The crash of cryptocurrency prices continued over the weekend. Over the course of the week beginning July 17, there was a little bounce, but this doesn’t change the trend. More important is the question, why? Why does this happen? Is there any concrete reason?

Thinking about why prices move up or down is often nothing but speculation. There could be thousands of reasons, why a price is soaring or falling, and sometimes it happens without real reasons but just because of the swarm mechanics of the markets.

That they have been falling, should be out of doubt. Over the weekend you could watch the money leaking from the cryptocurrency markets. On July 14, bitcoin was worth more than $2,300, whereas by July 16 it was as low as $1830 on the Bitstamp exchange. The outcome? A loss of 15 percent.

This loss was quickly recouped, as by July 18, BTC-USD breached above $2,300 again and has managed to sustain above this psychological level at the time of writing. However, when looking at the six month price action below, we see a similar candlestick pattern as for the brief rise above $1000 in 2013. Also, the equilibrium price is suggested to be at $1521.50, as indicated by the conversion (blue) line of the Ichimoku indicator. So we could see a long-term drift toward $1,500 before more gains are made.

And no, things do not get better if we look at the overall crypto market. On Friday July 14, all cryptocurrencies had a cumulated value of a little more than $80 billion. Until Sunday this rate has dropped to less than $61 billion. Makes a minus of 24 percent.

The weekend’s outcome is even worse if we look at ether. This currency was at $200 on July 14, and sunk as low as $134 on July 16. Makes up to a loss of 30 percent. Ouch.

The weekend’s outcome is even worse if we look at ether. This currency was at $200 on July 14, and sunk as low as $134 on July 16. Makes up to a loss of 30 percent. Ouch.

Looking at the six month price action for ETH-USD, we see a long upper wick for the previous candlestick, indicating that buyers struggled to mantain highs above $300, and the close was just within the upper third of the range, suggesting a switch to bearish dominance.

So it is clear that prices tumbled downwards on the weekend. But there remains the question, why?

Because Bubbles are Going to Pop

Financial bubbles are a common drama of history. The screenplay has always remained the same; there is some new financial product – tulips, shares for the south sea trade, shares for the railway, derivatives, bitcoins; people buy it and hoard it. Then the price soars, everybody wants to be a part of this cool new thing, and the fear of missing out (FOMO) is spreading like a virus. You know it, at some time everybody wants to buy, just because he is so sure, that the price will continue to rise and that he will find an idiot who is willing to pay more.

Then a bid remains unanswered. There are no bigger idiots. Prices remain at a peak, but start to tumble. Then they drop. People realize that it will no longer climb higher, but is still ridiculously expensive. Panic spreads, everybody wants to sell, as long as it is a win. The bubble pops.

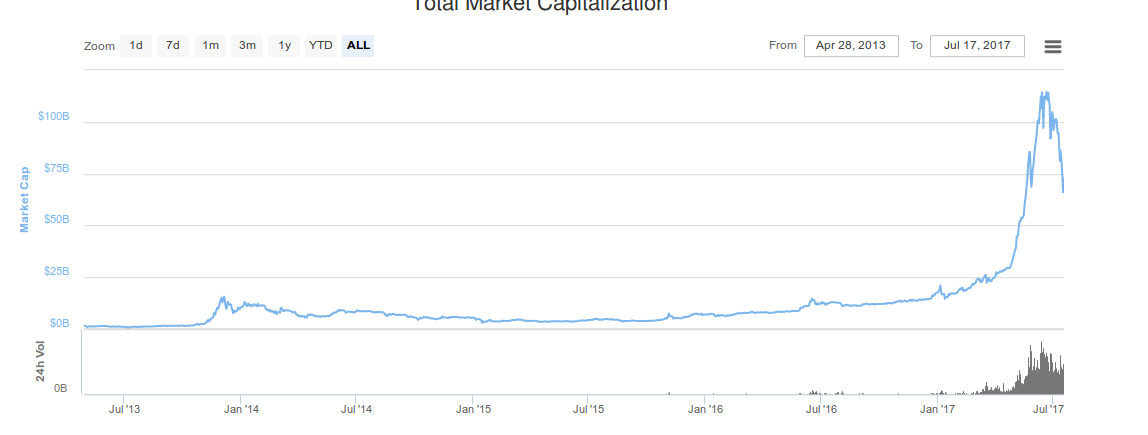

This happens in 100 percent of all financial bubbles. Everytime. And if you look at this chart, it is really hard not to see the bubble:

This chart shows the market cap of all cryptocurrencies. Let’s have a closer look at some random dates and values, and let’s calculate a naive assumptions about the percentages with which the price did soar daily:

These are, as said, very naive calculations. But they demonstrate very clearly that the price of all cryptocurrencies shot up dramatically. The question, everybody needs to ask, is: are there fundamental facts which justifies the rise? If yes, great. If no, we’ve spotted a bubble which is going to pop. The buying orgy of the markets cannot last forever.

