This Week in Crypto – April 6th, 2018

Dude, Where’s the Floor?

No seriously, where is it? After mid-March’s further dip, the cryptocurrency market briefly bounced back above $350bln, only to continue a slow and steady decline back down to mid-March levels.

Now, however, the space’s total market cap is lower than the lows it touched half a month ago. At $249bln, we’re at our lowest since November 22nd, 2017. From here on out, seeing some month(s)-long sideways action would be a favorable sign, indicating that the market is calming down and consolidating. If not, and Bitcoin breaks back below $6k, brace yourself for a continued downtrend still.

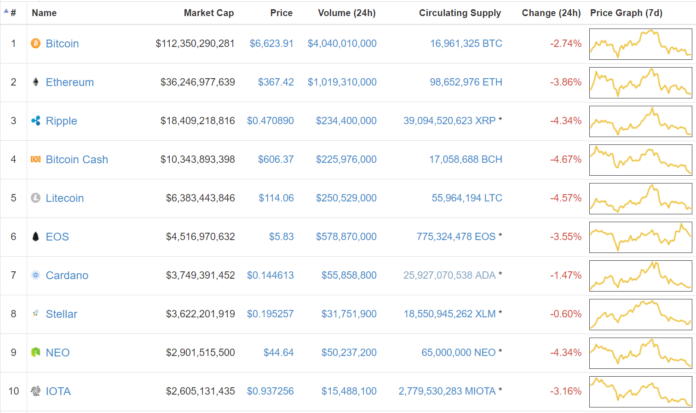

Bitcoin: Down 4% on the week, Bitcoin is resting at just over $6,600. Not the worst drop, but a sheer sign that we haven’t been given a clear trend reversal in favor of rising prices.

Ethereum: Crypto’s silver boy is in the same boat as big bro Bitcoin. At $368, Ethereum is also down 4%, which is almost a welcomed departure from the larger losses it has garnered compared to its cohorts in recent weeks.

Ripple: Coming in third (both in terms of price and market cap), Ripple has sustained double the losses of our other two assets, down 8% from its price last Friday.

Domestic News

All That Cash and Ripple Still Can’t Get Listed on Gemini or Coinbase: Reports surfaced this week that, despite multiple efforts, Ripple failed to get XRP listed on Coinbase or Gemini. The banking coin’s team tried its hand at paying $1mln upfront to Gemini and even loaning $100mln worth of XRP to Coinbase, both to no avail. As the US’s hotspots for buying crypto directly with fiat, a listing on either exchange would further cement Ripple’s status as one of cryptocurrency’s top-tier assets.

US Investors Owe a Cumulative $25bln in Crypto Taxes, Strategist Estimates: Imagine an insignificant portion–less than 7%–of a country’s population owing more in taxes than the entire GDP of a small nation. Well, according to Thomas Lee, Fundstrat’s co-founder and leading researcher, this boot fits the United State’s cryptocurrency investing populace. The analyst estimates that US investors owe some $25bln worth in cryptocurrency taxes, a consequence that could be contributing to the crypto market’s sickly health as of late, Lee believes.

Congress (Finally) Gives Cryptocurrency a S/O in Annual Joint Economic Report: Up until last month, congressional committees and subcommittees have led cryptocurrency discussion for the federal government. On March 13th, though, the whole of Congress addressed crypto in its Joint Economic Report, devoting an entire section to the impact of cryptocurrencies and blockchain technology. Notably, the report labeled 2017 as “the year of cryptocurrencies,” continuing to state, “[if] digital currencies become less volatile in the future, valuing items in those denominations could become easier and individuals might begin using them more frequently as a medium of exchange.”

Robinhood Launches Fee-less Crypto Investing Option: On April 2nd, Robinhood launched its much-anticipated cryptocurrency trading services, adding to its suite of stock trading options. Popular among millennials, Robinhood announced this January that it would provide fee-free cryptocurrency trading for Ethereum and Bitcoin. Now, the service is live, allowing residents in California, Massachusetts, Missouri, and Montana to purchase Bitcoin and Ethereum for USD. Robinhood expects to expand the service to more states down the road.

SEC Delivers KO to ICO Promoted by Floyd Mayweather: Perhaps celebrities will think twice before they promote an ICO from here on out. Centra Tech Inc., which was promoted by retired boxer Floyd Mayweather, raised $32mln after it promised investors that it would allow them to automatically transfer cryptocurrencies to fiat thanks to its partnership with Visa and Mastercard. Of course, no such partnerships existed, and the SEC charged its founders, Sohrab Sharma and Robert Farkas, with fraud, arresting Farkas in an airport as he was preparing to flee the country.

