Isaac Phillips is one of the Founders of Siglo, a Gibraltar-based blockchain protocol for decentralized apps to sponsor connectivity in emerging markets.

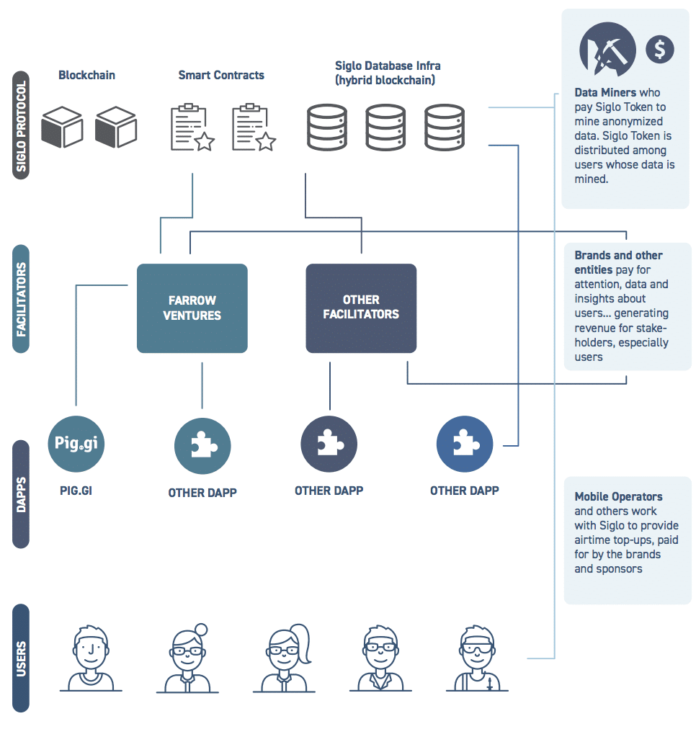

Siglo aims to build ecosystems of users and decentralized apps in emerging markets to facilitate digital and financial inclusion.

Users in these ecosystems can monetize their attention and engagement with retailers by choosing to share their anonymized interactions and exchange them for increased mobile connectivity or other rewards.

With over 70% of the worlds’ mobile phones being prepaid, individuals in emerging markets often find themselves at a lack of consistent connectivity due to the high month-to-month costs.

What does Siglo want to accomplish?

We’re focused on essentializing the revenue of the internet. So you have companies, which are basically Google and Facebook and a few of their peers gather that, a hundred billion dollars of revenue a year, and their main product is our attention and our engagement as users.

And we feel like that could be a — if you end up dividing that out, Facebook’s revenue per user is more than two dollars a person worldwide. Which is insane and here in the U.S., it’s actually 13 or 14 dollars a month that Facebook makes from us.

So what if that could be passed back to the users and put to a good cause? Facebook says that their main goal is to connect people, but if they already give two dollars of connectivity to every person that used Facebook, then it would literally change the world and bring millions of people, billions of people, online.

So we’re doing that and we’ve been doing it for about three years, officially two years. We did some pilots and the way we give those profits back is through airtime. So if Facebook wanted to give everyone in the United States 12 dollars, every one of their users, how would they do that?

From the Siglo whitepaper.

There’s not really a way or a platform to do that. Obviously Bitcoin transaction costs would be too high, Venmo doesn’t have public APIs. They could use PayPal but what’s the penetration of PayPal, even in the U.S. In Latin America and in Asia and in Africa, everyone uses a prepaid cell phone, and we can send deposits of 50 cents to all of our users. In Mexico, we can hit 82% of the population, with a tiny, 50 cent transfer, and it’s immediate. So we take the revenue of marketing and we give it back to our users in the form of connectivity.

And we’ve given out about 600,000 dollars of connectivity so far in our initial trials, and we’re working with brands like Coca-Cola has been a big help, they actually put us in one of their innovation programs, sent us to all of their bottles.

Same with the ABM guys, where they have a real focus on the innovating and emerging markets. And for them, connectivity is — one, it’s a big barrier for communicating with their constituents. So whether it’s communicating with their salespeople or whether it’s communicating with their consumers.

