What Is Stellar?

Stellar advertises itself as an open-sourced, distributed payments infrastructure, built on the premise that the international community needs “a worldwide financial network open to anyone.” The project is filling this need, connecting individuals, institutions, and payment systems through its platform.

In doing so, the Stellar team wants to make monetary transactions cheaper, quicker, and more reliable than they are under current systems. Additionally, their protocol connects people from all over the world by allowing for more efficient cross-border payments.

In this guide, we get into all the details including:

- How Does Stellar Work?

- Stellar Team

- XLM Trading History

- Where to Buy XLM

- Where to Store XLM

- Stellar Roadmap

- Final Thoughts

- Additional Stellar Resources

How Does Stellar Work?

Like (almost) all other cryptocurrencies, Stellar bears that beautiful buzzword that has become the hallmark of blockchain technology: decentralization. The network runs on a web of decentralized servers supported by an international consortium of individuals and entities. These servers support the distributed ledger that keeps track of the network’s data and transactions.

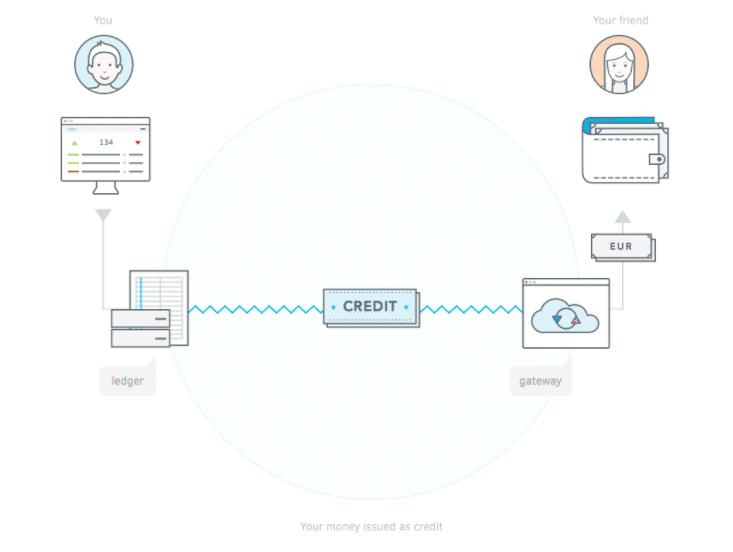

In practice, the Stellar protocol functions like a more inclusive, more flexible PayPal. To start using it, you need to upload funds to an anchor on the network. Much like a bank or PayPal, this anchor then holds your money and issues credit to your virtual wallet in its stead.

Stellar Anchors

You might be wondering why you need to exchange debit for credit with an anchor in the first place. Well, anchors serve as a bridge for any given currency and the Stellar network. The swap allows you to formally convert your funds into Stellar’s public ledger.

This integration means you can send funds instantly on the network without having to wait for a bank transfer, as with PayPal. It also streamlines cross-border payments. Let’s say you wanted to send funds to your impoverished expat brother living in France. You would use your credited USD balance to shoot him funds through the Stellar network. Stellar would then automatically convert the USD to EUR using the lowest exchange rate, and your brother’s account would be credited with the exchanged amount in EUR. After receiving the transfer, he can withdraw the funds from an anchor that supports EUR and go about living his Bohemian lifestyle.

Distributed Exchange

Stellar also offers you the option of placing exchange orders onto the public ledger to sell or buy other currencies. All rates are pre-determined by the individual placing the order, so they are not subject to the automatic exchange rate that Stellar applies to personal transfers.

If you wanted to exchange, say GBP for EUR, you’d place an order in Stellar’s order book. That order then enters the global marketplace, which you can also consult to see how your order stacks up against others like it. Note that this exchange is not limited to fiat currency only. It also includes cryptocurrency and fiat trading pairs as well.

Multi-Currency Transactions

As we previously noted, Stellar allows you to freely send money across borders without the hassle of formal banking procedures or currency exchange.

In order to accomplish this, the network does one of three things when you request a currency transfer:

- Stellar converts the funds with a previous offer on its order book and automatically facilitates the exchange.

- Stellar uses Lumens (XLM), its coin, as an intermediary for the exchange. It converts the funds from currency A into Lumens on the global marketplace, and then it takes those Lumens and converts them to currency B for the user receiving these funds.

- If there are no trading pairs in the exchange for the two currencies, Stellar searches for offers on the network that will lead to a chain conversion into the desired currency (e.g., USD to EUR, EUR to GBP, BGP to AUD, AUD to JPY).

This multi-currency exchange process is pretty ingenious, and it offers users a flexible approach to easily swap currencies on an international scale.

Stellar Team

Jed McCaleb is the face of Stellar. Previously, he created the infamous Mt. Gox, although he was no longer involved during the over $450 million hack. After that, he went on to found Ripple, Stellar’s most notable competitor. In 2013, he left Ripple due to differences in ideology against the rest of the leadership team. Shortly after, he started Stellar.

Stellar has one of the most impressive advisory boards of any other project in the cryptocurrency space. The list includes Patrick Collison (Stripe CEO), Matt Mullenweg (WordPress Founder), Naval Ravikant (AngelList Founder), and Sam Altman (Y Combinator President).

XLM Trading History

XLM has had an interesting trading history, to say the least. The coin experienced around a 5x increase in value at the end of 2014. However, that runup was shortlived, and the price slowly fell throughout all of 2015, 2016, and even the beginning of 2017.

