What is Exchange Union?

Exchange Union is a “decentralized network” that connects individual digital asset exchanges from around the world. The team is on a mission to solve one of crypto’s most prominent issues – illiquidity.

Most investors have experienced this first-hand: You find a digital asset you like and want to invest in. However, the coin is only available on a handful of exchanges. On top of that, you can only use Bitcoin or Ethereum to trade for it. This leads to a sometimes hour-long process filled with multiple manual transfers over at least two exchanges.

And, the illiquidity problem means there are numerous trading pairs that aren’t even available yet.

Exchange Union connects the order books from different exchanges to bring you instant, trustless trades for a better price and overall improved trading experience.

In this Exchange Union guide, we’re going to cover:

- How does Exchange Union work?

- XUC tokens

- Exchange Union team & progress

- Trading

- Where to buy XUC

- Where to store XUC

- Conclusion

- Additional Exchange Union resources

How does Exchange Union work?

The Exchange Union team describes the platform as a “meta-exchange” because they’re building it as a layer on top of the existing centralized exchanges. It’s effectively an exchange of exchanges. To do this, the project utilizes popular second-layer scaling solutions like:

- Payment channels

- Atomic swaps

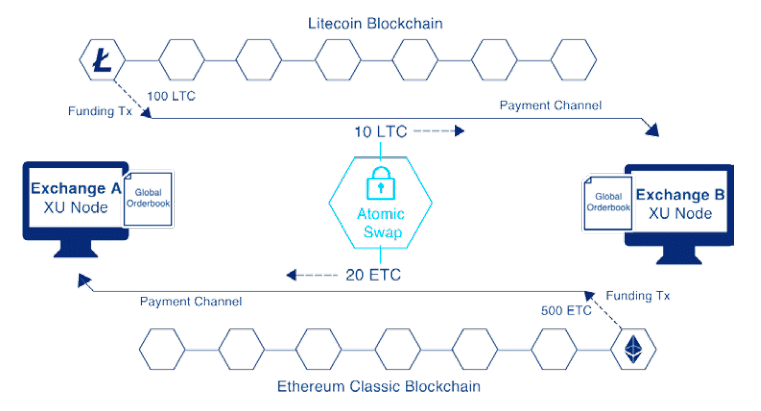

Payment Channels

Payment channels provide an instant way to transfer digital assets off-chain between two parties. The transactions are only recorded on the blockchain when the payment channel is first opened and when it’s closed. You can think of it as updating balances on both ends of the channel for each transfer. Once you close the payment channel, both parties get their respective final balances.

Payment channels are trustless – any disputes are resolved automatically through cryptography. And, transfers using them are secured by the underlying blockchain making them as reliable as exchanges on the blockchain itself.

Bitcoin’s Lightning Network and Ethereum’s Raiden Network are two of the most popular examples of payment channels.

Exchange Union utilizes Hashed Timelock Contracts (HTLCs) when connecting payment channels between exchanges. These contracts allow the platform to set-up XU nodes as trust-less intermediaries to route transfers through payment channels to multiple parties. This prevents exchanges from having to open up payment channels with every participant on the network. Instead, they can use a route of channels to facilitate transfers to their final destination.

Each platform participating in trades through Exchange Union needs to have an XU node and connect it to at least one other exchange for each digital asset with a payment channel.

Atomic Swaps

A trade always consists of two transfers across payment channels. Because of this, there’s an inherent risk of one party behaving dishonestly. After receiving their part of the trade, the first party could simply not transfer their funds to the other party. Via atomic swaps, it’s cryptographically ensured that both sides of the trade have to happen successfully. This makes trading on Exchange Union secure & trustless.

Atomic swaps use modified HTLCs to enable trades across payment channels. For example:

- Sally wants to trade her Litecoin for Ethereum Classic on Exchange A.

- Bob wants to trade his Ethereum Classic for Litecoin on Exchange B.

- Exchange A sends Sally’s funds to Exchange B on the Litecoin payment channel.

- Exchange B sends Bob’s funds to Exchange A on the Ethereum Classic payment channel.

- The unique HTLC guarantees that both sides of the trade happen successfully.

The Lightning Network is currently live on Bitcoin, Litecoin, and several other chains, and, because the Raiden Network supports all ERC20 tokens, you can already swap a significant amount of digital assets with this method.

Decentralized Orderbook

Instead of using a complete, global orderbook, each XU node keeps track of the relevant orders on its own payment channels. Each node then broadcasts their local orderbook to the other nodes on the network creating a decentralized system of orders.

XUC token

XUC is an ERC20 token that the Exchange Union team primarily uses for incentives on the platform.

For Exchanges

The team will airdrop XUC to all traders on platforms using Exchange Union. You can only use XUC to pay for Exchange Union services, and you must hold the token to participate in the network. Ideally, exchanges will see an influx of new traders looking to take advantage of the increased number of trading pairs and better prices that Exchange Union participants provide.

For Traders

Traders receive XUC when hitting certain trading volume milestones on the Exchange Union network. The team has not yet set the milestone or reward numbers.

For Service Providers

Node operators get rewarded XUC for relaying orders to exchanges. Also, individuals who monitor the main chain for illicit activity receive XUC rewards.

For Developers

To build a strong developer community, Exchange Union rewards developers who contribute to the platform codebase with XUC. You can also review and test code to get XUC payments.

