Cryptocurrency markets are slumping today as most digital asset markets are seeing losses between 8-20 percent over the past 24-hours. Lots of speculators are attributing the dump to the recent measures taken by Japan’s Financial Services Agency (FSA), asking cryptocurrency exchanges like Bitflyer to make improvements to the Japanese trading platforms’ anti-money laundering practices.

Also read: William Shatner Joins Bitcoin Mining Project, Admits He Doesn’t Quite Get It

The Crypto-Bears Are Back

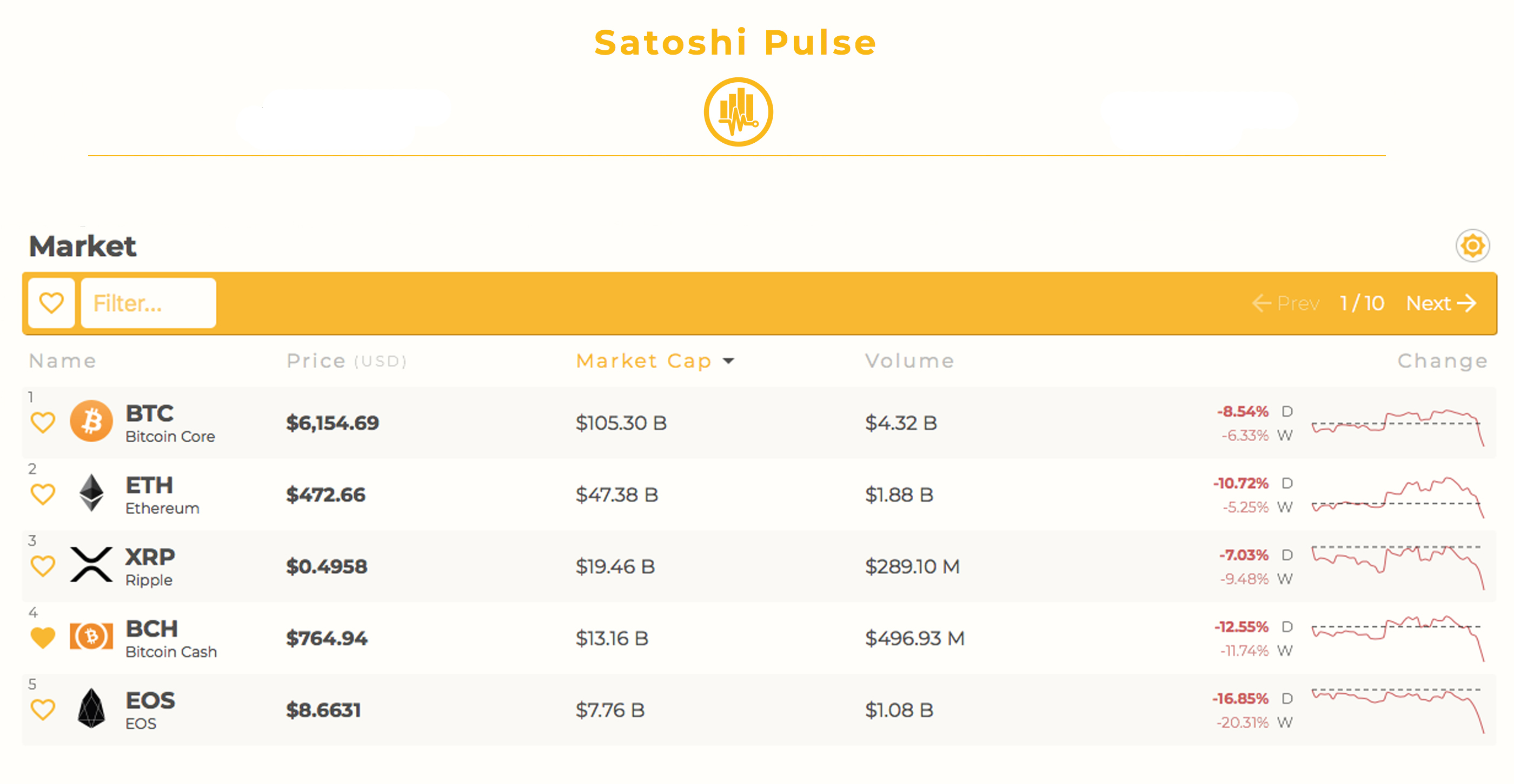

Just a few days ago digital currency market prices were reversing northbound after the extremely bearish first two weeks of June. Now markets are once again being attacked by bears, and most of the top cryptocurrencies are seeing deep losses over the past day. Bitcoin Core (BTC) values have tumbled 8.5 percent over the last 24-hours and the currency is down 6.3 percent over the last week. Bitcoin Cash (BCH) markets are also down 12.5 percent during the past day, and over the last seven days BCH is down 11.7 percent. The decline in prices started after Japan’s FSA began telling exchanges they need to upgrade their systems and anti-money laundering procedures. We don’t really know whether or not this announcement is the true reason behind the dump, but traders and speculators have tethered the two together.

