This Week in Crypto | April 13, 2018

Bulls on Parade (Don’t Get Trampled)

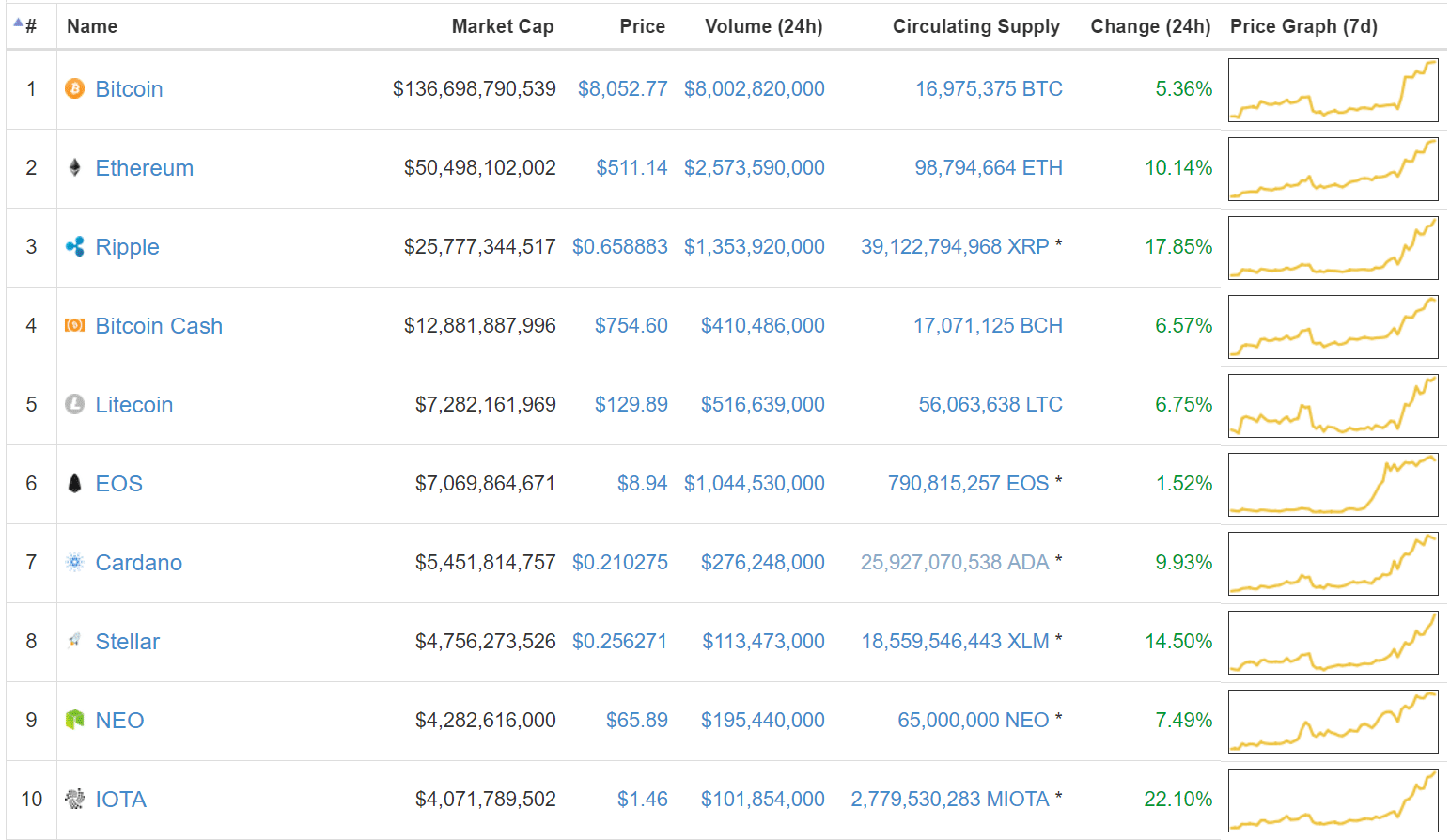

For the first time weeks, we’ve seen some clear, positive upwards momentum for the coin-wide market. Cryptocurrency’s comprehensive market cap is up 23% at $326bln, up from$248bln last Friday morning. But there’s one caveat: most of this growth has come in the last 36hrs.

