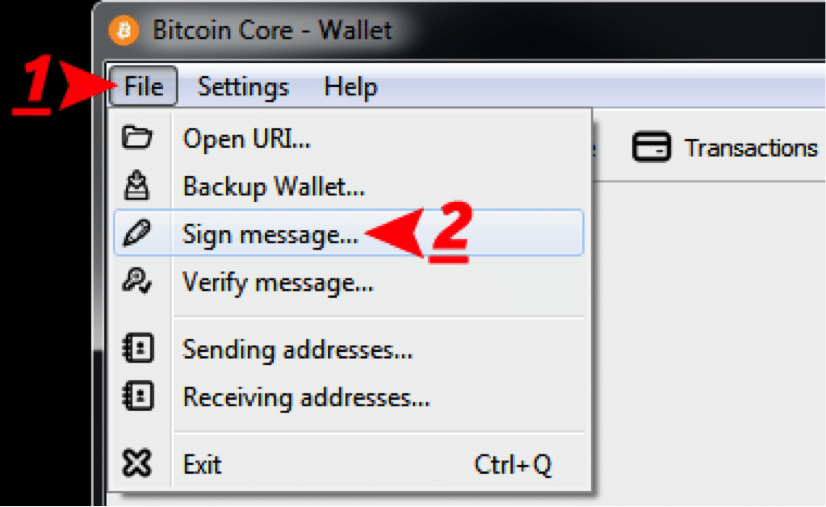

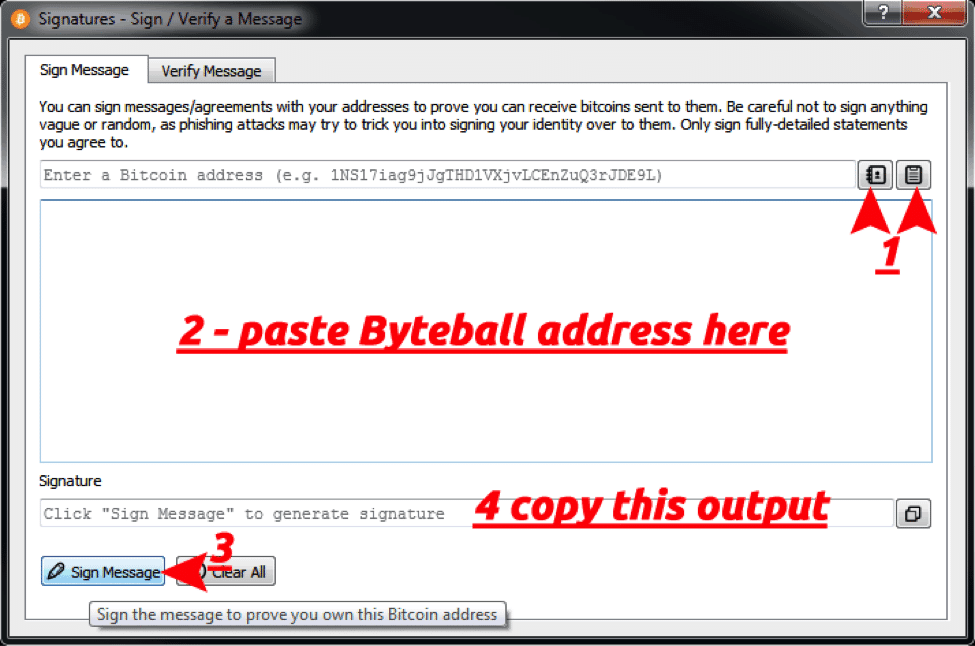

Bitcoin Core:

Select “File” menu then the “Sign message…” tool.

For Part 1, click the left button to select from a list of receiving addresses

(listunspent reveals which contain funds).

Clicking the right button will paste any change address you copied from the

listunspent command run in the wallet’s Console (Step 6).

