The most famous ETF that’s not actually an ETF yet is about to learn its fate very soon.

The paperwork for the Winklevoss Bitcoin Trust ETF (Pending:COIN) was originally filed nearly 3 ½ years ago and the SEC still has yet to officially rule on whether or not it will be approved. That’s about to change though. Following several years of SEC filings and three separate delay requests, the governing body is now out of extensions which puts the final ruling date at March 11, 2017. The ETF would be approved by default if the SEC fails to issue a ruling by that date.

The looming deadline brings a number of issues to light in determining whether the market and investors are ready for a bitcoin ETF.

Safety

In its early days, the greatest concern surrounding bitcoin was piracy. In 2014, Mt. Gox, the exchange that at one time handled the majority of bitcoin transactions, filed for bankruptcy and announced that around 850,000 bitcoins had gone missing. As recently as last summer, Bitfinex, another bitcoin exchange, had 120,000 bitcoins stolen.

While security has come a long way, the Bitfinex hack demonstrates that there are still vulnerabilities in the system. ETF shareholders would be exposed to similar risks.

Supply

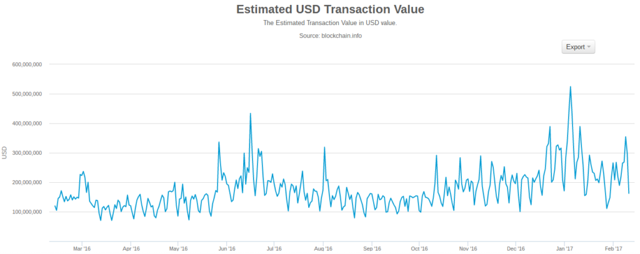

Interest in bitcoin has grown dramatically over the past several years but the market is still relatively limited. On an average trading day, about $200-300 million in bitcoin changes hands.

That’s important to remember because it’s reasonable to believe that a bitcoin ETF could attract that much in new investment once launched. On top of that, China just announced that it’s cracking down on the bitcoin market in order to get a better handle on money laundering and theft so that number should be expected to drop.

Such a disconnect between supply and demand could easily push bitcoin prices into bubble territory quickly. That kind of rapid price movement would almost certainly damage a good number of shareholders quickly.

Volatility

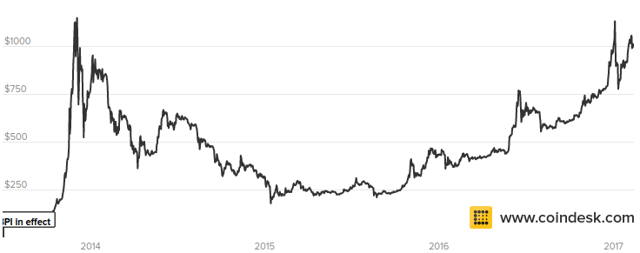

Let’s not forget how volatile the price of bitcoin can be absent the presence of an ETF.

Since its debut, the price of bitcoin has gone from under $100 to nearly $1200, back to under $200 and up to its current level of around $1000. That’s all in just a few years. Volatility tends to lead to panicky investors and panicky investors tend to lose their money. With the anticipated flood of investment, it could be easy to imagine bitcoin becoming even more volatile. Will the SEC be OK with this?

Shareholder Protection

The SEC’s ultimate job is to protect shareholders. Bitcoin isn’t overseen by the government and that lack of control should make the SEC uneasy.

Bitcoin is relatively illiquid, still vulnerable to hacking and could become costly to acquire once investors begin moving in. Will the SEC be satisfied enough with the potential impact of these issues that it’s willing to approve making bitcoin available to the masses? If something bad happens right off the bat, things could get ugly.

While a bitcoin ETF will almost certainly be approved eventually, it seems unlikely the SEC will approve a fund this time around.

TheBitcoinNews.com – Bitcoin News source since June 2011 –

Virtual currency is not legal tender, is not backed by the government, and accounts and value balances are not subject to consumer protections. TheBitcoinNews.com holds several Cryptocurrencies, and this information does NOT constitute investment advice or an offer to invest.

Everything on this website can be seen as Advertisment and most comes from Press Releases, TheBitcoinNews.com is is not responsible for any of the content of or from external sites and feeds. Sponsored posts are always flagged as this, guest posts, guest articles and PRs are most time but NOT always flagged as this. Expert opinions and Price predictions are not supported by us and comes up from 3th part websites.

Advertise with us : Advertise

Our Social Networks: Facebook Instagram Pinterest Reddit Telegram Twitter Youtube