Leading price movements as usual, Bitcoin rose roughly $1,000 dollars in a single hour, leaping from $6,800 to just over $7,700 between 7:00 and 8:00am on April 12th. Coinciding with this dramatic price movement, Bitcoin shorts were squeezed to their lowest volume in half a month, as roundabout 15,000 trades closed their position over the course of Thursday morning. As shorts were cut short and prices blew through the roof, Bitcoin’s one hour trading volume during its spike was $1.2bln, potentially the largest one hour volume in the currency’s history.

The upwards price movement is no doubt good–we’re all happy about seeing some green in the portfolio–but this short squeeze was so spontaneous and the price movement so like “recoveries” we’ve seen earlier in 2018’s bear market that we’re not drinking the bullish Kool-Aid yet. Still, shorts were at an all time high before price action shifted and some ~37% were liquidated, and the massive trading volume on Bitcoin’s one hour rise is encouraging.

Positive developments, but stay savvy as we may not be cleared for takeoff yet.

Bitcoin: As we went over above, Bitcoin underwent a drastic price increase yesterday morning. As of press time, it’s weekly price up 18% at $8,050.

Ethereum: After performing poorly for a handful of weeks, Ethereum is looking even better than Bitcoin, up by 27% over the week with a price just over $510.

Ripple: Ripple is on pace with Ethereum, sitting at $0.65 after rising 27% this week.

Domestic News

Nano Team Pegged with Class Action Lawsuit Over Bitgrail Loses: The Bitgrail saga continues, but this time, action is being taken against Nano’s core team. Colin LeMahieu, Mica Busch, Zack Shapiro, and Troy Retzer are all defendants in a lawsuit filed in New York State court by plaintiff Alex Brola, who claims to represent the Nano investment community at large. The class action charges the plaintiffs for misleading investors into using Bitgrail exchange to purchase and store Nano, requesting that the team hard fork Nano to recover lost funds. Hours before the lawsuit surfaced, Nano announced that it had established a legal fund for victims who lost NANO to Bitgrail, with a pledge to match contributions up to $1mln.

In a Week of Suits, JP Morgan Wears its Own with Legal Troubles Over Covert Crypto-Purchasing Fees: Financial titan JPMorgan Chase & Co. are staring down the barrel of their own lawsuit. Coming out of a federal court in Manhattan, a nationwide class of defendants accuse the institution of imposing surprise fees for cryptocurrency purchases and treating these as cash advances. Among other charges, the defendants say “Chase (JPM.N) charged both extra fees and substantially higher interest rates on the cash advances than on the credit cards.” In earlyFebruary, the bank began declining cryptocurrency purchases with credit cards, presumably due to the asset class’ volatility.