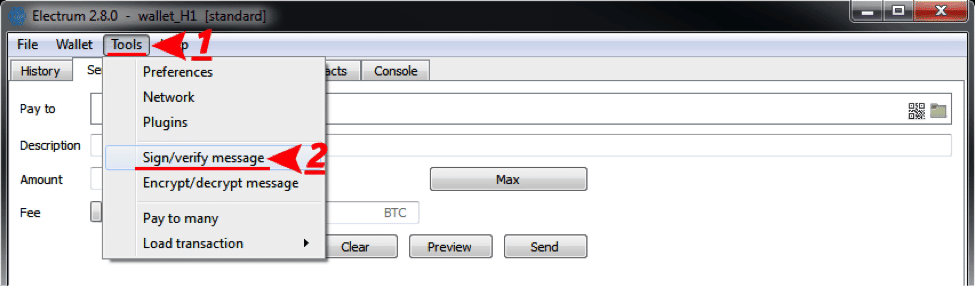

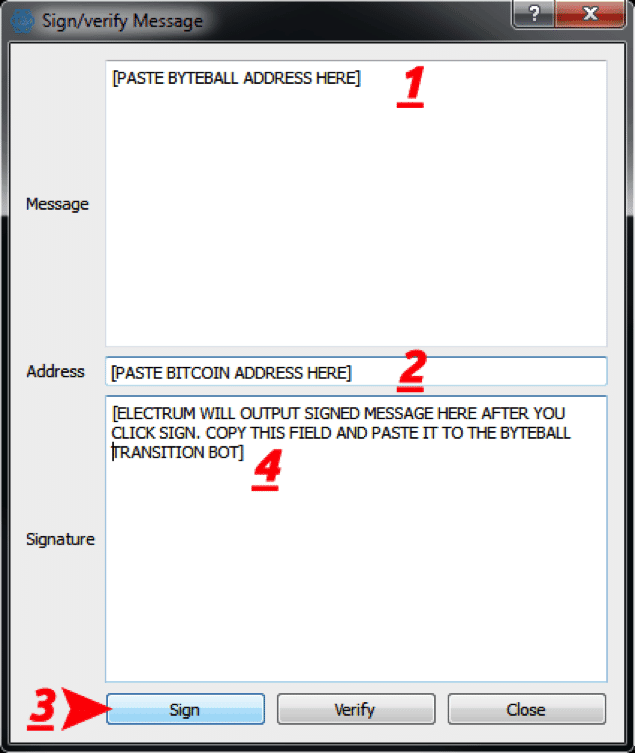

Electrum:

Select the “Tools” menu then the “Sign / verify message” option.

Paste the relevant addresses and click Sign. Now copy the output.

Signing is a useful operation, in the event you ever wish to prove ownership of a Bitcoin address. However, as the Core wallet advises, you should always name and date any statements you sign, particularly those with legal implications.

In this case, your signature can only be used to associate your Bitcoin addresses with a Byteball address. This is unlikely to cause you any problems in future, although do see the cautionary note contained in the below section, “A Note on Privacy Concerns.”

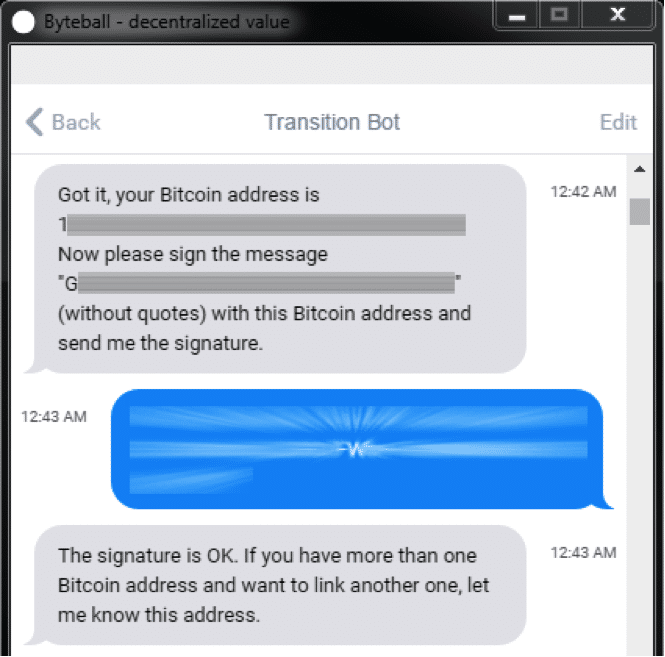

Step 9 – Give the Bot Your Signed Message

Get the signed message and paste it to the Byteball Transition Bot. If all goes well, the bot will let you know:

The Bot now knows you own the particular Bitcoin address you signed for!

If you were using a consolidated Bitcoin address, the process is now complete! If not, repeat Steps to 6 – 9 until you’ve signed your Byteball address with all your value-containing Bitcoin addresses.

