Ripple (XRP) – The CEO of UK’s Santander bank has aired that in few months his firm is introducing an app that will make it the first large retail bank to carry out cross-border payments at scale with blockchain technology. The idea is going to rely solely on Ripple’s xCurrent and RippleNet.

According to Business Insider, the Santander’s UK CEO, Nathan Bostock made this confirmation at an International Fintech conference in London on Friday, saying “this spring, if not one beats us to it, we will be the first large retail bank to carry out cross-border payments at scale with blockchain technology.”

However, Bostock did not state the date that the app would be launch. There has been no comment from the spokesperson for Santander since the information was relayed to the globe.

Remember that Santander, in May 26th, 2016, according to Ripple, announced that they are the first U.K. bank to introduce Ripple’s blockchain technology that will enhance international payments through a new app rolled out as a staff pilot, though they intended expanding the application for individual use.

Santander says the app once downloaded by their staff, the next thing is to feel necessary information, then they can make transactions without delay. The staff app is integrated with Apple Pay, and can now be used by users to transfer around £10 and £10,000 with payment available in GBP to EUR and USD.

During the early stage of the app, any transaction made in EUR can be delivered to 21 countries and at the same time, US dollar payments are delivered to the U.S.

In an earlier announcement, Sigga Sigurdardottir, Head of Customer and Innovation at Santander, maintained that the app was based on Ripple’s tools.

“The need for finance has evolved from providing a physical pound in your pocket or card in your purse, where you pay at a till, to being seamlessly integrated into a new, always on, connected lifestyle.

“At Santander we work hard to ensure our banking is simple, personal and fair and believe new blockchain technology will play a transformational role in the way we achieve our goals and better serve our customers, adding value by creating more choice and convenience.”

Image Credit: CCN

Santander Bank is among the first believer in Ripple’s tool. Earlier, the European bank invested $4 million in Ripple Labs in 2015 and in the Fintech company’s cryptocurrency in 2016.

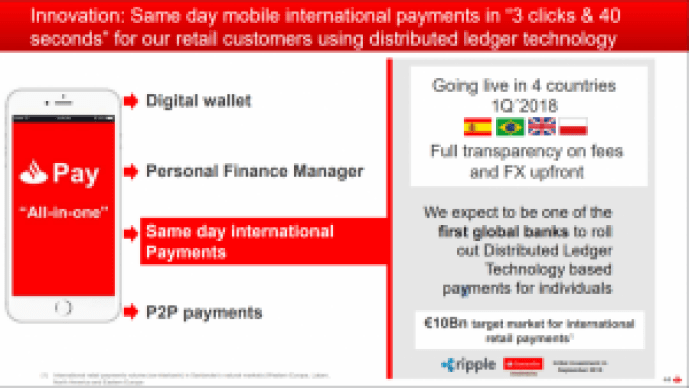

The opportunity is available in 4 countries, according to the company’s announcement in 2017 earnings presentation, and will facilitate on the go cross-border transactions in around 1 minute

The app is expected to get users digital wallets and a personal finance manager while facilitating trusted and speedy remittance. A spokesperson for Santander in late January said the app is going to survive on xCurrent, an unmatched cross-border payment tool devised by Ripple team. Observers opine that xCurrent does not use XRP, but it has the potential of adding to the cryptocurrency someday.

The development is coming as a sign of Ripple’s readiness to partner with more than half of the world’s top banks as reflected in a statement made by the CEO of the cryptocurrency platform, Brad Garlinghouse during an interview with Kyodo News, a Japanese leading news agency.

He said Ripple will “promote the introduction and set the goal of over half of the world’s banks to adopt the company’s remittance service over the next five years.”

Over the years, Ripple has been doing beyond expectations, however, the price of its XRP coin has not improved to a commendable standard. Analysts say there are lots of effort to be pulled by the team behind Ripple. While some are of the opinion that Ripple needs to move beyond lip services.

When you look around today, you are going to see that there are lots of financial services that Ripple is trying to pull in different countries of the world. Just this week, Ripple announced that there is no going back on coasting China. In an article, I explained some facts that will make Ripple scape through in China. One of those things is Ripple’s unparalleled tools and its overwhelmingly fast cross-border transaction.

Ripple is as well trying to pull more big firms. In a bid to make its product salable, the Fintech company has hired has hired Bloomberg Television’s Cory Johnson, as a chief market strategist to tell its complex story to investors. However, it is still surprising while all these have not added any positive impact to Ripple.

Theindependentrepublic.com is author of this content, TheBitcoinNews.com is is not responsible for the content of external sites.

Our Social Networks: Facebook Instagram Pinterest Reddit Telegram Twitter Youtube