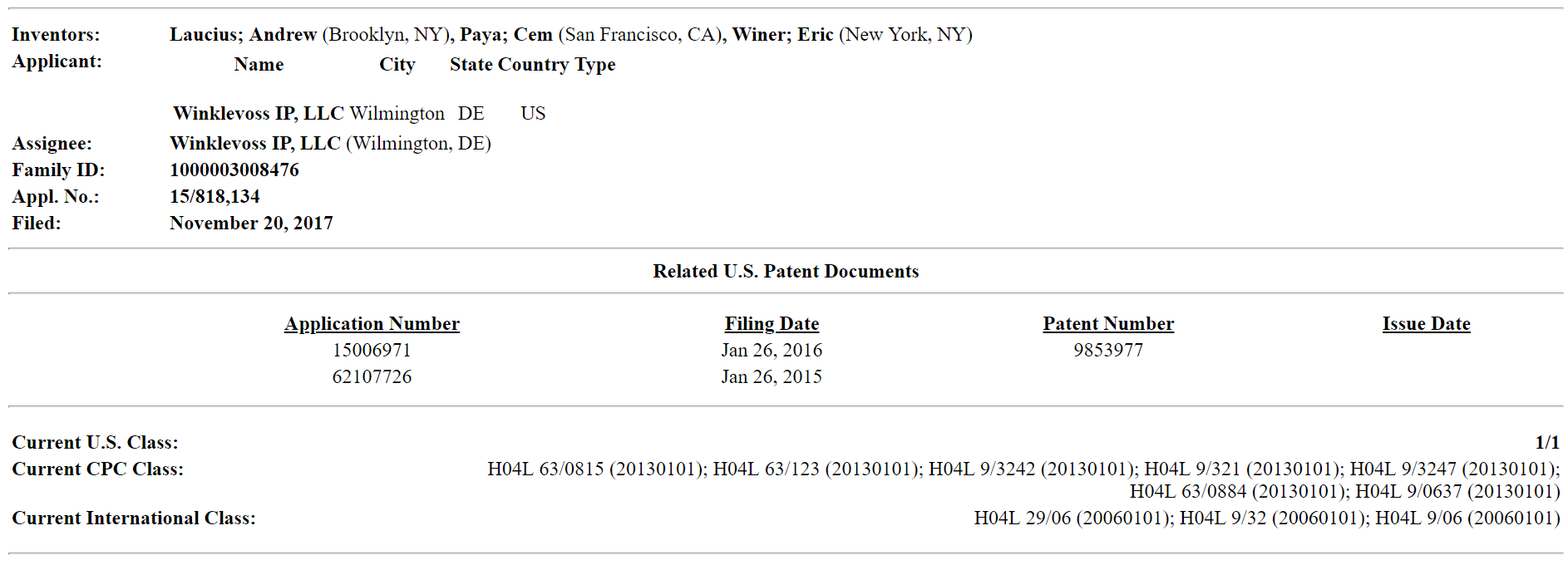

Winklevoss Twins Win Patent Filing for Cryptographic, Cloud Computing Payment System: They couldn’t get a foothold in the emerging social media sector, but the Winklevoss twins are becoming industry movers in the crypto-sphere. The Gemini exchange owners were just awarded a patent for a “system, method, and program product for processing secure transactions within a cloud computing system.” This adds to an ever-expanding suite of five patents held by Winklevoss IP, LLC, the twin’s legal entity. It’s speculated that the duo may look to implement the technology into their Gemini exchange.

Cryptocurrency Tax Anxieties (and FUD) Loom as US Tax Day Nears: Plenty of ink has been spilled over the IRS’s tax policy for cryptocurrency investing and trading. Some articles are read as helpful guides to advise readers on safe filing practices, while others read as pure FUD and scare tactics–kind like the CNBC article linked above. Now, we’re not telling you to skimp your responsibilities as a US citizen, but we will say that, unless you made mad gains (six figures or more) on your investments over the past year, the $250,000 in fines and imprisonment the article references are probably not for you.

The Billion Dollar Trifecta: Rockefellers join Soros, Rothschild Funds with Crypto Investments: The Rockefeller family is betting on cryptocurrency, and they’re betting for the long-haul. Venrock, the family’s venture capital fund, has partnered with the cryptocurrency investment firm CoinFund to vet blockchain-based businesses and startups. This makes the Rockefellers the latest out of the world’s richest families and funds to invest in the industry, following the likes of George Soros and the Rothschilds.

Bittrex Reopens User Registration, Greets Newcomers with New Look, and Closes Registration Again: As part of a general site rebranding, Bittrex opened its arms to new users this week. The move comes after Bittrex halted new account creation in December, an action taken by many top exchanges to expand infrastructure. Bittrex claims to have expanded to over 50 employees in the interim, giving its layout a complete UI/UX overhaul (met with mixed reviews within the community). After a deluge of newcomers drowned the exchange in fresh accounts, the exchange had to reclose registration to manage demand.

And…we’re back! Bittrex reopened registrations for new users last night. Simply complete our registration and customer verification process to start trading https://t.co/F7hqiiHOup pic.twitter.com/DVtXG8vYUZ

— Bittrex (@BittrexExchange) April 12, 2018

Executive Leaves Goldman Sachs to Work on Mike Novogratz’s Crypto Merchant Bank: A harrowing for legacy financial institutions? Let’s slow down there, as it’s only one executive, but even so, it’s a symbolic gesture. Richard Kim, who reportedly had been working on Goldman Sach’s cryptocurrency strategy desk, has left the firm to join Mike Novogratz as COO of Galaxy Digital. Novogratz, who also held a position at Goldman Sachs for 11 years, left wall street in 2015 to focus on cryptocurrency.

