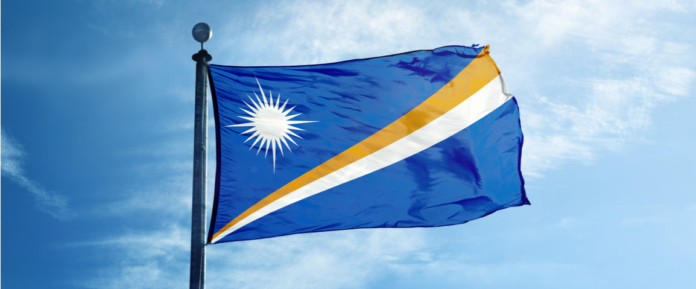

The International Monetary Fund (IMF) has announced that it believes the Marshall Islands should derail plans to install its own government-backed cryptocurrency to run alongside the U.S. dollar. The small chain of islands located in the Pacific, known officially as the Republic of the Marshall Islands, recently enacted a new piece of legislation that gave the jurisdiction the green light to introduce its own digital coin.

The idea behind the proposed issuance is to reduce the ongoing threats of being isolated from the wider global monetary system, as well as giving the domestic economy a much needed lift.

However, according to an IMF publication released yesterday, the inter-governmental organization believe that the Marshall Islands should rethink their plans.

The IMF’s Argument

Upon further scrutiny, the IMF states that the vast majority of the nation’s economy is attributable to foreign aid. This comes as no surprise, especially when one considers its constant battles with natural disasters and an ever-changing climate.

Moreover, the IMF also focuses on the fact that there is now only one locally based commercial bank that has a relationship with a U.S. financial institution. Known as a correspondent banking relationship, such arrangements are pivotal if a jurisdiction is to have access to U.S. dollar dominated financial services. The IMF warns that if the Marshall Islands proceeds with its plans to introduce a new state-backed digital currency, then they may face the risk of not only losing access to development aid, but U.S. dollar based markets in their entirety.

Regarding the planned digital currency issuance, one of the key concerns from the IMF is the lack of safeguards in place to counter the risks of money laundering and terrorist financing abuse. As it stands, the Islands have provided no details pertaining to their proposed due diligence strategies, which is something that might be the final nail in the coffin for its relationship with the U.S. based bank.

The comments outlined in the report make for an interesting reading, not least because they provide a stark reminder of the challenges that come with creating a domestic monetary system that falls outside the remit of the traditional banking sector.

Nevertheless, the Marshall Islands will need to think long and hard about its next step. Does it proceed with its plans and face the risks of losing its long-standing relationship with a U.S. based bank, or does it play it safe and listen to the advice of the IMF?

Unhashed.com is author of this content, TheBitcoinNews.com is is not responsible for the content of external sites.

Our Social Networks: Facebook Instagram Pinterest Reddit Telegram Twitter Youtube