Mike McGlone believes Bitcoin’s current volatility is unsustainable and as it tapers off BTC price will enter an extended period of consolidation.

Bitcoin Price will Drop as Volatility Dries Up

Earlier this week Bloomberg Intelligence senior commodity strategist Mike McGlone cast doubt on the widely held belief that Bitcoin is destined to the moon to a new all-time high before the 2020 halving event.

According to McGlone, technical charts show that Bitcoin’s volatility is “too high to sustain Bitcoin gains”.

McGlone explained that the 30-day minus 180-day guage is fast approaching levels not seen since 2015 and the last time this happened BTC “transitioned to a bull from a bear market.”

A number of crypto-twitter members vehemently disagreed with McGlone’s market outlook and one clever follower tweeted:

Is BTC Bullish or Bearish?

With that said, McGlone is not completely bearish on BTC’s future price action. In a lengthy Bloomberg post from August 6, McGlone said:

Bitcoin should remain a primary beneficiary of growing demand for its store-of-value, quasi-currency asset properties, similar to gold.

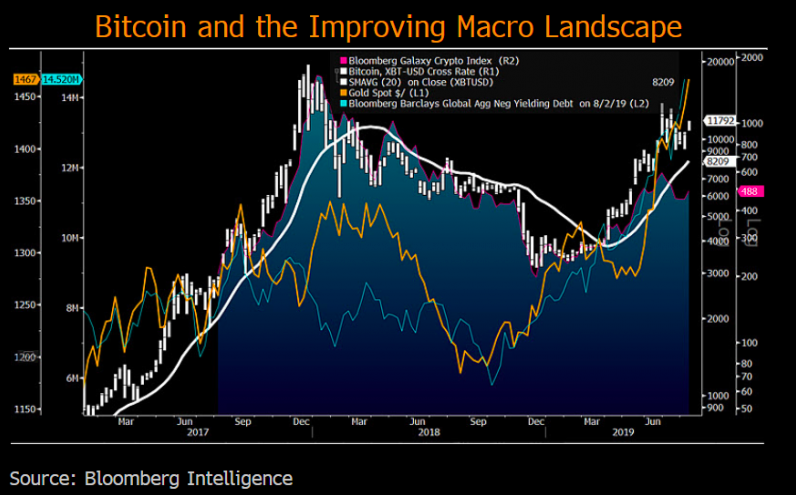

According to McGlone, softening macroeconomic fundamentals like monetary easing, interest rate cuts, plunging bond yields, and increasing stock market volatility are encouraging investors to hedge in BTC and commodities like gold.

Bitcoin is also sucking up all the air in the room and its increasing dominance rate has lead to the majority of altcoins entering a free fall. McGlone points out that this phenomenon “differentiates Bitcoin from other crypto assets, much as gold is gaining luster vs. most commodities.”

The report cites increasing institutional interest in crypto and Bitcoin’s growing correlation to Gold as reasons why the digital asset could be in the early stages of a bull market.

McGlone is confident that the rally has legs but cautions that retracement to the 20-week average near $8,200 could take place at some point in the future.

The report also references growing demand for BTC futures and steady increase in volume as factors supporting a sustained Bitcoin rally. Referencing Bitcoin’s 2018 price action, McGlone cautions that Bitcoin will take time to consolidate and cool off after each parabolic advance.

The analyst suggested that “further consolidation [could occur] around the halfway mark of the 2017-2018 decline near $11,300.”

BTC Futures are Telling the Future

Bitcoin futures are also on the rise and McGlone describes the situation as the “futures tail increasingly waggin the Bitcoin-bulldog”. Essentially, this means that activity within the futures market is impacting Bitcoin’s spot price and ascending trajectory.

According to McGlone, “increasing premium(s) in the futures’ trading prices is indicative of growing buy-and-hold interest.”

Interestingly, McGlone’s tweet is strongly contradictory to the Bloomberg report and one begins to wonder if it was nothing more than lucrative click-bait.

Do you think Bitcoin price will enter a consolidation phase if volatility drops? Share your thoughts in the comments below!

Image via Shutterstock, Twitter:mikemcglone11, Bloomberg

The post Is Bitcoin Price Rally Running Out of Gas? May be appeared first on Bitcoinist.com.

Bitcoinist.com is author of this content, TheBitcoinNews.com is is not responsible for the content of external sites.

Our Social Networks: Facebook Instagram Pinterest Reddit Telegram Twitter Youtube