What’s New at CoinCentral?

How Blockchain Technology is Changing the Gaming Industry: Blockchain has the potential to revamp how developers are compensated, how in-game economies function, and how gamers can manage in-game assets.

How to Transfer Ethereum to a Ledger Nano S: A simple lesson, but oh-so important for properly managing your EH stash.

3 Key Business Benefits of Blockchain: The technology’s benefits have sweeping ramification for how legacy businesses store, transfer, and manage data and handle day-to-day operations.

What is Bancor (BNT)? A Beginner’s Guide: Learn all you need to know about Bancor with our beginner’s guide.

What Blockchain Means for Small Artist: The case has been made for crypto opening doors for creative types for to more equally monetizing their work, and artists are no exception.

The State of Bitcoin Mining: Legal Regulations Around the World: Brush up on international mining regulations with our write-up on the status of global mining legislation.

How Blockchain Can Change the High-End Art World: Small-time artists definitely stand to reap blockchain’s benefits, but that doesn’t mean we should leave out curators, gallery owners, museum operators, and famous artists.

How to Transfer Ethereum from a Ledger Nano S: Title says it all, article tells you all you need to know–nuff said.

5 Ways Blockchain Technology is Changing How Art is Made: It’s changing how we monetize, register, and sell art, but blockchain has a hand in revitalizing the entire artistic process, as well.

BitMEX (Bitcoin Mercantile Exchange Review): BitMEX has become increasingly popular during 2018’s bearish slump for its margin trading services. Learn more with our detailed review.

Class Action Filed Against Nano Team, Demands “Rescue Fork” for Lost Bitgrail Funds: Nano’s core team has been slapped with a lawsuit for allegedly promoting Bitgrail to its investors, and the plaintiff(s) want a hard fork to recover their lost assets.

Building a Smart Contract: It’s Easier Than You Think: Much like minting your own shitcoin, creating your own smart contract isn’t as complicated as you might think.

