The price anomaly was caused by the low liquidity in the US exchange after SEC lawsuits.

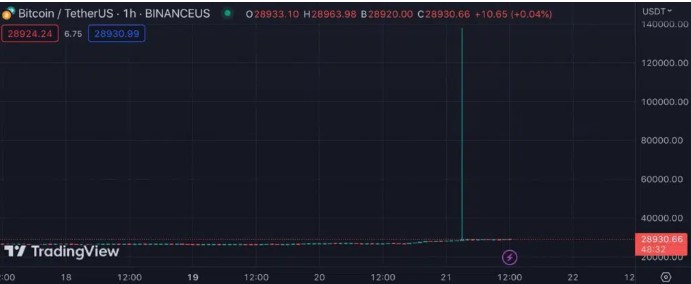

The price of bitcoin came to quote up to USD 138,000 on the Binance.US exchange in the early hours of this Wednesday, June 21.

It was at 6:50 AM (UTC time) when, for a few seconds, the price of the main digital currency against the stablecoin tether (USDT) reached that figure. Then, it resumed its “normal” price (that is, the one accepted mostly by the market).

The main reason for this drastic fluctuation in the price of bitcoin in Binance.US was the low liquidity that the platform is currently experiencing. This phenomenon is the result of the recent lawsuits that the US Securities and Exchange Commission (SEC) has filed against that company, accusing it of allowing the trading of unregistered securities. Many users of the US subsidiary of Binance withdrew their funds from the platform, facing the possibility of freezing money or bankruptcy of the company. It is worth clarifying that neither of these two things has happened with Binance, at least so far.

Liquidity, in layman’s terms, refers to the ease with which an asset can be bought or sold in the market without affecting its price. A market is liquid when there are enough buyers and sellers to allow smooth transactions and without major price changes. Conversely, when a market has low liquidity, there are fewer buyers and sellers available, which can lead to extreme price volatility. In this case, any purchase or sale operation can have a significant impact on the price of the asset.

In this case, the price of bitcoin may have reached $138,000 due to a purchase operation at a time when there was a limited amount of bitcoin available for sale. This trade may have pushed the price upwards, but only temporarily, as it then returned to its “normal” value once the trade was completed and the balance between buyers and sellers was restored.

Something important to clarify in this is that the price movement occurred in the US subsidiary of the exchange and not in Binance international. As reported by CriptoNoticias, it is a company created in 2019 with the aim of specifically complying with the regulations and regulations of the United States regarding the trading of cryptocurrencies.

[newsletter_form lists="1"]