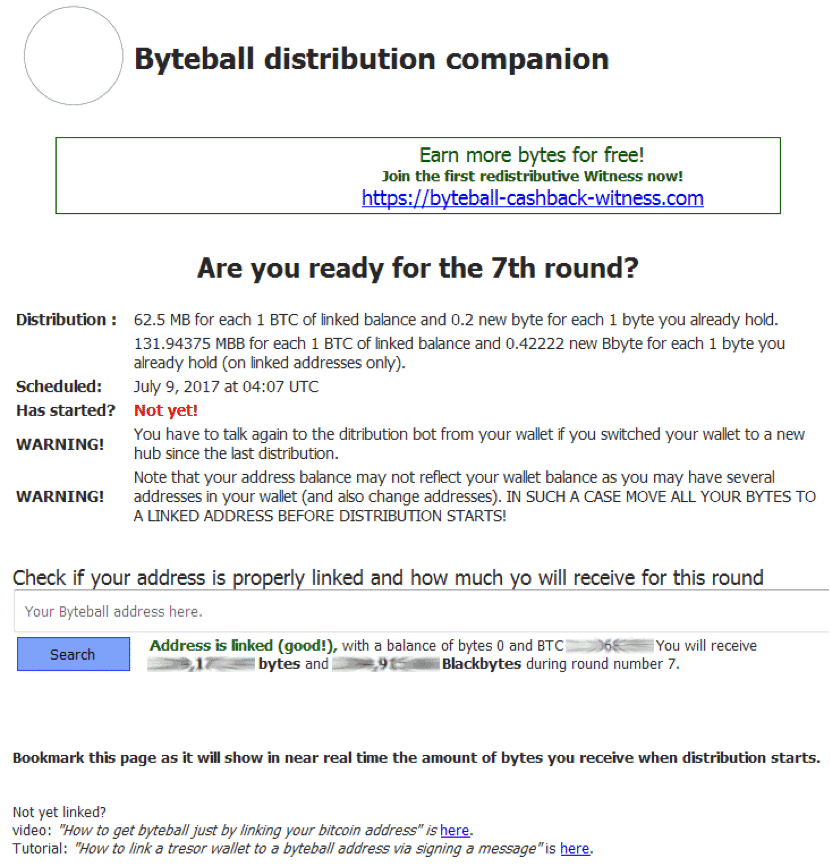

Step 10 – Check Your Total Pending Byteball and Blackball

Visit this website and paste your Byteball address into the field provided. Within a few minutes of completing the signing procedure, it’ll display the total amount of byteballs and blackbytes you can expect to receive in your Byteball wallet when the drop occurs.

Multiply your number of complete bitcoins by the expected byteball reward and compare the result by the total displayed by the website. If the website displays less than expected, it can only mean that you’ve forgotten to sign for one or more addresses. Note that there’s no benefit for including address amount which won’t bring your total above (integer) BTC.

I got the coins! Should I Sell or Should I Hold?

Once you have your free GBYE, you must decide whether to hold it or sell it! Below are some points which may help you to decide!

Daily prices of Byteball on Bittrex, its biggest market.

Note the run-up to June 9th (crosshaired) and the subsequent dip and recovery.

Reasons to Hold

- The pattern so far has been that Byteball price dips on the drop as a percentage of newly-awarded coins are instantly sold, but then recovers shortly thereafter. This implies that price will continue to rise, at least until the final coins are awarded.

- Holding GBYTEs in your linked wallet makes you eligible for a 20% bonus in the amount you’ll receive (based on your linked bitcoins) in the next distribution round. A similar bonus also applies to any blackbytes you hold.

- Byteball has yet to be listed on the major altcoin-only exchange, Poloniex. A price spike may be anticipated when (or if) it gets listed there, or on any other big exchange.

- Byteball’s DAG technology is promising… Smooth scaling, easy smart contracts and fast transactions are implied. Review the website and white paper for more details.

- Byteball’s distribution method and relative lack of promotional hype suggests a serious project geared towards major long-term success, rather than short-term gain. This would represent something of a welcome exception in the altcoin space.

Reasons to Sell

- If you really need bitcoins or fiat in a hurry, then it’s better to sell byteball than a kidney!

- Byteball’s code hasn’t been subject to any intensive peer review. It could contain secret bugs or exploits which harm the system.

- The DAG concept, as supported by Witness nodes, has also yet to be reviewed and challenged by cryptocurrency experts. There exists the possibility of a misaligned incentive structure or unknown attack(s) which could damage or even break Byteball’s security model.

