Bitcoin is known for its meteoric rises and plummeting dips, but the price has not seen much upward momentum over the past few months. Ever since Bitcoin topped $20k in December 2017, people have been waiting for the bull market to return. However, there are a few things that may be keeping the price down. Here are a few reasons why Bitcoin might not be reaching new highs any time soon.

The Curious Case of Bitcoin’s Price

Since it’s creation, Bitcoin has been known for its dramatic price swings. Tenfold increase followed by a 90% drop were not a rare thing for Bitcoin, and it still isn’t today.

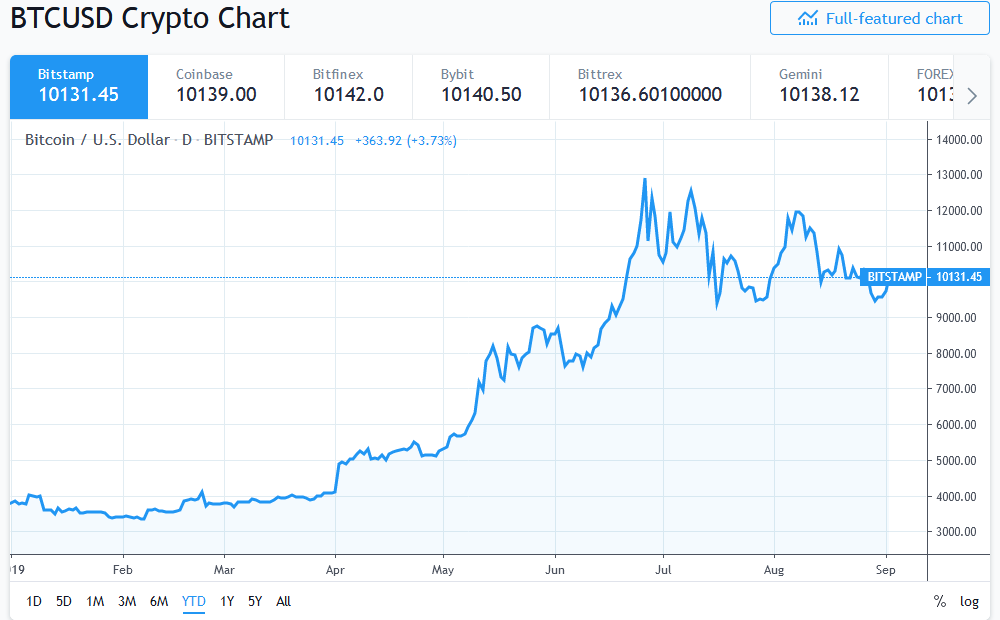

Bitcoin’s peak was at the end of 2017, reaching just around $20k before it started to come back down to Earth. After that, the price began to tumble more and more. When the dust cleared, Bitcoin had bottomed out at under $4,000.

Since reaching the bottom, Bitcoin slowly climbed back up. It has been bouncing between $7,000 and $11,000 for most of 2019. Many people are expecting good times to return soon enough. However, a large part of the community remains skeptical.

1. Slow Adoption from Institutional Investors

For years, there has been much talk of institutional investors entering the cryptocurrency space. Bitcoin’s properties, such as decentralization and security, make it a great investment vehicle for all types of traders. However, institutions remain hesitant to take the full plunge. There have been a few strides into that space, such as institutions offering Bitcoin futures contracts and other cryptocurrency derivatives to investors. Many hoped that the launch of the Bakkt platform would attract investors, but it’s been off to a very rocky start.

There seem to be two big reasons why institutions continue to have cold feet. The first is simply the unknown that comes with investing in Bitcoin. While Bitcoin has been around for almost a decade now, Bitcoin and other cryptocurrencies remain very much an experiment. No one knows what Bitcoin’s fate will be. It could go the way of MySpace, paving the way for another cryptocurrency to take dominance. Or, the entire crypto-currency market could go away, resulting in a failed experiment.

The other problem many institutions see with Bitcoin is the custody problem. Many traditional assets are insured or backed by either the government or other large institutions. These firms can rest assured that their stock holdings are highly unlikely to be hacked or stolen, however with cryptocurrencies, it is a very different story.

For the average user holding a fair sum of money in Bitcoin, a simple hardware wallet with a few backups is sufficient to keep your coins safe. However, a large institution holding millions of dollars in cryptocurrencies needs much greater security measures in order to make sure their funds are safe.

Some companies like Coinbase and others have begun offering custodial solutions, which absolutely have caught on. At one point Coinbase was gaining millions of dollars of customer funds weekly. However, the custody problem remains an issue for institutional investors.