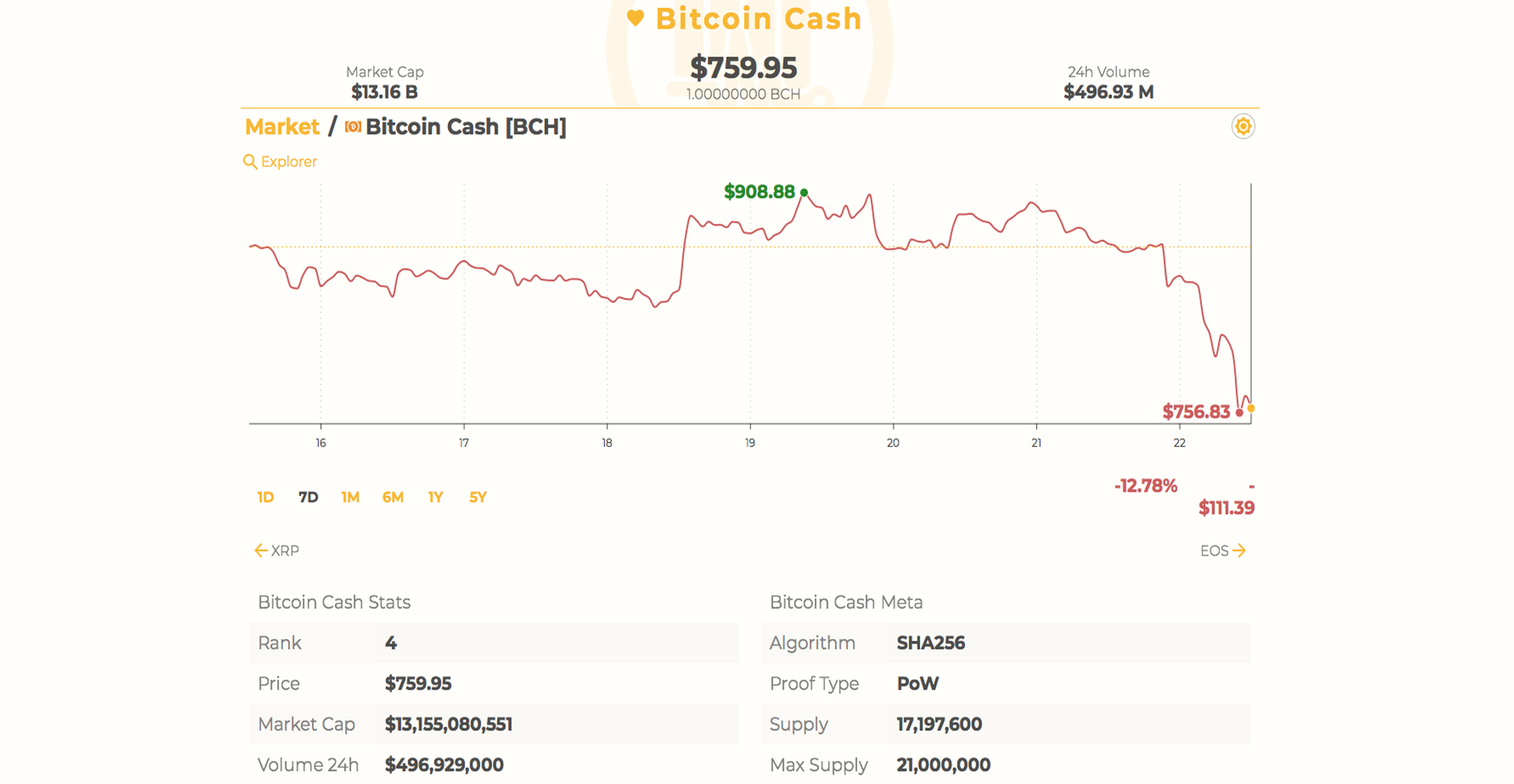

Bitcoin Cash Market Action

Bitcoin Cash market prices are hovering around $759 USD per BCH at the time of publication. BCH is the fifth most traded cryptocurrency today as far as volume is concerned as the market has traded roughly $496Mn over the past day. At the moment the BCH market capitalization is 13.2Bn. The top exchanges swapping the most BCH today are Okex, Bitfinex, Huobi, Hitbtc, and EXX. The top currency traded with bitcoin cash today is BTC holding an average of around 42 percent of trades. This is followed by tether (USDT 22.8%), USD (21.2%), ETH (3.7%), and KRW (3.4%).

