Never before has the Bitcoin Blockchain seen such a large traffic jam. The number of unconfirmed transactions reached a level, at which it hurts. The Bitcoin economy is not amused; BitPay’s Stephen Pair speaks out with exceptional clarity, while Barry Silbert of the Digital Currency Group tries to establish a broad alliance for a new compromise.

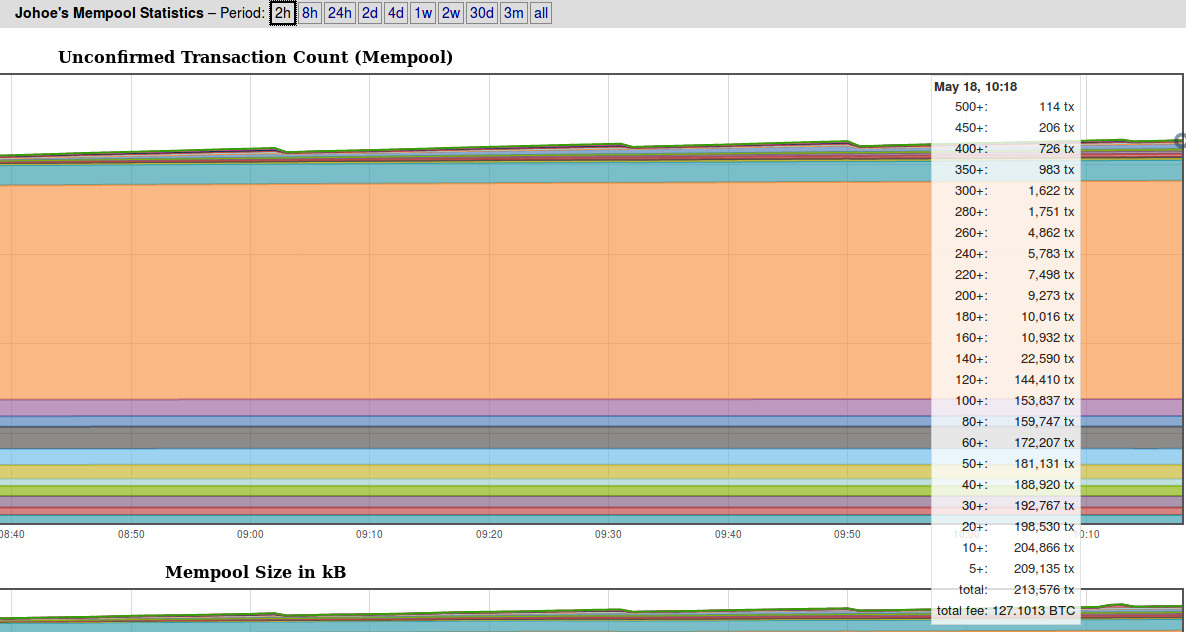

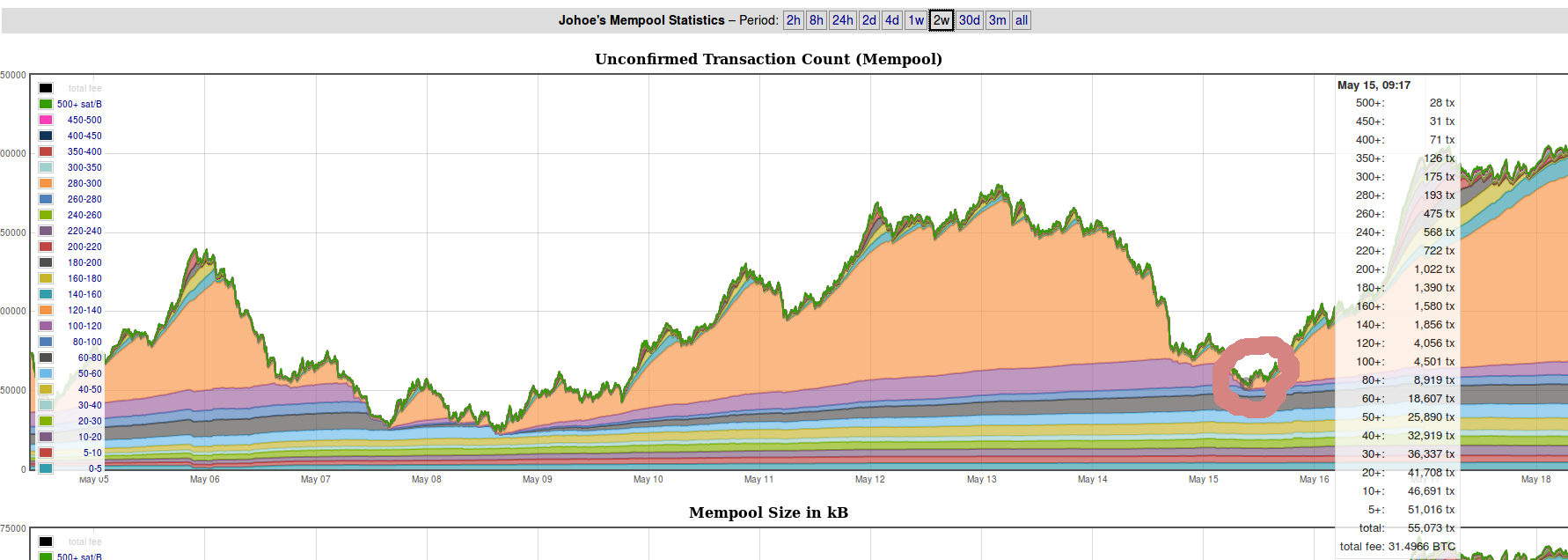

At least there is something the Bitcoin community can agree about; the MemPool reached a new all-time high. At the time of writing, more than 200,000 transactions were waiting for space in the blocks. Around 160MB of data is tacked in the blockchain traffic jam. As the network is only capable of confirming 144 blocks with each 1MB in 24 hours, it will need at least one day to clear the MemPool, even if everybody stops using Bitcoin.

The fees have become insanely expensive. Nearly 7,000 transactions paid a fee of more than 200 Satoshi for each byte, which equals a good dollar for a standard transaction which has the chance to be confirmed during the next two hours. Whoever wants to have a chance to get a place in the next block, needs to pay more than 300 Satoshi each byte, roughly $1.50. Anybody paying less than 80 Satoshi each byte (less than 50 cents) should be aware that his transaction is only one of 160,000 in the same queue.

Bitcoin has become expensive, and unreliable for those, who are unable to match the correct fee. But things become really dreadful when you have a lot of small inputs with a value of less than 60,000 Satoshi. Many people who have daily payouts of cloud mining or collected bitcoins with faucets might know this. Inputs smaller than 30,000 Satoshi have become unspendable with fees higher than 100 Satoshi, and if fees raise beyond 300 Satoshi, even small inputs of 75,000 Satoshi ($1.20) are frozen.

