Bitcoin has had a volatile trading history, with its price rising and falling sharply over its short history. Since its inception, bitcoin has been on an incredible trajectory; if you had invested in bitcoin when it was first launched in 2009, you would be seeing returns in the millions or billions, as the initial value of the asset was $0. Below we have gathered a series of examples that chart this drastic rise in the value of bitcoin over the past decade.

- Comparing Bitcoin to world GDP:

When compared against individual nations’ Gross Domestic Product (the value of all goods and services produced within a country’s borders), the cryptocurrency market would be positioned in 10th place between France and Italy. The total value of bitcoin is now equal to ¼ of world GDP and is higher if you include other forms of cryptocurrencies. The value of all the world’s bitcoin is higher than the GDP of nations such as Switzerland, Argentina, Saudi Arabia, Sweden and Thailand.

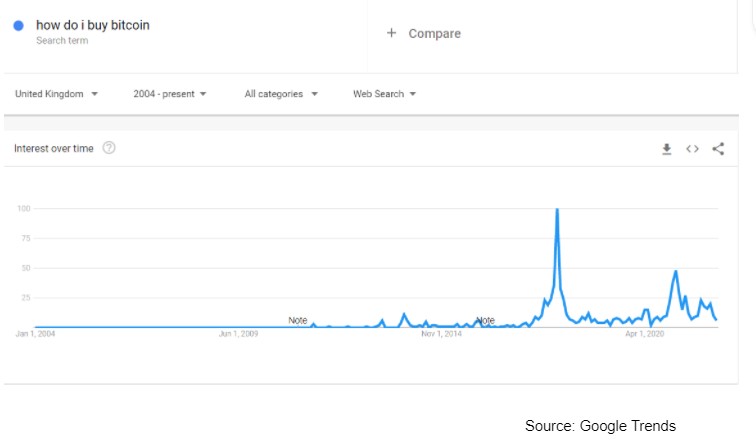

- Search interest over time

The amount of search activity on Google for the term ‘How do I buy bitcoin’ has drastically increased over the course of the past decade. There was a notable peak in November 2017, where the price of bitcoin was at its highest. The increasing search volume shows bitcoin is shifting into the mainstream and that there is an increasingly widespread interest in crypto adoption.

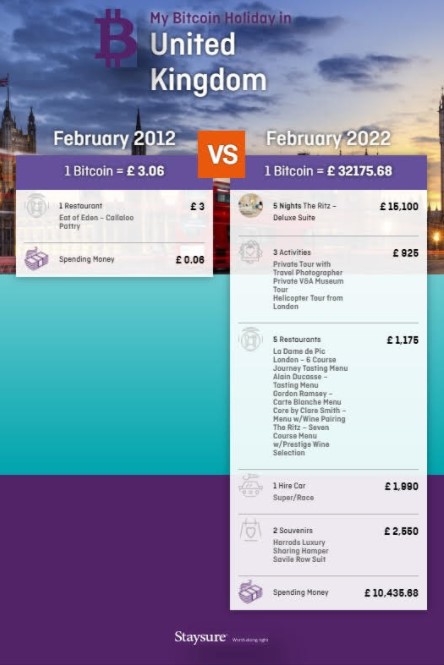

- Budgeting for a holiday with the value of 1 BTC

Staysure’s ‘My Bitcoin Holiday’ tool charts the rise in the value of 1 BTC in the novel medium of budgeting for a holiday. The tool demonstrates the growth in bitcoin over the past decade; For example, a 1 BTC holiday in February 2022 could buy you a drastically different holiday to the kind you could buy in February 2012. At the value of £3.06 in 2012, a 1 BTC holiday would allow you a visit to one restaurant in the UK. In 2022 however, you’d be having a 5 night stay at the Ritz, with over £1000 pounds to spend on dining out, and a total of over £10,400 spending money.

[newsletter_form lists="1"]