Gaining a better understanding of when to buy Bitcoin can help you take your investment strategy to the next level. It has been an interesting year for Bitcoin and the entire cryptocurrency market. The crypto market shed the majority of its 2017 gains this year as market corrections kicked in. These losses left many investors with difficult decisions to make, such as when to sell Bitcoins, and should I buy Bitcoin now? The important thing to remember is that there isn’t one particular style of investing that fits everybody.

Choose Your Strategy

When it comes to investing in Bitcoin, there are a couple of popular strategies to follow. In the end, you may find that a combination works best for you. This is normal and finding the right balance increases your return on investment (ROI) and reduces your stress levels in times of market corrections. Let’s explore two popular Bitcoin trading strategies.

Long-Term: HODL

The Bitcoin HODL (hold on for dear life) community is strong and why wouldn’t it be? Bitcoin is the world’s first successful cryptocurrency. Aside from the fact that it introduced the world to blockchain technology, there is also a social and economic freedom associated with this cryptocurrency.

HODLers believe in Bitcoin’s underlying quest to free the world from a corrupt and nefarious financial system. Additionally, they believe that Bitcoin will always see a rise in value in the long term. Considering that there is fewer than four million Bitcoin left to be mined, the scarcity of this digital asset is undeniable.

Unmined Bitcoins via Bitcoinblockhalf

This is by far the easiest Bitcoin investment strategy to follow. You buy Bitcoin when the price dips and hold it. That’s it. If you review Bitcoin’s price history, anyone who followed this strategy before mid-2017 made out in a big way.

Short-Term: Day Trading

Day trading takes a more active approach to cryptocurrency. Day traders look to make gains based on their market understanding, rather than HODLing their Bitcoin. For these investors, utilizing the best market tools is essential. Advanced market analytics and trading bots are two perfect examples of popular day trading tools that can improve your ROI.

Strengthen Your Position

Day traders earn their profits during times of volatility. A savvy day trader knows how to make a profit, even when the market is collapsing. In a bear market scenario, these traders will strengthen their position. This trading strategy requires you to sell your Bitcoin at the beginning of a market drop and then repurchase Bitcoin at a lower price once the market bottoms out. The result: more Bitcoin. This strategy is easier said than done, however.

Combo Method

Many investors utilize a combination of these tactics to achieve the goal of increasing their Bitcoin holdings. These investors hold their Bitcoin until major market adjustments. As a crypto investor, monitoring new developments in the crypto market is important. In theory, it’s easier to predict a bear market than a bull market.

Remember, the crypto market is still new to many investors and bad media can spread FUD (fear, uncertainty, and doubt), which causes a sell-off by worried investors. For example, if you wake up tomorrow and type Bitcoin into the Google news search engine and the first three pages of stories are negative, it’s likely that this will cause the price of Bitcoin to drop. How much? Nobody knows.

Comparing Market Cycles

Market cycles are like the tides of the ocean. While nobody can guess exactly how powerful the tide will be, they can reference the year’s prior activity to get a general idea of when market activity increases or decreases. Bitcoin is now 10 years old and there is a decade of market research that can be evaluated to obtain a better understanding of Bitcoin’s market cycles.

