CODEX is a licensed trading platform for digital assets and cryptocurrencies. It is built on a unique reward system and uses a vanguard security structure. The exchange only launched in December 2018, making it relatively new. Even so, the company behind it has plenty of experience, giving users confidence.

AtticLab is the company that runs CODEX. This company already has experience with cryptocurrencies thanks to its status as a block producer for EOS. The exchange itself is Estonia-based, a convenient location due to the country’s crypto-friendly regulations.

Sergii Vasylchuk is the CEO & co-founder of both AtticLab and CODEX exchange, bringing 15 years of experience in finance and software development. He has advised both Alliance Banking Group and SmartBank, an online banking organization. Vasylchuk is also a known public speaker in FinTech and Blockchain events worldwide, including Poland, India and Ukraine.

What Cryptocurrencies Does CODEX Support?

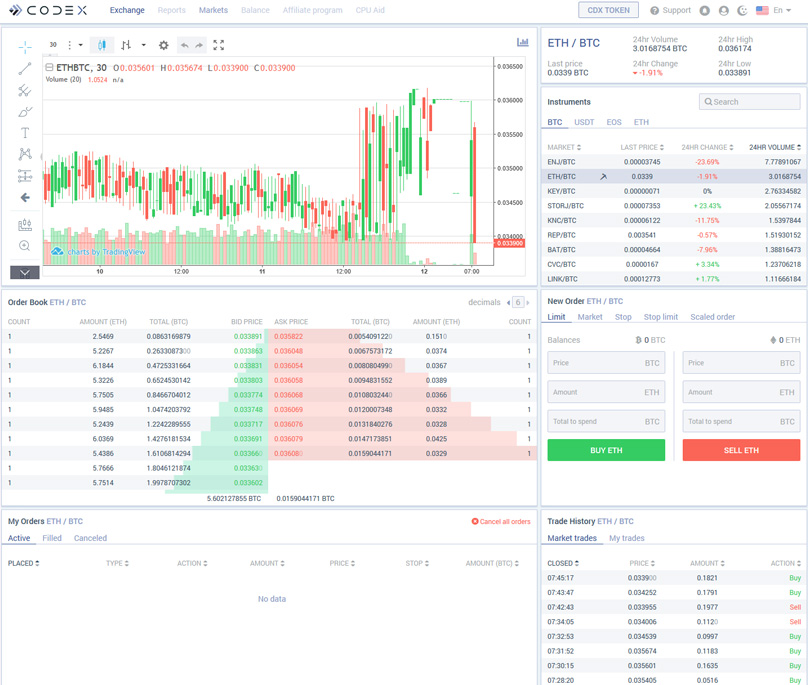

CODEX supports more than 100 cryptocurrency trading pairs, including ETH, BTC, LTC, EOS, GRIN, ZRX, BAT and more. CODEX is planning on expanding its support not only for many other cryptocurrencies after a thorough security and fundamental audit, but to extend its reach to fiat pairs as well, mainly USD and EUR.

Is CODEX Regulated?

CODEX has a license to provide services related to exchanging fiat and virtual currencies. The licenses also allow it to provide a wallet service for virtual currencies. The Registry of Economic Activities regulates this license and thanks to it, CODEX maintains its status as a fully-regulated exchange within the EU. The relevant licenses are FVR000169 and FRK000141.

In the cryptocurrency space, trust is an important issue. With exchanges getting hacked on a daily basis, and with so many ICO exit-scams – investors and traders are now wary and thoroughly check who they trust their funds with.

Therefore, CODEX has decided one of its biggest goals is to achieve and maintain trust. It does so, by working with and for the community.

Codex Community

While many cryptocurrency exchanges simply focus on making a profit, CODEX aims to be community-oriented. As such, it delivers a range of infrastructure solutions that can work with various blockchains. At the moment, CODEX is mostly focused on EOS since it is the blockchain the team has more experience with. In the future, however, this will expand to other communities.

For example, CODEX is hoping to become a hybrid exchange. By combining features of both a decentralized and a centralized exchange, CODEX means to leverage the advantages while minimizing the disadvantages. It plans to do so by allowing a web/desktop login method with private keys, instead of a username and a password. While primarily available for EOS users, CODEX will broaden their reach and allow other blockchains login the same way. This way, CODEX will not be holding user funds, while simultaneously reducing the amount of personal data it holds on its customers.

On top of that, CODEX continues to create infrastructure solutions that different blockchain communities can use, like generating EOS wallets for free or sharing CODEX Codes with the community. The Codes are an electronic voucher system that makes it simple to transfer funds across platforms instantly without fees. They were first developed for internal usage but will become widely available soon.

There are already over 9,000 active users in just two months. This shows that CODEX is well on its way to achieving the community goal.

Security Measures

The CODEX exchange takes security seriously since funds are always involved. CODEX goes above and beyond the security measures of other exchanges by utilizing EdDSA cryptography for users’ API. As such, CODEX does not store any secrets or data from the API. Instead, CODEX only stores the relevant public key.

Additionally, CODEX has its own internal Anti-Fraud System. This system works to identify unusual behaviours that can indicate fraud, such as making large withdrawals without warning. If the system flags fraud, CODEX will then investigate.

To further ensure the security of CODEX, the exchange is engaging in a multi-stage security audit. At first, it was audited by an Hacken external security auditing team. The second stage included an internal security audit, and the third is an-going bug bounty program. There is another crucial 4th step, however since it is currently on-going it cannot be disclosed.

