The first-ever crypto investment report released July 18 by digital asset management fund Grayscale Investments reveals that the majority of capital inflow this year is coming from institutional investors.

Grayscale has been overseeing investments into crypto for five years, launching a Bitcoin (BTC) Investment Trust back in September 2013 and then expanding to other single-asset funds — including Ethereum Classic (ETC), Zcash (ZEC) and Litecoin (LTC) — as well as diversified offerings, notably its Digital Large Cap Fund.

According to this week’s report, institutional capital accounted for 56 percent of all new investments into Grayscale products during the first half of 2018.

Despite the undeniably bearish picture for crypto markets during this time, Grayscale remarks that “counterintuitively,” the pace of investment has “accelerated to a level that we have not seen before.”

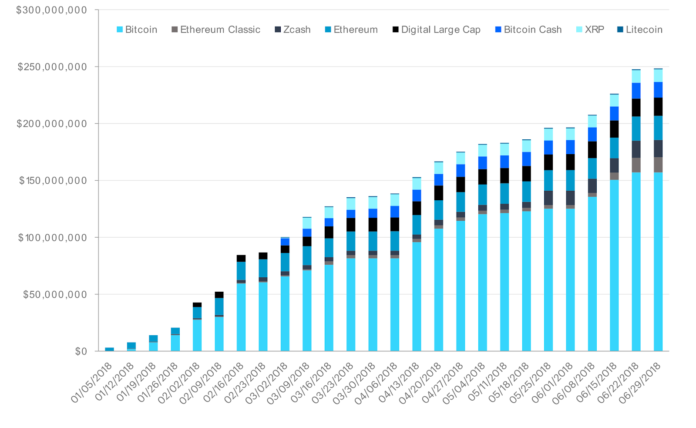

Total investment through June 30, 2018 was almost $248.4 million — the strongest ever fundraising period since 2013. $9.55 million in fresh capital has been incoming every week on average, with $6.04 million — 63 percent — going to the Bitcoin Investment Trust.

Grayscale Cumulative Inflows by Investment Product, December 31, 2017 through June 30, 2018. Source: Grayscale H1 2018 Report

In addition to the institutional investors who occupy the lion’s share of Grayscale’s portfolio, their investor profile data shows that accredited individuals account for 20 percent, retirement accounts for 16 percent, and family offices for 8 percent.

Of these, roughly 64 percent of all new investments came from within the U.S., 26 percent from offshore investors (“e.g. Cayman-domiciled entities”), and 10 percent from other regions.

The average investment sum was $848,000 for institutional investors, $553,000 for family offices, $335,000 for retirement accounts, and $289,000 for individuals. The report qualifies these figures by noting the data is skewed by several “large, one-time outliers,” as well as sums that were broken up into multiple allocations over a series of days.

Grayscale’s report suggests that major investors potentially consider the year’s downturn as a prime moment to enter the crypto markets — moving in to “buy the dip” just as the infrastructure to facilitate institutional entry is materializing.

This week saw significant news that the $6.3 trillion asset management heavyweight BlackRock –– the world’s largest provider of exchange traded-funds (ETF) –– is beginning to assess potential involvement in Bitcoin, stoking considerable excitement from industry stalwarts and possibly bolstering an impressive market uptick.

Cointelegraph.com is author of this content, TheBitcoinNews.com is is not responsible for the content of external sites.

Our Social Networks: Facebook Instagram Pinterest Reddit Telegram Twitter Youtube