Advertisment

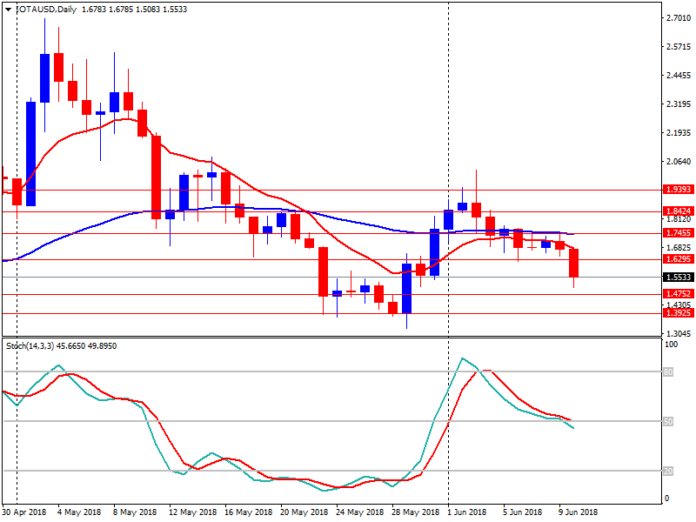

IOTAUSD Long-term Trend -Bearish Supply zone: $2.0000, $2.2000, $2.3000 Demand zone: $1.4000 $1.3000, $1.2000 Iota is in a bearish trend in the long-term outlook. After making a bullish move to the supply area at $2.0267 on June 3rd, the cryptocurrency has been dropping. This is due to momentum loss by the bulls for a continuous…

iota-news.com is author of this content, TheBitcoinNews.com is is not responsible for the content of external sites.

Our Social Networks: Facebook Instagram Pinterest Reddit Telegram Twitter Youtube