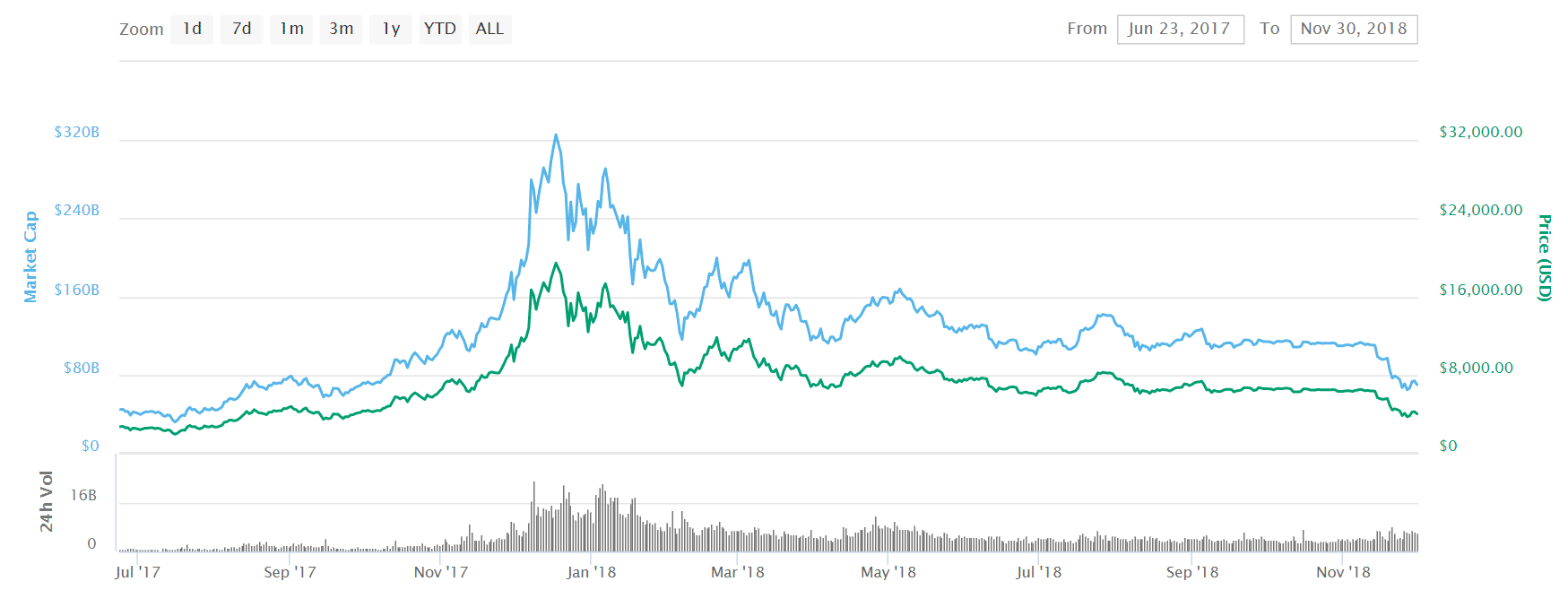

Bitcoin via CoinMarketCap

Recent Market Stabilization

The market appears to be stabilizing with volatility at its lowest levels in years. Does this mean that Bitcoin is stable? Probably not. Bitcoin usually experiences volatility following this type of market behavior. In most cases, a bull market ensues.

The Truth About the Dip

Buy low, sell high. This is the investment axiom that is echoed by experts throughout the crypto space. While it seems easy enough, predicting when the dip is at its lowest point is tricky, to say the least. One of the best strategies is to review the market charts and if the dip is near resistance lines, buy. Resistance lines on a market chart represent points in which the market showed an increase in buying activity, thereby stopping the bear.

Whales Splashing

Following the trading activity of whales within the Bitcoin space is another awesome way to schedule your buying efforts. Bitcoin whales are people that own huge amounts of a Bitcoin. A recent Bloomberg report revealed that just 1,000 people own over 40 percent of all the Bitcoin in existence.

When a whale makes a move, the entire market responds. A report published by Investopedia in September 2018 highlighted this scenario. The report showed how one whale caused a $53 billion Bitcoin sell-off. The moral of the story, watch the whales because they can affect prices dramatically.

Police Auctions

Law enforcement officials are stepping up their crypto confiscations, and if you are looking to invest heavily into cryptocurrency, these scenarios are ideal. Large-scale crypto auctions provide you with the perfect opportunity to get huge sums of crypto at discounted rates.

Longtime crypto investor Tim Draper famously bought nearly 30,000 confiscated Bitcoin from authorities following the Silk Road bust. While Draper refused to give the specific price details paid, a report by Fortune magazine places the average price paid for Bitcoin at around $334.

When to Buy Bitcoin

Learning when to buy Bitcoin comes down to learning what type of crypto investor you want to be. Once you understand your strategy, you know when it makes sense to purchase more Bitcoin, HODL, sell, or strengthen your position. With these concepts in mind, you are now ready to learn how to increase your cryptocurrency portfolio like a pro.

The post When to Buy Bitcoin: A Guide to Stacking Satoshis appeared first on CoinCentral.

Coincentral.com is author of this content, TheBitcoinNews.com is is not responsible for the content of external sites.

Our Social Networks: Facebook Instagram Pinterest Reddit Telegram Twitter Youtube