US College Students Are Mining Bitcoin with Free Dorm Room Electricity: The times they are a-changin’ and students are changing with them. Rather than settle for a typical work-study or part-time job, college kids these days are taking advantage of their dorm rooms’ free electricity to mine Bitcoin and other cryptocurrencies. The trend began picking up steam last year, but during the market downtrend, it’s become less popular as mining profits diminish.

Arizona Legalizes Blockchain Use for Businesses, Corporations: Headline says it all. Adding to its list of crypto-friendly litigation, Arizona has now given in-state businesses the green light to store and transfer data using blockchain technology. Arizona governor Doug Ducey signed the bill into law on April 3rd.

Coinbase Continues to Corner Market as it Starts Forming VC Fund: The market may be down, but Coinbase is paying no mind. The world’s largest cryptocurrency exchange/vendor announced this March that it would launch its own index, and now, it’s establishing its own venture capital fund. Coinbase Ventures, as it’s called, will look to curate “early stage companies that have the teams and ideas that can move the space forward in a positive, meaningful way,” according to Coinbase.

Introducing Coinbase Ventureshttps://t.co/flW2jsF60M

— Coinbase (@coinbase) April 5, 2018

George Soros OKs Cryptocurrency Trading for His Investment Fund: In a surprising turn of events, George Soros has approved cryptocurrency trading for the New York-based Soros Fund. This past January, Soros spoke none-so highly of cryptocurrencies at the World Economic Forum in Davos, Switzerland, but this move seems to indicate a departure from his hard-line stance of just a few months ago.

What’s New at CoinCentral?

Ledger Nano S Setup Guide (Configuration + App Installation): Need help setting up your Ledger Nano S? We’ve got you covered.

Bitcoin Full Nodes: What they Are and How to Set One Up: Understanding how nodes operate is a task of its own, let alone establishing one for yourself. Luckily, we’ve got all the info you need.

Blockchain and Art: The Market is Here and What You Need to Know: Some people say that technology is a form of art. With the recent boom of the blockchain art market, this is looking to be more fact than fiction these days.

What is Civic (CVC)? A Beginner’s Guide: Take a look at our beginner’s guide on Civic to learn more about blockchain identity verification and management.

How to Send ERC20 Tokens From a Ledger Nano S (Using MyEtherWallet): Ledger Nano S hardware wallets integrate with MyEtherWallet’s services, making storing and sending ERC20 tokens a cinch.

Apex Token Fund’s Chris Keshian is Bringing Crypto Hedge Funds to the Average Investor: Few cryptocurrency hedge funds are open to unaccredited investors–Chris Keshian wants to change that.

Blockchain Shipping: A New Shipment Protocol: Blockchain technology has the potential to revolutionize an age-old industry: shipping.

Bitcoin Mining is Heating Up on College Campuses: Hey, if you had access to free electricity, wouldn’t you give mining a try?

Bitcoin Private, a first of its kind “fork-merge” of Bitcoin and Zclassic: Some developers got together to pull off something unprecedented in the crypto-sphere: they created a new currency by forking two existing ones.

How to Transfer ERC20 Tokens From a Ledger Nano S (Using MyEtherWallet): Sending ERC20 tokens to your Ledger is a little more complicated than sending Bitcoin and Ethereum. Instead of using a Ledger app, you need to use MyEtherWallet. Don’t fret, though. In this guide, we’ll teach you how to transfer ERC20 tokens to a Ledger Nano S.

As Market Slides, Crypto Hedge Funds Go Down With It: With 9 hedge funds forced to shutter services already this year, the world’s remaining 250+ cryptocurrencies could see trouble on the horizon.

Blockchain Meets Digital Advertising: 3 Projects Looking to Dethrone the Kings: Blockchain has given hundreds of projects the silver bullet to take down the reigning intermediaries – the question is if they have what it takes to build the gun and actually shoot it.

Introduction to Reversal Chart Patterns: Want to up your TA skills? We can help you out with our guide to pattern reversals.

What is Enjin Coin? A Beginner’s Guide: Learn more about Enjin coin and blockchain-backed in-game assets with our beginner’s guide.

How to Transfer Bitcoin to a Ledger Nano S: Simple as it may sound, sometimes everyone needs a little help, so don’t sweat the small stuff–we already have for you.

Meet Plantoid: A Blockchain-Based, Bitcoin-Eating Work of Robot Art: A Plantoid is a robot art installation built on the blockchain. Fully autonomous, the robotic plant survives off Bitcoin donations with the sole objective of reproducing other Plantoids.

Even with Money on the Table, Top US Exchanges Don’t Want Ripple: Ripple just can’t seem to catch a break, even as it tries to pay its way onto Gemini and Coinbase.

Verge Suffers 51% Attack, Hard Forks in Response: Verge fell prey to the first ever 51% attack in crypto history, and its team is hard forking to minimize the monetary damage.

