In a bid to provide the customers with better liquidity services, Ethereum-based smart bench provider MyBit has integrated Bancor’s decentralized liquidity network support on its platform.

We are thrilled to announce that MyBit integrates with Bancor Protocol. Join our Discord here [https://t.co/tLxdkw90Pj ]or read our special blog for more information @CoinJournal @Cointelegraph @cryptonewsday @Bancor https://t.co/wvgkSkTm0W

— MyBit (@MyBit_DApp) June 11, 2018

Bancor, with cross-chain liquidity service, is one of the largest liquidity providers to the crypto industry. MyBit’s users can now convert any two tokens without a counterparty at an automatically calculated price, which is done using the “connector” token method.

Mentioning the advantages of Bancor, MyBit wrote: “And this means we can avoid all of the usual problems associated with them — like trusting others to hold your crypto, excessive fees, a lack of liquidity and having to manually find buyers and sellers.”

MyBit will also extend Bancor’s services to all its DApps. In the official announcement, the firm noted: “We’ll incorporate a one-click buy option within the DApp itself. Plus, any token on the Bancor Network can be converted in a few simple clicks from the MyBit platform.”

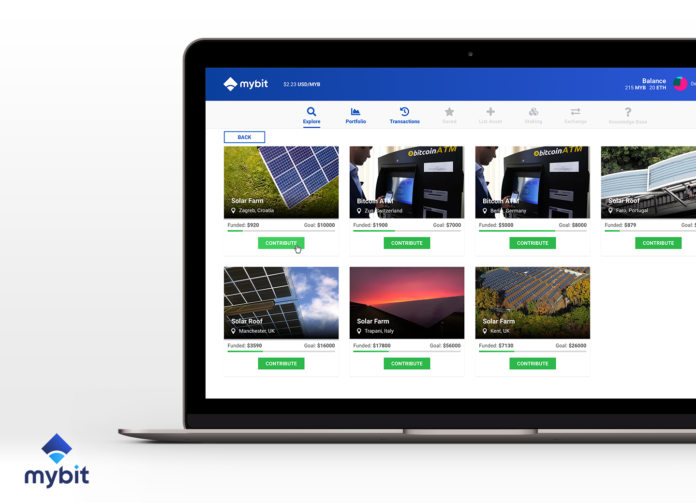

MyBit is leveraging the rapid expansion in the field of internet-of-things (IoT) and has developed an investment ecosystem for the booming sector. Anyone, using MyBit’s decentralized investment platform – MyBit DApp – can invest in revenue-generating IoT devices such as robotics, autonomous vehicles, 3D printers, drones, cryptocurrency ATMs, and miners.

Expanding services

MyBit has also recently announced the launch of a decentralized asset exchange – MYDAX – to trade stakes of IoT industry. Moreover, earlier this month, the firm partnered with Ability Concept.

Despite the partnerships and developments, MyBit-issued coins (MYB) has dropped significantly in the bear-clutched market. With a dip of 5 percent in the daily chart, MYB is trading at $0.08 and has a market cap of little more than $5 million.

Financemagnates.com is author of this content, TheBitcoinNews.com is is not responsible for the content of external sites.

Our Social Networks: Facebook Instagram Pinterest Reddit Telegram Twitter Youtube