They can’t reach their total adjustable market because many of them don’t have connectivity. And from the user side, we found that it’s a really powerful incentive. So our users, in exchange for our connectivity coin, they will take a photo of — work with — one of our recent campaigns was, you take a photo of a receipt with a particular item from any store in Mexico, you upload that and then when you do some data analysis on that, it’s completely anonymized.

But the brands find out, oh wow, when people buy vodka, they tend to buy it with peanuts. Or they tend to buy it with — depending on their different interests and different demographics, you find really different trends.

So our users are willing to go and take pictures of the receipts, or answer questions or check prices in this particular store. And all of that, they’re winning points for, that they can exchange for currency.

So monetizing their daily activity for data for a lot of these bigger brands?

Right and it’s all anonymized data. For us, our users’ data is sacred, especially their private data. We think that that should be protected, but the more contextual information, that can be monetized and that profit can be passed back to them.

How does a project in this space make money for themselves, that goes towards marketing, towards onboarding users, towards partnerships? What keeps the lights on?

Well, we’ve raised some capital and obviously, that’s required to build a mass consumer platform now. But we usually keep a small margin. So if Coca Cola pays us 100,000 dollars, we’re going to keep a small margin on that.

Well, right now, we’ve — instead of doing things where we start with an eloquent white paper and concept and raise capital, we did things reverse. So we launched a product, started working with customers and consumers and we did it all off chain initially. So right now, it lives in an app. You can’t take our coins out. Literally, you have to have an account and access our server to be able to do that.

So with the transaction database, we can process thousands and thousands of transactions a day. But as we are now tokenizing that ecosystem so that we can expand it, that will allow it to have it frictionless between apps. And that’s what we need to get to, long-term.

Cool, what are the next steps for you guys?

Well, right now, we’re in the process of tokenizing this. So our users who have won off chain choices, they’re mostly in banks, they’re young people. They’re tech-savvy but mostly not — they don’t have the sophistication of using desktop computers. They never had desktops; they’re mobile first and mobile only.

So now that we’re moving towards a tokenized platform, we’re super focused on crypto education. So how do you teach someone who doesn’t have a bank account how to use crypto? How do you teach someone who just got their first Android phone last year about public and private peace? It’s not that easy. So we’re in the process of migrating to that, and our users are really excited.

They’re excited about the platform and the currency that they can exchange for other crypto and for fiat and that’s our current focus, is getting this first app to run on the protocol, and then bringing on other developers. Pretty much any developer in emerging markets, their market is limited by the internet penetration. So if they can give connectivity with their app, then they can double their market.

Are you saying that the app is actually giving people connectivity to get access to the internet? Through monetizing their devices?

Exactly.

Here’s the data, here’s the physical thing, now you can access the internet for a month at a time, whenever you do this.

Exactly.

Very cool. Yeah, that would be an awesome way increase internet penetration rates.

The problem is, we have to do that in a way that protects our users. In emerging markets, there is — we talk about trust here in the U.S., but overall, I trust Chase Bank. I assume they’re probably not charging me all of these different fees. I generally, compared with the government in Latin America, trust the U.S. government.

Crypto here is a fun experiment and it’s been very profitable, but most of the basic services offered by blockchain, we can do without it here. In Latin America and in emerging markets, people need it because literally, governments make arbitrary decisions. Brands — in Mexico, for example, you can buy the entire DMV database for about 500 bucks on a USB stick in an illegal market.

Whenever you create an account in Apple, you have to get your company certified by D&B [Dun & Bradstreet]. But just the point is that there’s not a trust between the consumer and the institutions that we’d be sponsoring their connectivity.

So how do you protect someone’s identity, their personal information, and still get the brands to sponsor that? And I think that’s where we really innovated and we’ve come up with a way that we can protect our users’ identity, not share private data, but at the same time, give brands access to the information that they need.

And once you established this network of people that were recently just connected to the internet, you can do a lot of other things. Now, you’ve got access to the internet, you’re taking in a lot more money doing that, so you guys are like the partnerships in a lot of organizations part of their business model is integrating on banks, people that are off the internet, into their ecosystems.

Well, here’s like a really simple example.