Coinnest CEO Arrested for Fraud, Embezzlement: For banks and exchanges alike, South Korean officials have been careful to put fraud and money laundering practices on lock-down, and as the Coinnest arrests suggest, with good reason.

Aragon’s Luis Cuende on Blockchain Governance & Digital Jurisdiction: We had the privilege to have a chat with Luis Cuende, Aragon’s founder and project lead, about the role of blockchain in governing.

The Rise of Blockchain Courses at Top American Universities: Blockchain is making its way into computer science syllabi across the country, so we took a look at these curricula and the universities offering them.

How to Send Bitcoin From a Ledger Nano S: Again, may seem simple, but here’s a quick rundown in case you need it.

Crypto News from Around the World

Korean Exchange Execs Get Tagged with Embezzlement: The CEO of Coinnest and his crew are being detained by South Korean Police for “the embezzlement of billions of won from their clients’ accounts and transferring it to their own.” In total, it’s reported that they embezzled roughly $940,000 worth of funds.

Monex purchases Coincheck, Follows in the Footsteps of Circle: Monex, a Japanese internet brokerage firm, is bailing Coincheck out with a multi-million dollar buyout. In late January of this year, the exchange suffered the most expensive hack in the crypto-sphere to date, losing some $530mln worth on NEM. The acquisition makes Monex the second company to purchase an exchange this year, following Circle’s purchasing of Poloniex exchanges.

India’s Central Bank Drops All Crypto-Related Accounts: No, India is not banning cryptocurrencies, as some reports erroneously suggested. That said, the Central Bank of India is cutting all ties with businesses, persons, or organizations that are involved in cryptocurrencies. The banking authority released the news in its “Statement on Developmental and Regulatory Policies” on April 5th, along with its plans to release its own national cryptocurrency down the road.

Verge Gets Hit with 51% Attack, Team Decides to Hard Fork: A first in the cryptocurrency realm, popular privacy coin Verge fell victim to a 51% network attack this Wednesday. Exploiting Verge’s unique multi-algorithm PoW consensus, the hacker tricked the network to allow him/her to mine a block per second using Scrypt. After the hacker made off with some $1mln worth of XVG, the Verge team is planning a hard fork to amend the loses.

We will be releasing a new Qt wallet for windows and Mac OS tomorrow, along with a detailed explanation of the mining exploit we dealt with. thanks everyone for being patient! We are NOT having a give-away as seen below, it’s spam. #vergefam $XVG

— vergecurrency (@vergecurrency) April 6, 2018

Japan Develops Framework for ICOs, Looks to Legalization: The Japanese government’s ICO task group has outlined a rule book for enabling legal initial coin offerings in its country. On April 5th, the ICO Research Group issued a report that looks to promote growth while keeping scams at bay, stating that the “ICO [model] is still in its infancy and has no industry practices yet,” so “[appropriate] rules must be set to enable [ICOs] to obtain public trust and to expand as a sound and reliable financing method.”

South Korea’s Banking Giants Stay Friendly to Cryptocurrencies, OmiseGo: Even as Kookmin, South Korea’s largest bank, is shuttering cryptocurrency services, Shinhan and Woori have kept open arms to the movement and its exchanges. Shinhan, for instance, has begun testing payments on Ripple’s network, is developing wallet and vault services for cold storage, and has entered into a strategic partnership with OmiseGo.

First Lightning Network App Strikes Google Play Store: It’s been a little over three weeks since Lightning Labs released their beta for the Lightning Network, and developers have been busy. ACINQ release its Eclair wallet, one implementation of the LN, on April 4th, “a next generation, Lightning-ready Bitcoin wallet” that “can be used as a regular Bitcoin wallet, and can also connect to the Lightning Network for cheap and instant payments,” according to the technology startup.

Bitmain Introduces Ethash, an Ethereum-Compliant ASIC Miner: On April 3rd, the Chinese mining manufacturer Bitmain tweeted that they’ve begun production for their Ethash ASIC miner. The ASIC would allow users to mine Ethereum and a handful of Proof-of-Work altcoins, and the company is advertising the hardware as the “world’s most powerful and efficient EtHash ASIC miner.” Each costs $800, they aren’t available for Chinese residents, and buyers are limited to one per order. Ironically, the company only accepts BCH or USD for the orders.

We are pleased to announce the Antminer E3, world’s most powerful and efficient EtHash ASIC miner.

Ordering limit of one miner per user and not available in China.

Limited stock, order here now: https://t.co/Zfw3afjJHs#antminerE3 pic.twitter.com/SjHu2eUThp— BITMAIN (@BITMAINtech) April 3, 2018

The post This Week in Crypto – April 6th, 2018 | CoinCentral appeared first on CoinCentral.

Coincentral.com is author of this content, TheBitcoinNews.com is is not responsible for the content of external sites.

Our Social Networks: Facebook Instagram Pinterest Reddit Telegram Twitter Youtube