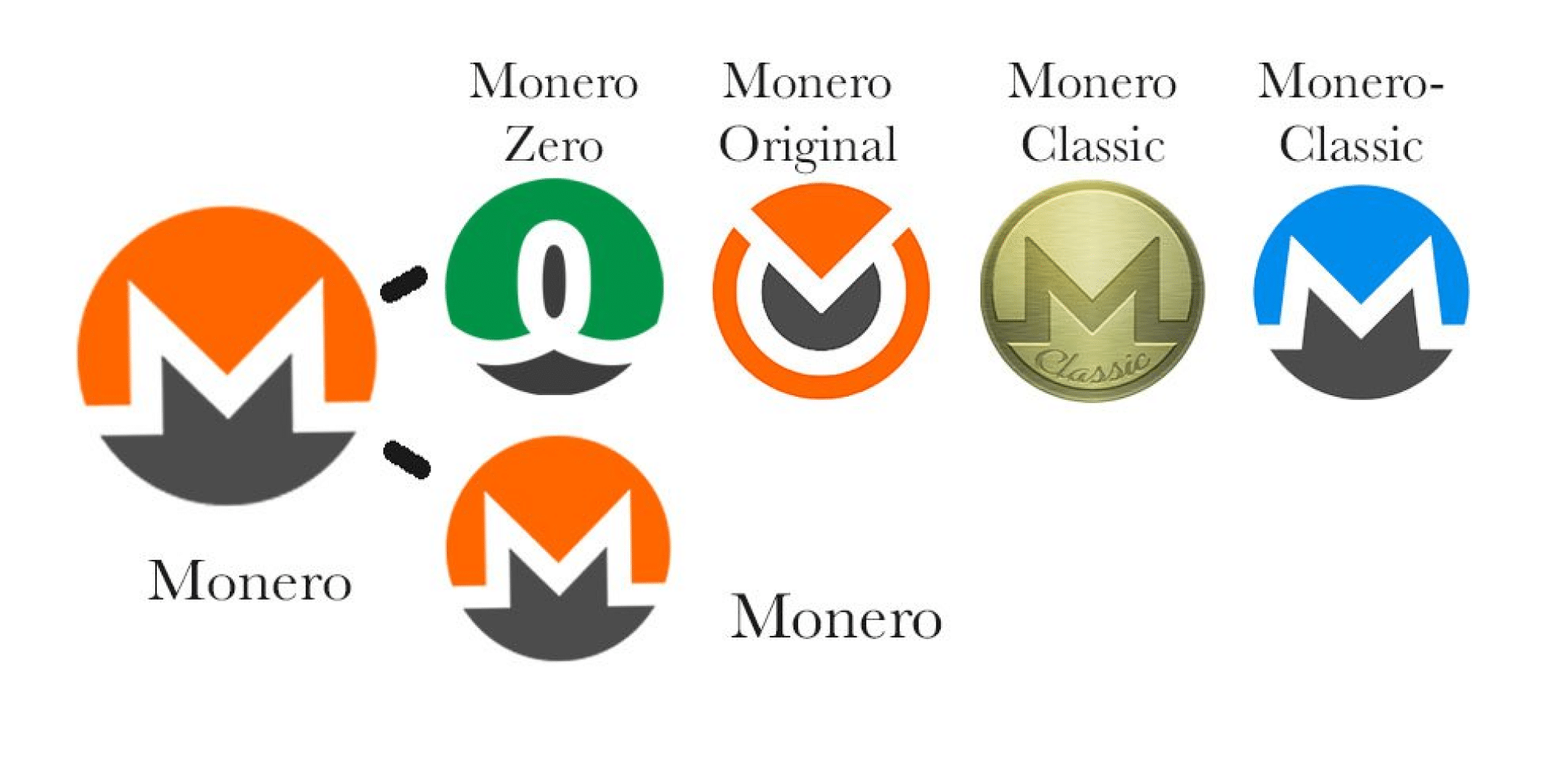

Monero: A Tale of Five Forks: If you though Bitcoin hard forked too much, how about this one–Monero producing five forked coins in one week.

What is CryptoKitties? A Beginner’s Guide on the Blockchain’s Collectible Cats: Love ’em or hate ’em, CryptoKitties have become a staple in Ethereum’s ecosystem, so what’s all the fuss about, anyway?

An Insider’s Guide to the Best Decentralized Art Galleries: You mean there are actually decentralized art galleries? Yeah, why do you think we’ve been talking about blockchain’s growing presence in the art world so much recently?

Codex Partners with ConsenSys and Rare Art Labs for Live Auction at NYC Ethereal Summit: This Tuesday, Codex, a blockchain title registry, announced their partnership with ConsenSys, a blockchain software development company and incubator founded by Ethereum Co-Founder Joe Lubin, to host a live charity auction during the Ethereal Summit.

Interview: Halsey Minor on Transforming the Video World with VideoCoin: Halsey Minor is a serial entrepreneur with a resume that will make any startup nerd’s head spin, and we had the pleasure of talking with him about his latest venture, VideoCoin.

Bittrex Exchange Re-Opens User Registration, Closes It Again After Wave of Sign-Ups: After months of being walled-off to new comers, Bittrex opened its doors to new accounts, only to close registration again after overwhelming demand.

Physical Assets on the Blockchain: Why Bother?: If crypto is all about digitizing, why use blockchain and tokens for physical assets? Well, as our guide will show you, the question kind of answers itself.

What is Pepe Cash? A Beginner’s Guide to Memes on the Blockchain: Some would go to great lengths to own their very own rare Pepe–so much so, that there’s a niche economy for this kind of unadulterated memery (if this seems moronic to you, go ahead and keep reading because this guide likely won’t alter your opinion).

Interview: Halsey Minor on Innovating in the Blockchain World: Check out part two of our interview with VideoCoin founder Halsey Minor.

What is the Byzantine Generals Problem? Make sense of this computer science quandary with our guide.

Time Draper Sees $250k Bitcoin on the Horizon: Prolific tech investor and Bitcoin bull Tim Draper has some optimistic expectations for Bitcoin’s price in three years.

What is Decentraland (MANA)? A Beginner’s Guide: Decentraland is an Ethereum-powered virtual reality platform. In this virtual world, you purchase plots of land that you can later traverse, build upon, and monetize. There’s no limit to what you can do. It’s the first digital platform that’s completely owned by its users.