2. Technology Woes

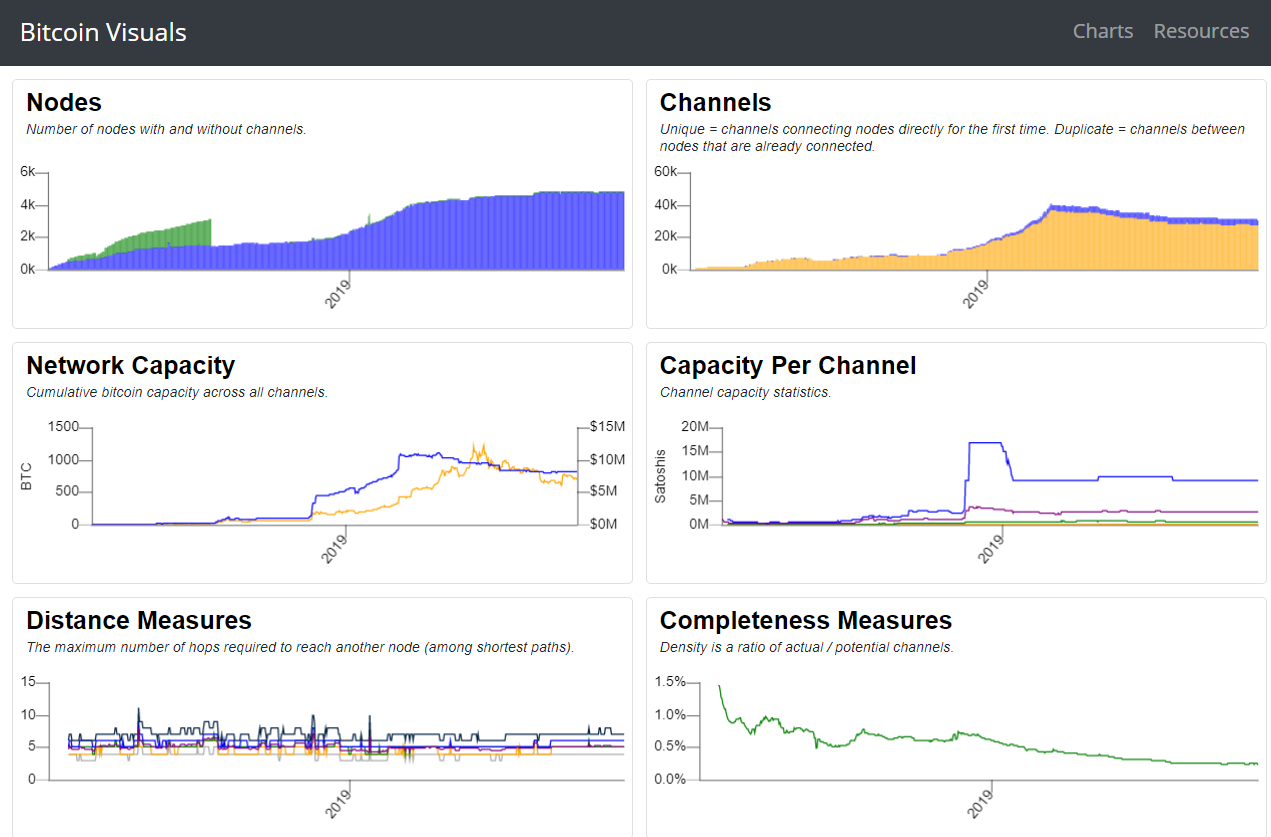

Bitcoin has put nearly all of its faith in layer two technologies in order to scale the network. Layer two tech like the Lightning Network and Blockstream’s Liquid network allow transactions to happen off-chain, taking the pressure off the main blockchain. However, these technologies are not without their own issues and have barely caught on over the past eighteen months.

The Lightning Network has been absolutely stagnated over six months, no matter what metric you look at. The number of nodes has been barely increasing since April, currently sitting at a little under six thousand nodes.

The total number of channels, the total capacity of the network, and the average channel capacity have all been dropping since April. After reaching a new high of 1000 BTC capacity, the capacity of the network dropped and continued to drop to 818 BTC, where it sits today.

Without a sufficient scaling solution, many investors are likely to be concerned over the future viability of Bitcoin and whether it will ever be able to compete with the likes of Visa.

3. General Bitcoin Market Sentiment

On top of all the problems Bitcoin currently faces today, there is also the issue of market sentiment. It seems like there simply isn’t enough hype to drive Bitcoin back up into the $10,000’s.

During Bitcoin price return to $13,800 earlier this year in June, industry commentators were hopeful that ‘Crypto Winter‘ was officially over. However, since that intra-year peak, the leading cryptocurrency has been back on a downward spiral as bears squeeze momentum out of the market.

When Bitcoin originally reached $20k, the hype surrounding cryptocurrencies was off the charts. It appeared to have reached the mainstream and tons of non-tech investors were rushing to invest in the new big thing. It was being discussed on multiple news channels, hitting countless headlines, and exchanges were seeing millions of new sign-ups per day.

However, it seems that fever isn’t present in today’s crypto market. There just isn’t much happening in the space that would cause another massive spike in investors. We will have to wait and see what comes next that could spur a new wave of investment into digital currencies.

Do you think Bitcoin will return to $20K soon? Let us know your thoughts in the comments below!

Images via Shutterstock, Lightning Network charts by Bitcoinvisuals, BTCUSD chart by Tradingview

The post 3 Things Stopping Bitcoin From Returning to $20k appeared first on Bitcoinist.com.

Bitcoinist.com is author of this content, TheBitcoinNews.com is is not responsible for the content of external sites.

Our Social Networks: Facebook Instagram Pinterest Reddit Telegram Twitter Youtube