It wasn’t until May 2017, that things really started to turn around for the coin. That month, the price skyrocketed from $0.00547 (~0.00000363 BTC) to just over $0.047 (~0.0000283 BTC) in four days. It’s not exactly clear what caused this monumental jump. It may have been a recent airdrop the team hosted, more people learning about to project, or just typical market shenanigans.

Following the early May rise, the XLM price more or less followed the rest of the market. It grew to an all-time high of over $0.91 (~0.000061 BTC) in January 2018 and fell for the remainder of that year. That said, XLM has weathered the bear market significantly better than most other altcoins. In fact, it’s only lost around 50 percent of its BTC value when many other coins have lost over 90.

The addition of more anchors, partners, and (obviously) users, should all impact the price in a positive way.

Where to Buy XLM

Stellar Lumens trades under both the XLM and STR ticker. The Stellar team changed the ticker from STR to XLM a while back, but some exchanges, such as Poloniex, haven’t bothered to change it.

Bittrex, Poloniex, and Binance account for a vast amount of XLM’s trading volume. Binance and Bittrex support both ETH and BTC trading pairs, while Poloniex supports BTC, USDT, and USDC only.

If you’d like to purchase XLM with USD or EUR, it’s worth taking a look at Kraken.

Where to Store XLM

Most of the wallets used to store XLM are either XLM specific or exist within Stellar’s network for use with its global marketplace. Stronghold, for instance, is the distributed exchange built into Stellar’s system, and StellarTerm is a client that allows you to access the distributed exchange to trade or send funds. The Stellar team has also created a Desktop Client that is specific to the XLM currency.

If you’re looking for a non-Stellar-exclusive wallet, the Ledger Nano S is probably the safest bet, but if you don’t have this hardware wallet, you could check out stargazer, Papaya, and Saza.

In a recent promotional stunt, Blockchain added support for XLM and gave away $25 worth of XLM when you verified your identity.

XLM Wallet Options

Stellar Roadmap

Stellar does not have a concrete roadmap on their website, but they do keep a regular blog.

In this blog, they post monthly roundups of that month’s biggest developments. For the October 2017 roundup, for instance, they recapped their partnerships with IBM and KlickEx for cross-border payments. They’ve also secured partnerships with Remitr, MSewa Software Solutions, PesaChoice, and Chaneum ICO Advisory Services.

In the vein of ICOs, the Stellar team believes that their network would be ideal for overseeing ICOs and blockchain startup fundraising. There’s a strong case to be made for the flexibility Stellar’s network offers to startup ventures, as it could facilitate a multitude of cryptocurrency and fiat payment options.

As mentioned above, Stellar partnered with the Blockchain wallet provider in November 2018. The partnership includes integrating XLM support into Blockchain and airdropping up to 500 million XLM to Blockchain users.

Final Thoughts

If Ripple (XRP) was built for financial institutions and banking giants, then Stellar Lumens goes to work for the common man. It has the potential to revamp how we process peer-to-peer transactions on a global scale.

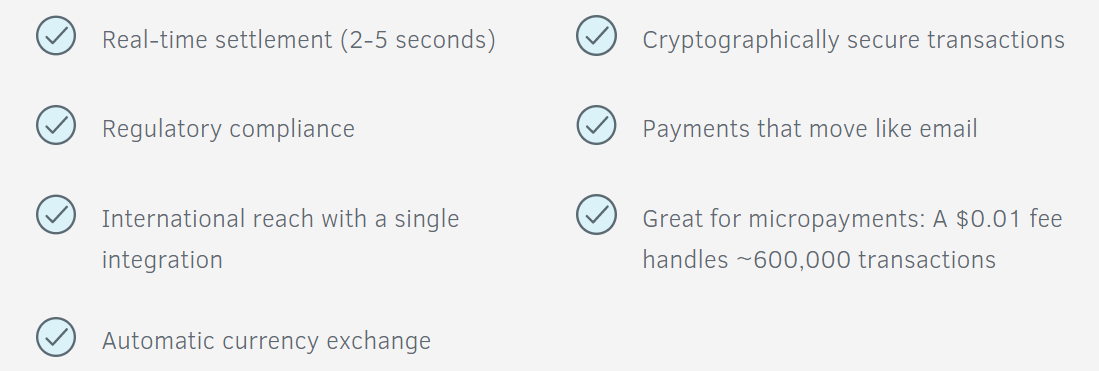

Its versatility and use cases make it function like a financial Swiss Army Knife. With Stellar, you can handle micro-payments with nominal fees, send remittances without fretting over currency exchange or bank transfers, and settle payments in real time (2-5 seconds).

If the IBM and KlickEx partnerships weren’t enough to impress you, Deloitte, Parkway Projects, and Tempo have started building services on Stellar’s network.

Between these companies using Stellar for real-world adoption, its official partnerships, and the vision Stellar has for the future of currency exchange, we’re excited to see what the next few years have in store for the layman’s Ripple. We won’t tell you to put your money into it, but it’s worth getting to know.

Editor’s Note: This article was updated by Steven Buchko on 1.10.2019 to reflect the recent changes of the project.

Additional Stellar Resources

The post What Is Stellar (XLM)? | A Guide to the Common Man’s Financial Network appeared first on CoinCentral.

Coincentral.com is author of this content, TheBitcoinNews.com is is not responsible for the content of external sites.

Our Social Networks: Facebook Instagram Pinterest Reddit Telegram Twitter Youtube