The affairs have begun to become painful for the Bitcoin economy. The past days are full of examples that the industry is not prepared for this fee event. For example, Trezor, the hardware wallet, charged fees of astronomical $500 for a single transaction, because the provider, to which Trezor has outsourced the fee estimation, could not deal with the full blocks. Meanwhile, users of the wallet Multibit complained that they are unable to spend their balances, and the wallet Electrum reached the limit of “sanity fees” of 300 Satoshi each byte.

Large Bitcoin companies like BitPay or Shapeshift, which accept and send thousands of transactions each day, are drowned in support requests, because everybody wants to know, when, finally, their transaction will be confirmed. AirBitz, the mobile wallet, even publicly considered paying its employees no longer with bitcoin, but with litecoin or ether, because Bitcoin transactions have become too expensive and unreliable.

Bitcoin 8MB, Litecoin SegWit

Naturally, the economy is not amused. BitPay’s Stephen Pair vented his anger on Twitter. He started with telling the world in unknown clarity what BitPay wants. He reminded of the high fees and the unconfirmed transactions and demands “time for a hard fork to larger blocks … 8MB please”.

a typical #bitcoin transaction costs $1.80 now, 200k unconfirmed transactions, time for a hard fork to larger blocks … 8mb please

— Stephen Pair (@spair) May 17, 2017

With this tweet, Pair opens up the usual discussion. Adam Back, CEO of Blockstream, answers, that activating SegWit should be the first step, as this is already developed and tested. Actually, SegWit could increase the size of the blocks, if the new transaction format is used. The segregation of the signatures might especially be useful to send a lot of small inputs. In light of the obvious lack of capacity, it is as legitimate to ask for SegWit as for a hard fork.