When the Price goes higher, it becomes more Expensive to Maintain a Cryptocurrency’s Basic Functions

It is nice to see a cryptocurrency’s value rising. But most people overlook that a high price has its costs. With the dollar price the pressure on the system as a whole increases too.

The basic function of cryptocurrencies is to serve as a means of payment. To process transactions, the system needs the miners, which confirm the transactions. For this service, the miners are rewarded with a certain amount of the cryptocurrency’s token.

So there is a steady stream of newly minted coins brought to the markets. Their value in dollars is the price to be paid to maintain the basic function of a cryptocurrency. Every day. If there is not enough demand for a cryptocurrency’s token, the price will drop inevitably.

Let’s look at the cost of maintenance for some of the most popular cryptocurrencies. Most data are taken from the website BitInfoCharts; prices are nominated in dollars.

As you can see, the big cryptocurrencies cause substantial costs just to maintain their basic function. In the case of ETC, LTC and XMR the price requires investors to pay more than 0.03 percent of the market cap – each day. To permanently maintain their value cryptocurrencies need to generate an appropriate demand for their token. This demand usually consists of speculative demand in their future value, and “real” demand, because people want to use the coins.

However, only a few coins have a significant “real” demand. Bitcoin, to use the coins as a means of payment, Ethereum as a platform for ICO and smart contracts, eventually Ripple, as the blockchain of the banks, and Monero or Zcash to launder money. Laundering money is not as bad as it seems because if you have no way to increase privacy by laundering money, cryptocurrency will become the most transparent way to pay ever, the dream of Big Brother. So privacy-centric coins have an important function in the ecosystem. Unlike coins such as Litecoin, Ethereum Classic or Dash, which mostly serve as hedges against the breakdown of Bitcoin and Ethereum.

As long as there is no good reason for the market to pay the maintenance costs of a cryptocurrency every day, its price is determined to drop.

What about the August 1 fork?

Around a year ago, it was said that the block size fighting keeps the price down. And for one year this turned out to be wrong. Neither the potential forks of XT, Classic or Unlimited put sustainable pressure on the price, and neither did the unresolved state of the block size problem.

Is it different, this time? Maybe. SegWit2x seems to be determined to do something and maybe to cause a fork. Also, the mammoth backlog in May demonstrated that Bitcoin knocked on its limits of growth. This time for real. And still, SegWit2x seems to be controversial. If such a wide alliance of companies and miners is not able to bring about peace – who else could be?

However, there are good chances that SegWit2x will settle the block size debate, at least temporarily. So it could also be a reason for a rise in the price. And if it was just about the block size debate – wouldn’t it be rational for the market to increase its hedge with Altcoins? Wouldn’t a more likely outcome be that bitcoin’s share of the whole crypto market dropped further? But the investors do not flee from bitcoin. They flee in bitcoin, from Altcoins.

These contrasting views on SegWit2x indicate mostly one thing; that it has a very low influence on the price.

Is it because the Big Darknet Market Alphabay was busted?

Recently the biggest Darknet market, Alphabay, was busted and ceased to exist. However, it is not really a new thing that a Darknet market gets eliminated. Like the Hydra, there is always one successor. It’s a safe bet to say that right now one or more other markets compete to become the new leader, while merchants and customers moved nearly instantly.

It is highly unlikely that an event like the bust of Alphabay could have any real influence on the price. A serious vulnerability in Tor could cause a drop of the price. But not the shutdown of a single market.

Is there any Concrete Reason at all?

Nearly every other crash in bitcoin’s history had at least some possible concrete reasons. Mostly it has been a crash of a major exchange, or rumors that China or another important state will outlaw bitcoin. But this time? There seems to be nothing. No hack, no prohibition.

If there is a concrete explanation of the drop, it might be the excess of the ICO hype. There have been many tokens based on the Ethereum blockchain, which have been sold to an incredible high amount and which gave some crypto startups incredibly high valuations. It was madness, obviously.

However, again, you have not the single one event, that made the ICO bubble pop. There was a general feeling, that something was overheated. But there was no real pop. Right now a lot of companies and startups still plan an ICO, and the community will still be willing to put money in it. It’s not very likely that a silent pop of the ICO bubble will cart the whole crypto market along in a hole. Rather it is likely that the ICO bubble popped, because the wider crypto markets popped.

After all, it is remarkable difficult, to find concrete reasons, why this bubble did pop. It rather seems to happen because it must happen.

Btcmanager.com is author of this content, TheBitcoinNews.com is is not responsible for the content of external sites.

Our Social Networks: Facebook Instagram Pinterest Reddit Telegram Twitter Youtube