Update: Since this article was originally published on Thursday morning, Bitcoin has risen by about 20 percent to $3,700. It’s still down 25 percent from its September 1 high. The original article follows.

The last year has seen an astonishing boom in the two most popular cryptocurrencies: bitcoin and ether—the latter being the currency of the Ethereum network. The price of bitcoins soared from around $1,000 at the start of the year to nearly $5,000 on September 1. Ether rose from $8 to almost $400 over the same period.

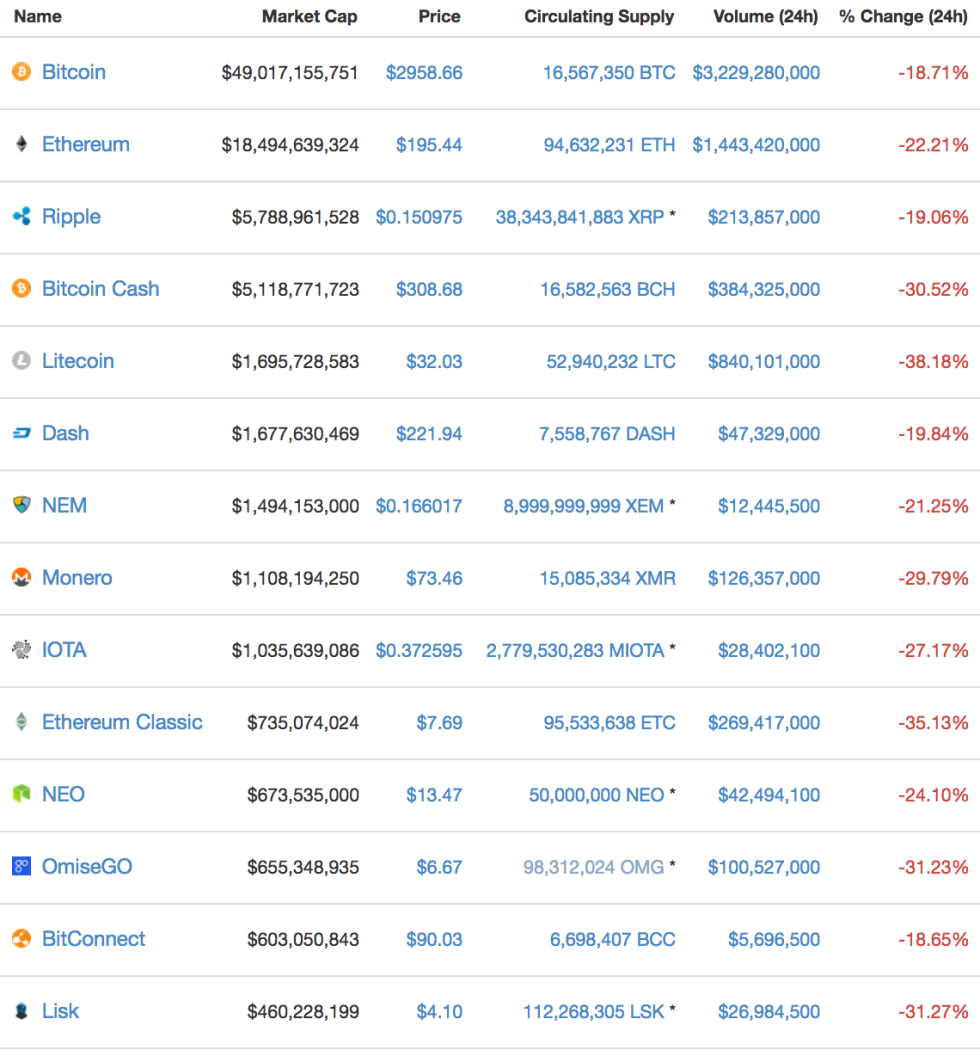

But now both currencies are plunging. Bitcoin has fallen to $3,000—an 18 percent drop in 24 hours and down by 40 percent from the start of the month. Ether is worth about $200, down more than 20 percent in 24 hours and almost 50 percent since September 1. And this is part of a broader cryptocurrency bloodbath, with dozens of lesser-known currencies posting double-digit losses in the last 24 hours.

In recent months, hundreds of projects have introduced new cryptocurrencies that compete with Bitcoin and Ethereum or use the concepts they pioneered to tackle other problems like file storage. Most initial coin offerings were conducted in Bitcoin or ether, and a number have been for coins built directly on the Ethereum platform. Accordingly, the ICO boom pumped up the price of Bitcoin and Ethereum.

Explaining market movements is never an exact science, but one likely factor driving the current crash was an announcement last week that the Chinese government was banning ICOs. This week, it became clear just how broad the Chinese crackdown was, as the government announced that Bitcoin exchanges in China would need to shut down. China had become a major market for Bitcoin, so a government crackdown there can be expected to have a big impact on its price.

The China news came at the same time many people were worried that the ICO boom had become an unsustainable bubble. ICOs kept breaking records this year, with an Ethereum compeitor called Tezos raising $232 million in July. In recent weeks, celebrities like Paris Hilton and Floyd Mayweather have endorsed cryptocurrency offerings.

Yet in many cases, the technologies underlying these coin offerings hadn’t even been built yet, and their regulatory status remained uncertain in the United States and in many other countries. Once people started to doubt whether the boom could be sustained, psychology reversed itself, and people started stampeding for the exits.

Our Social Networks: Facebook Instagram Pinterest Reddit Telegram Twitter Youtube