After a significant slide since January, the cryptocurrency bounced back in April. Though it could not touch the apex, the upward momentum created a positive market sentiment. However, that did not last long.

Several market events and regulatory concerns again pushed the trend down. The initiation of the month of June projected some stability on the market, but all of that went wrong after the recent attack on the South Korean crypto exchange Coinrail.

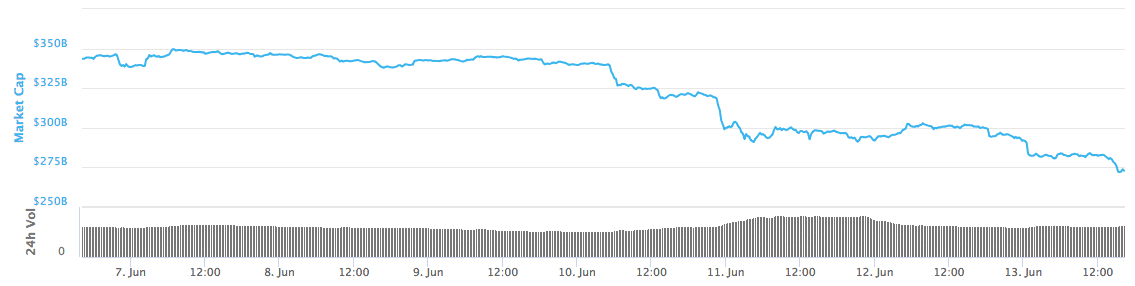

As coins are struggling to maintain their values, the entire market shed $28 billion in mere 24 hours. This added to the weekly loss of $78 billion as the total market cap went down from $345 billion to mere $272 billion, according to CoinMarketCap.com.

Total market capitalization

Total market capitalization

Still “digital silver”?

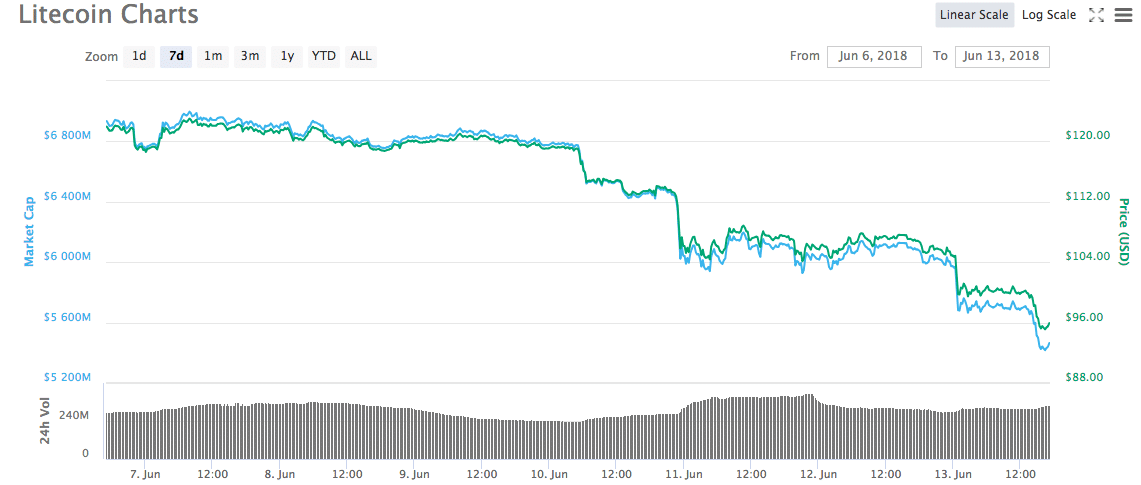

Though every major coin added to this loss, the case of Litecoin stands out as its prices went below $100 for the first time since last December.

The value of Litecoin started to climb in November and with a massive spike in December, as its value touched $370. It also had a massive 50-day appreciation of almost 600 percent. Many market positive factors like the listing of the coin on South Korean exchange Coinone and active involvement of Charlee Lee in its promotion pushed the value up.

However, since May, Litecoin is struggling to find any solid support. It went down from $145 on the monthly chart, depreciating more than 52 percent as the floor value hit $95. This was heavily boosted by the dip in the recent hours as the coin lost 10 percent in last 24 hours.

Litecoin

Litecoin

Charlee Lee in a recent tweet also addressed the bearish market issue but in a humorous way.

I’m in Taiwan right now and will be at the Taipei Bitcoin meetup tonight. If you are in town, stop by and let’s figure out how to turn this 🐻 market around. 😀

https://t.co/RqomhIFjGw— Charlie Lee [LTC⚡] (@SatoshiLite) June 13, 2018

Part of the pack

Apart from Litecoin, conditions of other major names like Bitcoin and Ethereum are also not good.

Bitcoin is struggling to hold its value as it went below $6,500, and for Ethereum, the condition is even worse, as it dipped below $500, again.

Commenting on the market performance, Maxim Nurov, a fund manager at Black Square Capital, said: “The hack of the Korean crypto exchange may have initially triggered the market breakdown; however, the overall bitcoin market condition was already uncertain. From early June, the bitcoin price has been relatively flat with low volatility and many people were not willing to buy or sell bitcoin until there were clear bullish or bearish market signals. Over the weekend, the sudden drop in bitcoin price caused an increase in sales orders and also triggered stop-loss orders leading to further deterioration in price.”

Financemagnates.com is author of this content, TheBitcoinNews.com is is not responsible for the content of external sites.

Our Social Networks: Facebook Instagram Pinterest Reddit Telegram Twitter Youtube