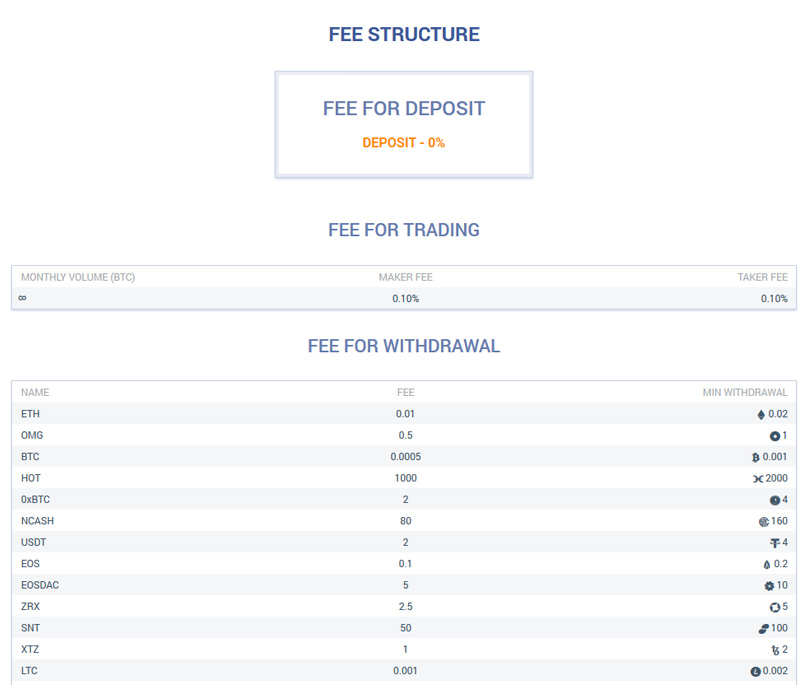

CODEX Trading Fees

As an exchange, CODEX needs to make money to be able to maintain its website, servers, team, and other expenses. Their business model focuses on the trading fees that traders pay when buying or selling their digital assets. Even so, CODEX is able to keep these fees fairly competitive.

CODEX aims to deliver low fees so users do not have to worry about high commissions. There is no fee associated with making deposits into your CDX account. The fees for trades follow the maker-taker model and only go up to 0.05 percent.

The CODEX Token

The CODEX token, CDX, is designed to support and serve the platform’s users. It also stimulates the platform’s growth, rewards users for loyalty, and encourages action. There was no ICO for the CDX token and the full supply of CDX is awarded via trade mining and more.

There is a total supply of 2 billion CDX, with 15 percent allocated to investors. 9 percent is allocated to the team, 25 percent to the reserve, and 51 percent to cashback. This 51 percent is part of the trade mining feature. You should note that 49 percent of the tokens have been pre-mined. These pre-mined coins have a vesting period equal to one year, as this will help stabilize the token’s price.

What is CODEX’s Trade Mining Feature?

Another interesting feature of CODEX is trade mining, which you may not have heard of in other exchanges. This is the way that traders automatically gain dividends in the form of CDX simply by trading. The incentives focus on certain specific markets. Each day, the various traders on the exchange receive up to 1,000,000 CDX tokens among themselves. These CDX tokens are distributed proportionally. Those who have more CDX in their wallets will receive higher returns for trade mining. The distribution will feature 1 million CDX tokens total each day for the first year of CODEX. The daily amount will lower each year.

Compared to other trade mining methods, there is no risk that a single person will dominate the mining fully. This is done with a Volume/Bonus equilibrium that will reduce the effect when reached, giving casual traders equal opportunities to earn the tokens.

CODEX Loyalty Program

In addition to the earning of CDX tokens via trade mining, you can also earn them via the loyalty program. This program rewards traders who make daily trades on the platform. The rewards arrive in the form of CDX tokens.

Other Benefits for CDX Holders

To encourage users to hold CDX tokens, CODEX offers a few other benefits for doing so. Paying trading fees with CDX leads to a 50 percent discount for the first year.

There is also the ability to apply for a multiplier on your CDX token balance. This applies to those who participate in trade mining. It lets those who meet a CDX token threshold to use the volume multiplier to boost earnings.

Additionally, affiliates who hold CDX tokens will receive a higher commission rate for each referral. The base referral commission is 20 percent of trading fees. Depending on the CDX token balance of the affiliate, this figure can increase to 40 percent.

At some point in time, holders of CDX tokens will have the opportunity to be involved in listing new tokens. They will also be able to vote on which ones should become available in the future.

Other Key Features

- CODEX supports trading through both a mobile app and a computer.

- There is a demo version available, so you can view the platform before you make a deposit and start trading.

- You may choose between day mode and night mode.

- The exchange offers scaled orders, which is a feature being utilized by experienced traders to enter or exit a trade within a range of prices.

- CODEX supports 9 different languages including English, German, Spanish, French, Portuguese, South Korean, Chinese and Japanese.

CODEX Roadmap

During Q2 of 2019, CODEX is expected to launch many features and community-oriented infrastructure solutions, including the EOS private key login and wallet generation.

It will also launch a new matching engine that is made from scratch and fiat trading pairs, while starting to allow purchases with credit and debit cards.

Conclusion

CODEX is among the newer cryptocurrency exchanges available, but aims to bring a new spirit to the crypto space, of trust and community orientation.

While the volume is still low, and fiat trading pairs are not yet available, the cryptocurrency exchange has strong security via encryption, trading fee incentives and many other features that they believe will lure new users in.

CODEX certainly looks like an interesting new platform with a bright future ahead of it.

The post What is CODEX Exchange? Complete Beginner’s Guide appeared first on Blockonomi.

Blockonomi.com is author of this content, TheBitcoinNews.com is is not responsible for the content of external sites.

Our Social Networks: Facebook Instagram Pinterest Reddit Telegram Twitter Youtube