Bitcoin Mining: Risks and Rewards for Entrepreneurs: Mining isn’t for everyone, but if you’ve decided to start it for yourself, there are some pros and cons you should consider before diving straight in.

Cryptocurrency News from Around the World

For the Sake of ASIC Mining, Monero Forks–Five Times: After Bitmain announced that it would be releasing an ASIC miner for the ASIC-resistant Monero, the privacy coin decided to undergo a fork to change its scripting algorithm and keep to its roots. Some developers, though, welcome ASIC mining to Monero’s consensus, and they all decided to hard fork Monero to accommodate the developments, giving us Monero 0, Monero Original, Monero Classic, MoneroC, and Monero-Classic (yeah, there’s two of these, and they both have the same ticker (XMC), but hey, at least the dash distinguishes them).

22 European Nations form European Blockchain Partnership: This week, 22 European nations signed a collective agreement to form the European Blockchain Partnership, which includes Austria, Belgium, Bulgaria, the Czech Republic, Estonia, Finland, France, Germany, Ireland, Latvia, Lithuania, Luxembourg, Malta, the Netherlands, Norway, Poland, Portugal, Slovakia, Slovenia, Spain, Sweden and the U.K. The coalition is meant to be a “vehicle for cooperation amongst Member States to exchange experience and expertise in technical and regulatory fields and prepare for the launch of EU-wide blockchain applications across the Digital Single Market for the benefit of the public and private sectors.”

Cryptocurrency Malware is Becoming a Rampant Global Issue, Report Reveals: According to the UK’s National Cyber Security Center, cryptocurrency mining malware has become a ubiquitous, digital parasite for many a worldwide computer user. The trend began in 2017 as hackers developed remote mining scripts for Monero, and the report indicates that as many as 4,000 websites could be infected with the malware, including as much as 55% of global businesses.

Don’t Forget to Pay Utilities: Russian Mining Operation Shut Down for Overdue Power Bills: One of the largest mining farms in Russia (if not in Europe) has been shut down by Russia’s Ministry of Internal Affairs. The MIA arrested two men in charge of the mining operations in the city of Orenburg for not footing a multi-million kilowatt-hour electricity bill. Apparently, the operation had been illegally sapping electricity from a local power supplier’s substations.

Malta Continues to Attract Crypto Companies as OKEx Moves to the Island Nation: South Korean Exchange OKEx, which consistently flirts with the #1 and #2 24 hr trading volumes on CoinMarketCap, has joined Binance in Malta. The exchange made the move public in a press release this Thursday. Malta, which has recently passed crypto and ICO friendly legislation, is quickly earning a reputation as “Blockchain Island,” as its attempt to attract blockchain-related companies to its shores the accommodating legislation is achieving the desired effect.

OKEx Is Expanding To Malta Given Country’s Comprehensive Blockchain Initiatives.https://t.co/CrE4wEPOuq pic.twitter.com/nMfKFl4N1g

— OKEx (@OKEx_) April 12, 2018

What Ban? Chinese Crypto Investment Fund Rears Up with $1.6bln in Capital: Still believe the age -old media stories that say China is, yet again, “banning” crypto? Tell that to the Xiong’An Global Blockchain Innovation Fund, a privately and publicly funded crypto/blockchain development fund that launched this past Monday. The jointly-funded investment arm has been made possible by the Yuhang District Government, the Future Science and Technology City Administrative Committee, and the Hangzhou Yanqi Investment Management Co., with government funds accounting for roughly 30% of the organization’s capital.

Santander Unveils Cross Border Payment App Using Ripple’s Protocol: The Santander Group, a global banking institution, has plans to roll out a new payment app. One Pay FX, as it’s called, makes use of Ripple’s network for a focus on cross-border remittances, and Santander announced that it plans to offer the app to customers in Spain, the UK, Poland, and Brazil, countries that make up nearly half of the bank’s customer base. Down the road, it hopes to expand the app’s services to other countries, as well.

The post This Week in Crypto | April 13, 2018 appeared first on CoinCentral.

Coincentral.com is author of this content, TheBitcoinNews.com is is not responsible for the content of external sites.

Our Social Networks: Facebook Instagram Pinterest Reddit Telegram Twitter Youtube