Pair, however, replies that it is now too late for SegWit and that it cannot help anymore. He does not detail if he means that SegWit will never get enough support to be activated, or if he thinks that the capacity increase provided by SegWit is not sufficient to solve current problems.

@adam3us it’s too late for segwit unfortunately … would not help this situation

— Stephen Pair (@spair) May 17, 2017

After this, a discussion started, which might be highly representative for the whole drama and the unsolved problem. Pair notes that he is not in general against SegWit and that he is open to it after it has been tested on Litecoin. Then other people reminded of the successful SegWit activation on Litecoin, vituperate against BitMain and Roger Ver and announce cancellation of customership at BitPay. The Swedish Pirate Rick Falkvinge joins the discussion and asked if a compromise needs a concession, many Twitter people have a “UASF” in their name, and some members of the community start to cry for a boycott of BitPay because the payment provider sold its soul by partnering with BitMain.

Shortly after, Pair tweets again: “best plan: 8mb hard fork on #bitcoin now, test segwit on litecoin.” Now Core developer Eric Lombrozo steps in. Lombrozo is usually known for being polite and sane. Here he reacted surprisingly hostile: “I really liked you, @spair – sad to see the corrupting influence of money on people you like.”

@spair I really liked you, @spair – sad to see the corrupting influence of money on people you like.

— Eric Lombrozo (@eric_lombrozo) May 17, 2017

Shapeshift CEO Eric Vorhees piped up and complained about the arrogance of Core developers; only the Core devs are immune to corruption, while everybody not agreeing with them are “at the behest of evil.” And so on.

Rude Words

Let us not get lost in gossip about what rude things this Bitcoin celeb said about the other. But there is something new in tone of the statements voiced the last days. It seems, the economy is losing patience with Core. For example, Wang Chun of F2Pool, known for funny and puzzling tweets, wrote that he considered a move from Bitcoin 0.14.0 to 1.0.1.1, was can be translated into from Bitcoin Core (v. 0.14) to Bitcoin Unlimited (v. 1.01.1.). He adds the hashtags #core #fail. Shortly later, however, he spins his idea further and tweets, “Why not go to geth 1.6.1 (Ethereum) instead of Bitcoin 1.0.1.1?”

If you could have v1.6.1 by upgrading to geth, why go for BU only v1.0.1.1? https://t.co/Q0mJdHiKKo

— Wang Chun (@f2pool_wangchun) May 17, 2017

Taking an angrier tone is the prediction market Fairlay. The website warns its users publicly: “Due to Core’s incompetence in solving the problems that need to be solved fees will be raised to 0.5 mBTC per withdrawal and 0.2 mBTC per deposit on May 20.” In a now deleted message, Fairlay called the Core devs “a bunch of poorly organized scientists” which are represented by “socially awkward and ignorant” people not capable of leading Bitcoin.

And Jon Matonis of the Bitcoin Foundation and nChain commented, that the discussion has gone from the question, ‘When will SegWit be activated?’ to the question, ‘What can Core do to save its influence?’

One of the most drastic examples is again Stephen Pair, who commented on UASF. UASF means “User Activated Soft Fork” and stands for a plan to activate SegWit not with, but against the miners with the nodes. For some weeks, parts of the Bitcoin community have cheered for a UASF, while Core developers have not voiced a clear stance toward an UASF, but, at least, do not pragmatically reject the idea.

BitPay already expressed his disagreement with UASF some weeks ago. Now Pair tweets: “UASF is not a grassroots effort, it is an astroturfing effort.”

@spair astro-turfing would imply a company behind? almost certain there is not, and really user led. risky approach IMO, but don’t mischaracterise.

