- Bitcoin’s price action as of late is finally beginning to reflect the fundamental strength incurred throughout the past several months

- Virtually all on-chain metrics are currently playing in bulls’ favor, while other fundamental developments – like the adoption of BTC as a reserve asset – also give it a boost

- This fundamental strength may be what helped lead the cryptocurrency up from recent lows of $9,900 to highs of $11,700 that were tapped just days ago

- The cryptocurrency is now caught within a bout of consolidation as it struggles to surmount its $11,600 resistance

- That said, one trend seen while looking towards Bitcoin whale activity indicates that a flood of retail investors may soon enter the market

Bitcoin and the entire crypto market have, so far, seen a quiet day of trading. BTC has mainly been ranging around the mid-$11,000 region, while altcoins all see similar consolidation phases.

The latest push higher that helped drive Bitcoin’s price to its current levels came about directly after news broke of Square buying $50 million worth of BTC to hold on their balance sheets as a reserve asset.

This news seemed to spark the momentum that the crypto had been losing, ultimately helping to lead it all the way up to its recent highs of $11,700.

One trend seen while looking towards whale activity does seem to indicate that retail investors are about to flood into the market.

Bitcoin’s Price Gains Stable Uptrend

At the time of writing, Bitcoin is trading down just over 1% at its current price of $11,420. This is around where it has been trading throughout the past couple of days.

It is important to note that both bulls and bears have largely reached an impasse in the time following the cryptocurrency’s surge up to highs of $11,700 earlier this week.

Because bulls have gained control of the crypto’s mid-term trend, there’s a strong possibility that further upside is imminent in the near-term, but it does face some heavy resistance at $11,600.

This Trend Amongst Large BTC Buyers Indicates a Flood of Retail Investors is Coming

One trend seen while looking towards so-called Bitcoin whales indicates that retail investors are rapidly entering the market.

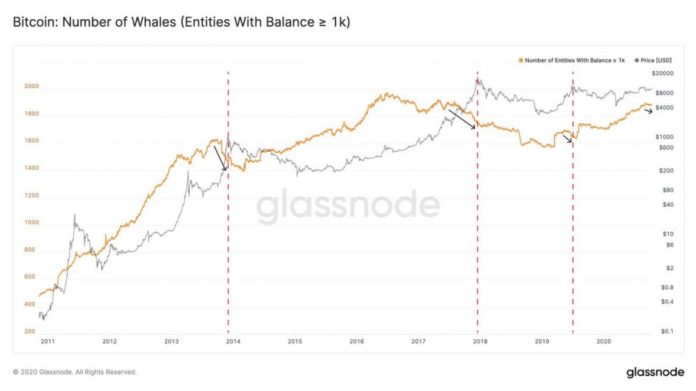

While referencing Glassnode data, Unfolded explained that a decline in the number of Bitcoin whales signals that retail investors are pouring in.

“Historically, the start of a decline in the number of BTC whales has often signified increased interest from retail investors and the beginning of a run up to a market top,” they explained while pointing to the below chart.

Image Courtesy of Unfolded. Data via Glassnode.

This trend – should it persist going forward – could mean that serious dry powder is on the sidelines waiting to be introduced to Bitcoin and the aggregated crypto market.

Featured image from Unsplash. Pricing data from TradingView.

Bitcoinist.com is author of this content, TheBitcoinNews.com is is not responsible for the content of external sites.

Our Social Networks: Facebook Instagram Pinterest Reddit Telegram Twitter Youtube