BCH/USD Technical Indicators

Looking at the charts show things are uglier today than our last markets update. The two Simple Moving Averages (100 & 200 SMA) have a deep gap between each other looking at the 4-hour BCH/USD chart on Bitfinex. The short-term 100 SMA is well below the longer term 200 SMA which indicates the path of least resistance will likely be towards the downside. However, MACd is steadily heading southbound and could reverse and show improvement in the next few hours. The Relative Strength Index (RSI) levels are showing oversold conditions around -29 at the time of publication. This also reveals we could see a small trend reversal soon for a short period of time and volume indicates this as well. Looking at order books towards the upside bulls need to muster up strength and push past strong resistance at $800. There’s another upside pitstop at $875 if bulls really push it to the limit before getting exhausted. On the backside, bears will see some stops between the current vantage point and $680 as there are some strong foundations there for the time being.

Bitcoin Core Market Action

Bitcoin Core (BTC) market prices are around $6,135 on Friday, June 22, 2018. The currency is the largest traded cryptocurrency as far as volume and BTC has traded $4.3Bn over the last day. The digital assets total market valuation today is 106Bn and BTC market dominance is 40.7 percent a slight increase since last week. The top exchanges trading the most BTC today include Binance, Bitfinex, Okex, Huobi, and Bitflyer. The Japanese yen accounts for over 60 percent of trades on June 22 as yen volume has decreased. This is followed by the USD (31%) USDT (7%), EUR (1.9%), and KRW (1.1%).

BTC/USD Technical Indicators

Looking at the 4-hour BTC/USD chart on Coinbase and Bitstamp shows similar action taking place compared to the BCH/USD analysis. The 100 SMA is below the 200 moving average which shows again that bears may continue holding the reigns. MACd just saw a small push up but is now heading southbound once again. RSI levels are around -21 indicating oversold conditions as well. BTC bulls need to jump past the $6,400 range again and will see more resistance around $6,700 where the price hovered for a few days prior. On the backside, bears will need to crunch through buy orders between now and $5,400 which are mountainous walls, at least for now.

The Top Crypto-Markets Tumble — EOS Suffers

Overall most of the top currencies are seeing losses, and the second highest capitalization belonging to ethereum (ETH) is down 10.7 percent today. One ETH is priced at $474 per coin, and the currency is down 5.2 percent over the last week. The second highest market, ripple (XRP), is down 7 percent today and one XRP is $0.49 cents per token. Lastly, the fifth largest valuation still belongs to EOS but the token is down 16.8 percent today. One EOS is priced at around $8.63, and markets have shaved 20.3 percent over the last week.

The Verdict: Skepticism Remains Strong

The verdict today is far less positive then our last markets update as things are starting to look gloomy again as the weekend approaches. Traders are all calling newer and lower bottoms, and many are skeptical of brighter skies in the short term.

Of course most are optimistic about the long-term but for now, no one is sure how long this bear run will last. With the naysayers saying 2018 is nothing like 2014 (including myself), it just may be that we are going through similar circumstances that may last just as long.

Where do you see the price of BCH, BTC, and other coins headed from here? Let us know in the comments below.

Disclaimer: Price articles and markets updates are intended for informational purposes only and should not to be considered as trading advice. Neither Bitcoin.com nor the author is responsible for any losses or gains, as the ultimate decision to conduct a trade is made by the reader. Always remember that only those in possession of the private keys are in control of the “money.”

Images via Shutterstock, Trading View, Coinlib.io, and Satoshi Pulse.

Want to create your own secure cold storage paper wallet? Check our tools section.

The post Markets Update: Cryptocurrency Prices Tumble Before the Weekend appeared first on Bitcoin News.

Bitcoin.com is author of this content, TheBitcoinNews.com is is not responsible for the content of external sites.

Our Social Networks: Facebook Instagram Pinterest Reddit Telegram Twitter Youtube