- Byteball’s real-world resilience to a persistent fork – or even multiple simultaneous forks – has yet to be established.

It’s up to the individual to weigh the above points and come to a decision. Good luck!

A Note on Security Concerns

It occurred to this author that, if the Byteball wallet were a particularly crafty piece of malware, it might trick users into providing signatures which could be used to authorise a transactions from users’ Bitcoin wallets – and drain them! However, this concern may be safely dismissed, for the following reasons:

1) Six Byteballs distributions have been completed thus far, with no reports of any such malicious activity.

2) The Byteball wallet generates the text to be signed (specifically, your Byteball address) before requesting any signatures from your Bitcoin wallet. It would have to a remarkably sophisticated malware to know which of your

3) The following conversation with Bitcoin Core developer, Gregory Maxwell, in which he confirms that preventions against such a signature attack have been implemented in Bitcoin:

HeySteve: is it possible to construct a message to be signed by a bitcoin address, such that the signed message could also be a signature used to authorise a transaction?

gmaxwell: If by “signed by a bitcoin address” you mean the standard signmessage functionality, then the answer is No because we very carefully constructed signmessage so this could never be possible.

What transactions are signing is sha2(sha2(masked transaction)) and what signmessage signs is sha2(‘Bitcoin signed message:’ || message)

(I might be slightly wrong about the exact string.)

I think the very early draft of that functionality didn’t do that– e.g. sha2(message), and someone (probably me or Peter Todd) pointed out that you could be tricked into signing something that was actually a transaction hash.

HeySteve: yes, that was my worry. I signed a series of 32 character altcoin addresses using my Bitcoin addresses

gmaxwell: Yea, we’re looking out for you. 🙂

A Note on Privacy Concerns

If you follow the above procedure, the Byteball developer and anyone he shares the information (willingly or otherwise) will be able to associate your IP address with all Bitcoin addresses for which you signed. Further, it would be possible for other addresses you own to become associated with your linked addresses.

You may mitigate these issues immediately after the drop occurs by anonymizing your bitcoins.

The Fairness of a “Bitcoiner Drop” Distribution

Effectiveness isn’t the only criteria for judging a coin’s distribution. Allegations of an unfair or selfish distribution can harm a coin’s reputation over the long term. Distributing new coins to holders of existing coins is arguably the fairest way to distribute a new coin, assuming the initially held coins were fairly distributed. Compare this method to the alternatives:

1) Mining

Proof of Work mining, performed on a CPU, was Satoshi’s original design for Bitcoin’s distribution. This method was perfectly fair in that any interested party with a computer could participate and earn their share of coin for contributing to the security of Bitcoin’s blockchain.

However, the advent of ASIC technology changed the game; only those with major investment into mining facilities in areas with cheap power are able to profitably mine nowadays.

In response to ASICs, many altcoins implemented ASIC-resistant mining algorithms. These restrict mining to those with powerful graphic cards – generally accessible and relatively affordable tech, with numerous applications. This ensures a fairly healthy distribution of coins over time, except in the case of pre-mined coins. Such coins reserve some percentage of their total issuance for developers – up to 100% in the case of Ripple.

2) ICOs

Initial Coin Offerings are essentially the pre-sale of coins / tokens for a project in development; like a crypto Kickstarter. This is currently a common – if questionable – distribution strategy for new projects. ICO developers tend to hype their project to the max to attract as much initial funding as possible. When (or if) the project launches, buyers get their coins… which then usually crash in price immediately. In rare cases, price recovers to trade above its ICO level.

The “ICO Special” – lots of froth, not much else!

Many ICOs are based on Ethereum, which was itself partly distributed as an ICO as well as pre-mined. The spectacular failure of the DAO, which led to the loss of over $60 million and the bifurcation of the Ethereum network, doesn’t seem to have dampened enthusiasm for ICOs. Currently the Bancor project has raised a record $153 million and ICOs have become something of a mania… Be wary of investing in such projects; many will turn out to be catastrophic money burners!

If you’ve tried this method yourself please let me know your experience in the comment section below!

Good luck!

- About

- Latest Posts

![]()

Bitcoin Video Crash Course

Know more than 99% of the population about Bitcoin. One email a day for 7 days, short and educational (guaranteed).

Our Social Networks: Facebook Instagram Pinterest Reddit Telegram Twitter Youtube