— Adam Back (@adam3us) May 17, 2017

Astroturfing is a funny word. In the original sense, it means to lay out an artificial turf. In a wider sense, it makes fun of the term “grassroots movement” and describes the PR strategy to stage a naturally emerging support from “the people,” while for real it is just a marketing show. There are dozens and hundreds of examples how companies and governments used astroturfing to manipulate the public.

Astroturfing is a rude accusation. The whole UASF movement, which is currently spreading through the Bitcoin community – is not a grassroots movement, but propaganda? As Blockstream’s community manager Alex Bergamon recently published a blog post which directly or indirectly encouraged users for UASF, Blockstream’s CEO Adam Back felt immediately spoken to. He insisted that there is no astroturfing since no company is involved.

An endless stream of this kind of discussion on the same old points flows through the net.

Again and Again: 2MB + SegWit

Less controversial is the push forward from Barry Silbert. The founder of the Digital Currency Group, an investment hub which finances dozens of Bitcoin companies, announced that he immediately supports the activation of SegWit and a hard fork increasing the block size during next 12 months.

I agree to immediately support the activation of Segregated Witness and commit to effectuate a block size increase to 2MB within 12 months

— Barry Silbert (@barrysilbert) May 17, 2017

Later Silbert tweeted that more than 50 companies from more than 20 countries would support this compromise. Then he asked the miners and reported nearly 80 percent of the hash rate are with him.

We are now at 78.3% of the bitcoin hash rate in support of the scaling compromise https://t.co/fC6XHnGmCU

— Barry Silbert (@barrysilbert) May 18, 2017

So, 2MB + SegWit. We are back at the infamous Agreement of Hong Kong, with which the miners and some Core devs, including Adam Back and Luke Dashjr, agreed to couple the activation of SegWit with a hard fork to bigger blocks. This compromise has been discussed again and again, recently with Sergio Lerner’s proposal. By convincing more than 50 companies and roughly 80 percent of the hash rate, Silbert made a revitalization of this solution more likely. It has the potential to calm down the block size fight for some years and give the community enough time to unleash the possible potential of off-chain solutions like the Lightning Network and to agree on a long-term solution to the block size limit.

But… Wait!

However, it is not so easy. The usual suspects of the Core devs protest vehemently. Luke Dashjr – who signed the Hong Kong agreement and covertly co-founded Blockstream, tweeted that this could only mean that Silbert will support an UASF to enable SegWit to increase the block size to 2MB during the next 12 months.

In other words, let us do exactly what we want to do. SegWit is the compromise, and so on.

@murchandamus @barrysilbert The obvious interpretation would be that it simply means the parties agree to USE segwit in their wallets to reach segwit’s 2 MB block size.

— Luke Dashjr (@LukeDashjr) May 18, 2017

Remarkably Luke presents himself on Twitter with a UASF cap. With this, he leaves no doubt that he supports a UASF, if this is needed to activate SegWit against the miners and without any (further) compromise. For Luke mining has failed anyway, since the near-monopolist BitMain took a position against Core and for Bitcoin Unlimited.

Also, Eric Lombrozo opposes the compromise. He replies that Core did already explain why this idea does not work.

@barrysilbert @JaEsf Far from silence! Many have pointed out that this won’t work.

— Eric Lombrozo (@eric_lombrozo) May 18, 2017

Further, Lombrozo says that there is not much to discuss. Some people do not like some other people and want to get rid of them. SegWit serves as a hostage. Lombrozo announced that he tends to UASF the stronger, the more groups try to negotiate consensus rules. Similar are the reactions of Adam Back and Peter Todd – who both signed the Hong Kong agreement.

But also Pair of BitPay is not so happy with the new compromise. He told Silbert to support it, but explained later, that he assumed the new compromise is not the revival of the Hong Kong agreement, but Sergio Lerner’s proposal. Roughly said a promise of Core is not enough, but he requires that the Hard Fork is coded in when SegWit is activated.

The Bitcoin community seems remain far away from an agreement. But it might be possible, that now, when the limited capacity has become a real problem, a solution will be found. It is about time.

Btcmanager.com is author of this content, TheBitcoinNews.com is is not responsible for the content of external sites.

Our Social Networks: Facebook Instagram Pinterest Reddit Telegram Twitter Youtube