Supply & Distribution

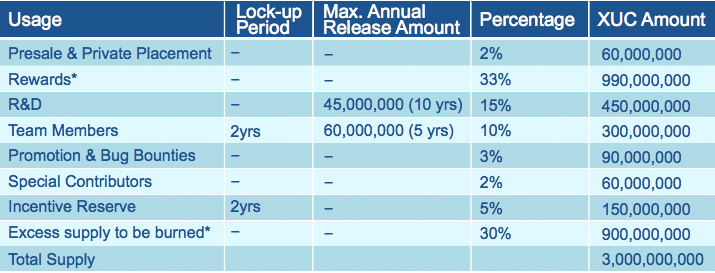

There are a total of 3,000,000,000 XUC tokens with only 65,000,000 currently in circulation. Exchange Union has not had an ICO – a rarity these days. Instead, 60,000,000 XUC tokens (2%) were sold to private investors to fund the project. The distribution is as follows:

Exchange Union team & progress

Team

James Wo (CEO), Terry Culver (CSO), Mikael Wang (Chief Blockchain Architect), and Kilian Rausch (Product Director) lead the Exchange Union management team. The team has extensive blockchain experience with some impressive positions on their resumes.

Wo is the Founder and Chairman of the Board of Digital Finance Group – the world’s leading blockchain focused business group. Wang was formally the CTO of BTCC as well as a Chief Solutions Architect at Ericsson. Rausch was previously the PO at Mobi, a leading digital asset wallet.

There are some impressive names advising the team as well. Brenden Eich, the creator of Javascript, Mozilla Firefox, and the Brave browser (BAT token), is a lead advisor. Other advisors either run or are involved with popular trading platforms such as Unocoin, Ripio, OKCoin, and Kraken. This should bode well for the team when integrating with exchanges.

Progress

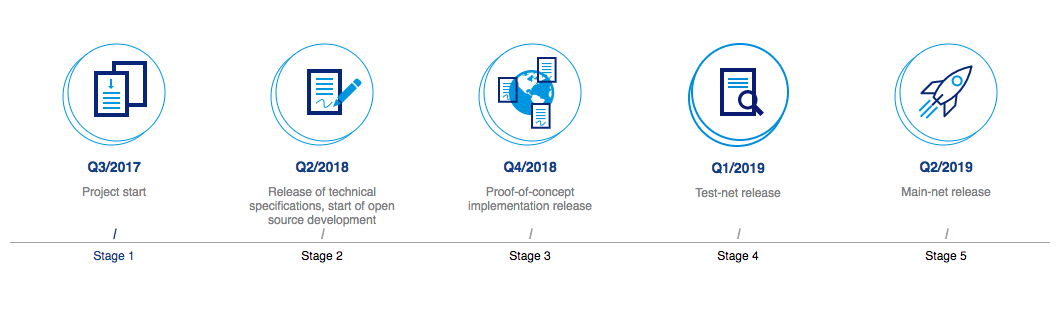

The project is still comparatively in its infancy – beginning in Q3 of 2017. The team will release the technical specifications during Q2 of this year (2018) and launch a test net by Q1 of 2019.

Competition

There are numerous blockchain projects tackling the illiquidity problem. Decentralized exchange protocols like 0x and Kyber Network are attempting to solve this issue by providing a new paradigm for exchanges.

QASH is another similar project that is building a combined orderbook of exchanges around the world in combination with their in-house matching algorithm.

Exchange Union is unique in that the team is working to integrate with already established exchanges. The platform is also one of the only ones to utilize payment channels for trades. Decentralized exchanges like 0x, EtherDelta and Kyber use atomic swaps but not payment channels. That’s why they tend to be slower and/or more expensive.

Trading

The XUC token began trading at the end of October 2017, so there’s not much trading data to analyze. The price has been turbulent, ranging from a low of about $2.00 (~0.00028 BTC) to a high of over $17.00 (~0.00092 BTC). Recently, the price seems to have settled in the $8-$9 range.

It’ll be hard to predict price movements until the platform is closer to being launched, but there are a few things that may affect it. The main things that could drive the price upwards are development milestone announcements and increased use of the network.

Where to buy XUC

Because the project is so young, you have limited options on where to purchase XUC. You can grab the token on OKEx or HitBTC for either Bitcoin, Ethereum, or Tether.

If you’re starting fresh with no funds, you should first purchase Bitcoin or Ethereum on an exchange such as Gemini.

For a full and updated list of XUC exchanges, be sure to check out the Exchange Union website.

Where to store XUC

As an ERC20 token, the ideal place to store your XUC is in a wallet with ERC20 support. MyEtherWallet is the most popular online option.

Trezor is a great hardware wallet with ERC20 support if you’re interested in something with more security.

Conclusion

Exchange Union connects existing exchanges through payment channels to bring more liquidity to the cryptocurrency ecosystem. Although the project is relatively new, the team and advisors behind it have ample experience in the blockchain space.

Unlike most other decentralized exchange focused projects, Exchange Union is working directly with centralized exchanges to integrate their technology. Be on the lookout this year as the team begins to build out their product and ramp-up development. You can stay up-to-date with all Exchange Union news and announcements through their blog.

Additional Exchange Union resources

Slack (Developers only)

The post What is Exchange Union? | Beginner’s Guide appeared first on CoinCentral.

TheBitcoinNews.com – Bitcoin News source since June 2011 –

Virtual currency is not legal tender, is not backed by the government, and accounts and value balances are not subject to consumer protections. TheBitcoinNews.com holds several Cryptocurrencies, and this information does NOT constitute investment advice or an offer to invest.

Everything on this website can be seen as Advertisment and most comes from Press Releases, TheBitcoinNews.com is is not responsible for any of the content of or from external sites and feeds. Sponsored posts are always flagged as this, guest posts, guest articles and PRs are most time but NOT always flagged as this. Expert opinions and Price predictions are not supported by us and comes up from 3th part websites.

Advertise with us : Advertise

For the latest cryptocurrency news, join our Telegram!