Strategy Executive Chairman Michael Saylor sparked debate with a survey suggesting that Gamestop needs to invest over $3 billion in Bitcoin to gain BTC legitimacy.

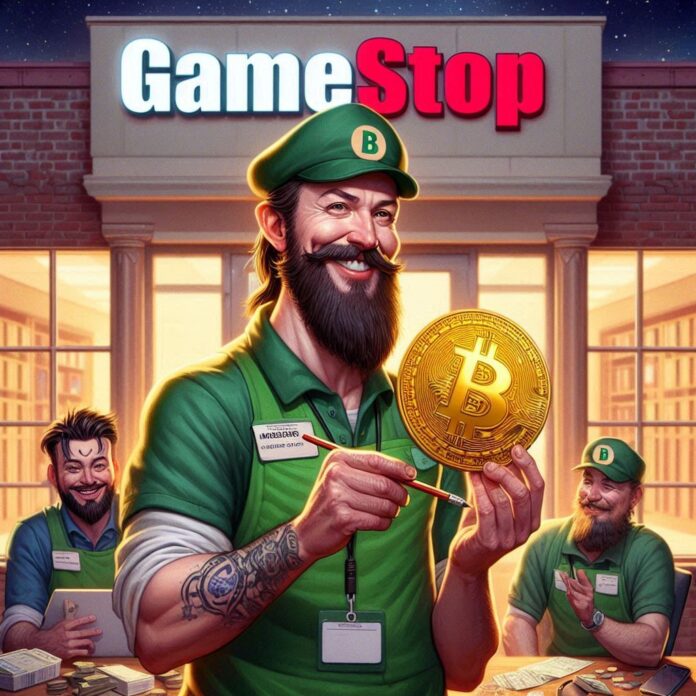

Michael Saylor Increases Pressure with Poll – Can Gamestop Live Up to BTC Expectations?

Michael Saylor, co-founder and executive chairman of the software intelligence firm Microstrategy (Nasdaq: MSTR), recently renamed Strategy, launched a poll on the social media platform X on March 26, asking how much Bitcoin Gamestop Corp. (NYSE: GME) would need to acquire to gain legitimacy among Bitcoin enthusiasts.

Saylor asked his 4.2 million followers how much Bitcoin Gamestop would need to buy to gain credibility among Bitcoin supporters. The 24-hour poll, which received 68,914 votes, offered four ascending buy levels. The $3 billion-plus option, which Saylor called the “king move,” led with 47% of the vote. The $1 billion “Tesla Tier” received 31.4%, suggesting that many view a multi-billion dollar investment as a threshold for entrepreneurial seriousness. The $250 million “MSTR Starter Kit,” which references Microstrategy’s 2020 entry, received 15.8%, while only 5.8% supported the $50 million “Just LARPing” option. Saylor’s post reached nearly 1 million views.

GameStop announced its Bitcoin strategy on March 25, revealing that its board of directors had “unanimously approved an investment policy update to add Bitcoin as a treasury reserve asset.” The company stated that a portion of its current cash balance, as well as proceeds from future capital raisings, could be used to acquire BTC. “The company’s investment policy permits investments in certain cryptocurrencies, including Bitcoin and U.S. dollar-denominated stablecoins.”

The following day, GameStop announced it would provide $1.3 billion through a private offering of convertible senior notes, with an option to issue an additional $200 million. “GameStop expects to use the net proceeds from the offering for general corporate purposes, including acquiring Bitcoin in accordance with GameStop’s investment policy,” the company stated. On March 27, GameStop shares experienced a significant decline of over 20% after the company announced the issuance of $1.3 billion in convertible notes to finance Bitcoin purchases.

Meanwhile, Strategy continued its aggressive Bitcoin accumulation. On March 24, it announced the purchase of 6,911 BTC for $584.1 million at an average price of $84,529 per coin. Saylor stated that the company has achieved a 7.7% Bitcoin return so far in 2025. As of March 23, Strategy holds 506,137 BTC, acquired for approximately $33.7 billion at an average price of $66,608 per coin.

[newsletter_form lists="1"]