The traditional system of money is structured in a way that we don’t really need to think much about the security of our wealth. The banking system is responsible for the security of our funds. Even if bank a bank is at financial risk, there are government insurance schemes such as FDIC that add another layer of security from institutional risk.

This is pretty much why people could potentially have trouble understanding the security aspects of cryptocurrencies. These digital assets are remarkable in a number of ways. For example, they offer seamless transfers across borders. They allow us a degree of financial anonymity that we’ve never known, especially in financial matters.

However, for all of these benefits, there are some downsides as well. Most notable among them is that there is no central authority with regulatory or oversight authority. Therefore, we must take the necessary precautions to safeguard our digital wealth.

In this article, I want to take you through everything you need to know about cryptocurrency safety and some of the common cryptocurrency security issues that tend to come up.

Cryptocurrency Safety

If you have any experience with cryptocurrencies, you should be familiar with cryptocurrency wallets.

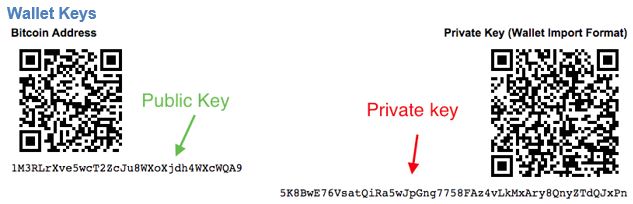

All of these digital assets are held and secured via two forms of alphanumeric codes known as keys.

- Public keys are used to send and receive cryptocurrencies. This is not the same as wallet addresses.

- Private keys determine the ownership on these digital assets. Should someone gain access to your private keys, they as access your funds.

Why Private Keys Matter

Since the ownership of cryptocurrencies is determined by its private keys, it is really important that you never store your digital assets in a wallet where you don’t wholly control the private keys.

Some of you might be thinking that this is redundant advice, that you wouldn’t willingly use a wallet that doesn’t give you complete and sole ownership of the private keys. You would be surprised to learn that a number of wallets, especially the exchange wallets, don’t actually give us control over the private keys.

So it might seem as your cryptocurrencies are in your account, but technically speaking, if you don’t have sole control of the private keys, you are pretty much dependant on good faith.

Hot Wallets and Cold Wallets

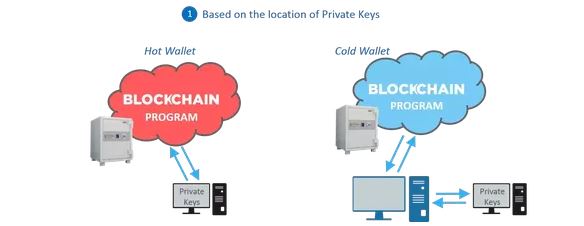

Look at how cold wallets are walled off from the internet. Source: Quora

There are several different types of wallets but in the current context of safety, we’ll only talk about hot and cold wallets. For a more comprehensive understanding of cryptocurrency wallets, you can go over this detailed and exhaustive piece about best bitcoin wallets.

Hot wallets are connected to the internet and can be accessed at any time. Cold wallets are offline and can only be accessed when they’re connected to the internet.

Think of a hot wallet like the cash you carry in your traditional wallet. It’s the funds you might want to access without much effort. Any money that you wouldn’t be using for small purposes should go in a cold wallet.

Storing your digital assets in a cold wallet is by far the most prudent way to store your cryptocurrencies. Since there are a number of dedicated hardware wallets available, it is best that you use a hardware wallet.

Hardware Wallets

Hardware wallets, available in different shapes and sizes.

Although dedicated hardware wallets are not the only way to use a cold wallet, it is by far the best method to do so. The simple reason is that these hardware wallets are designed not only to safeguard our digital assets from external threats, they also protect us from our own infallibility.

Since cryptocurrency transactions are irreversible, a small mistake a prove quite costly. The mere fact that you can break or lose a hardware wallet and simply recover the private keys on another wallet is the single most important feature that traditional cold storage methods can’t offer.

Major Cryptocurrency Security Issues

Since cryptocurrency transactions are irreversible, the trial and error method, for all its merits, doesn’t really work here that well.

Let’s go over some of the major security issues:

- Most of our computers and devices are infected with some form of malicious software and there is no real way to be completely certain if our systems are free from viruses and malware.

- The virtual world is susceptible to hacks and phishing schemes and cryptocurrencies are not exempt from this threat.

- Most of the major cryptocurrency exchanges hold on to the private keys of your depositors or customers.

A Few Tips on Keeping Your Cryptocurrency Safe

● Never Leave Large Amounts of Money on an Exchange

Even the most reputable exchanges have been hacked. It’s a risk you don’t necessarily need to take. If you’re an active trader you can even use KeepKey’s native exchange functionality to take advantage of the markets.

● Make Sure You have Control of the Private Keys

If you’re using a web-based hot wallet, you want to at least make sure that you have the sole control over the private keys. Since your money is at risk, you should be the one responsible for safeguarding it.

● Invest in a Hardware Wallet or Two

Hardware wallets are pretty cheap. Even the high-end models are surprisingly inexpensive. If you’re investing in cryptocurrencies, there is no excuse not to have a hardware wallet. These devices make it virtually impossible to use your cryptocurrencies, of course, this is if you’re using them correctly.

Conclusion

No doubt, there are some scary stories involving cryptocurrencies. But we can learn from their mistakes. We have the tools and the knowledge to never repeat those mistakes. If you have friends or family members interested in cryptocurrencies, you should share this article with them. Help us help everyone properly use this burgeoning financial technology.

[newsletter_form lists="1"]