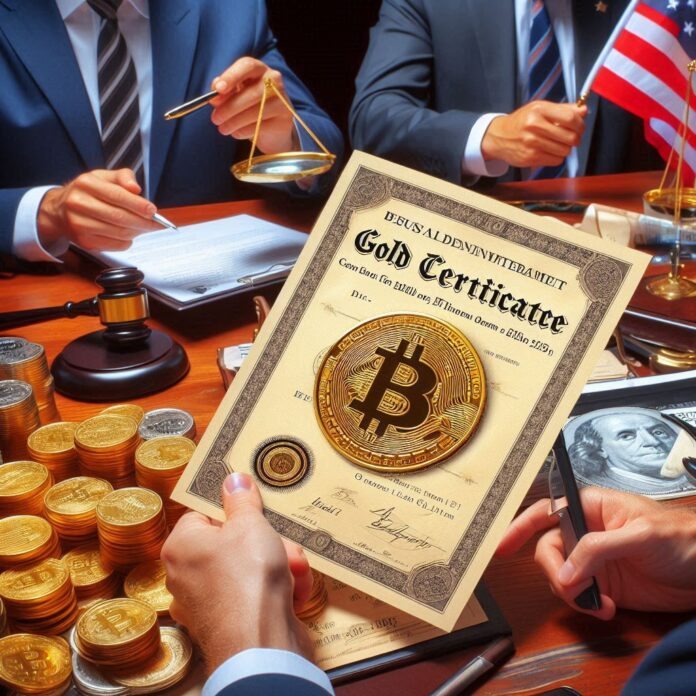

An innovative strategy for financing digital currencies: How the Trump administration plans to revalue gold certificates and acquire Bitcoin.

Budget-Neutral Strategies for Bitcoin Acquisition

Robert “Bo” Hines, Director of the President’s Council on Digital Assets, recently confirmed during the first episode of the “Crypto In America” podcast that repricing gold certificates could be a budget-neutral way to acquire Bitcoin.

In the context of an executive order signed by President Donald Trump establishing the Strategic Bitcoin Reserve (SBR) and a national altcoin repository for digital assets, Hines stated that the U.S. government will conduct future Bitcoin acquisitions through budget-neutral means. It remains unclear what strategies the administration is considering to increase its holdings.

Selling Gold Certificates to Fund Bitcoin

In a conversation with journalist Eleanor Terrett, Hines was asked for specific examples of a budget-neutral approach. He pointed to the Bitcoin Act of 2025 proposed by Senator Cynthia Lummis. According to Hines, the government could revalue the true value of certain gold certificates, currently worth about $172 per ounce. Such a revaluation would allow the government to use additional funds to purchase Bitcoin.

“We could realize the gains, and that would be a budget-neutral way to acquire more Bitcoin,” Hines noted, adding that various strategies are being discussed, with senior officials such as Treasury Secretary Scott Bessent and Commerce Secretary Howard Ludnick involved in the discussions.

Considerations for Fort Knox Gold and Beyond Bitcoin

A follow-up question from Terrett concerned whether the government could consider selling some of the gold at Fort Knox to purchase Bitcoin. Hines noted that, provided such a move remains budget-neutral and does not burden taxpayers, it could be considered. He emphasized that the administration is open to exploring creative solutions and that a cross-agency working group is analyzing various options.

Other crypto assets were also discussed during the conversation. Co-host Jacquelyn Melinek asked whether the government was considering other assets such as Ethereum, XRP, Solana, and Cardano. Hines explained that Bitcoin holds a special position due to its undisputed classification as a commodity.

“Bitcoin is different. It’s unique. It has intrinsic value and is widely recognized,” he emphasized, citing Bitcoin’s “immaculate conception,” meaning it has no central issuer.

This distinction led to the creation of two separate reserves: the Strategic Bitcoin Reserve (SBR) and the National Vault of Digital Assets, which includes other cryptocurrencies.

Hines clarified that the five assets mentioned—Ethereum, XRP, Solana, Cardano, and Bitcoin—were selected based on their market capitalization, but added that the administration aims to support innovation in the crypto space overall.

[newsletter_form lists="1"]