Say you’re a bank in an emerging market and you have a lot of account holders that don’t use the apps, because a) they don’t trust them and 2) it’s expensive. So the first thing is they end up going into the bank and — I hate banks in general and I hate going to a bank, but in an emerging market, it’s much worse than here. So there’s like a long line, you wait 30 minutes, and then there’s security sometimes.

A lot of banks in emerging markets, you have to go through a metal detector and there’s like restricted access, and then, you wait in line and you have to deal with a teller, and that costs the bank per transaction, let’s say, 1.50. Every time someone comes into the bank branch, to the labor of the teller, the security, the concrete, the rent, it’s about — now, if they do a transaction on their cell phone, it’s pretty much free for the bank.

So how do they get the people who are used to going into the bank, to start using their mobile app? Well first, you have to give them connectivity. So what if they could put 75 cents of the internet to a transaction.

So instead of going to the bank to pay your electricity bill, do it from the app and we’ll give you a connectivity token. So all of a sudden, that saves the bank money, the consumer is more connected, and it aligns the incentives. That is one particular use case, but it could be the same for an airline or for a workforce app; all of these need to give connectivity in order to grow their market.

Absolutely and blockchain allows for communicating data along with monetary values in single transactions. What do you think like the biggest hurdles are for addressing the user interface component of it?

Well, I mean, I think that that is one of the biggest challenges because everyone is talking about blockchain this week but there’s no apps really. I mean, the main use case in blockchain right now is either, the Bitcoin is the app perhaps, and then you have Ethereum which works for raising capital. But as far as actual apps for the end user, it doesn’t exist yet. So whoever can crack that problem will have a — will be very successful.

We’re focused on mobile, we’re also releasing a wallet for desktops, but mobile will be our focus. Android will be our focus. And creating a really simple interface, and we use cartoons, literally, to educate our users. We are about, what does it mean, do you want to keep your key or do you want us to keep your key because we have to give them that option, I feel like. But it will be a challenge.

We’re about to release our first wallet in probably 6-8 weeks. So we’re going through all of that and figuring out how does communicate in a simple way, with someone who isn’t that technical.

Yeah, definitely. So what are some ways in which someone who is reading this and is inspired and wants to help out, how can they get involved?

Well, they should start by joining our Telegram channel and we’re looking actively for developers who are interested in emerging markets. And who are interested in financial and digital inclusion, so I think that’s one of the biggest things.

Growing the developer community, because right now, most developers are focused on problems that aren’t having an impact on emerging markets. And we’re convinced that that’s where the biggest impact of blockchain is.

What are some ways you think you could counter the argument that emerging markets aren’t that monetizable for blockchain projects?

I think that we see a lot of international brands that are really excited about it. There’s a lot of brand spend in these markets, and it takes a while to build relationships with them. But once you have a relationship, it’s generally pretty long lasting. So working with — the two companies that I can mention because they publicly disclosed that they work with us are Coca Cola and ABM.

Those are two gigantic, the largest soft drink company in the world and the largest beer company in the world, and they’re super excited about blockchain. And they see it as a way to connect not just consumers, but even stores.

So right now in emerging markets, most consumer goods are still sold in mom and pop stores that are mostly unconnected. All of these brands want to connect with those mom and pop stores. They want to inventory information, they want to be able to communicate promos.

They want to establish direct communication, but they can’t until they’re online. So they literally came to us and they said, well, how can we do this? Is there a way we can use blockchain to get multiple companies to sponsor the connectivity of literally hundreds of thousands of mom and pop stores in Mexico alone.

So if you multiply that out throughout Latin America, there’s literally a million mom and pop shops that brands want to connect with; Blockchain is the way to do that.

To get more people onto the internet and companies like Facebook especially are making it a priority. The more users for them is more users for the business model, so they’ve got that plane. I don’t know if they’ve still got it going on.

Facebook, their market cap overall increases about — historically about 100 bucks for every user, I think that’s the number… let me check that, but I think it’s 100 bucks. So for them, yeah, obviously they’re very interested in connecting more people.

They have a group called internet.org which is a nonprofit, that gives — its focus is to connect people and they work with mobile operators in some markets and they give away free internet, but it’s limited to Facebook, WhatsApp and Wikipedia.

How did you guys start in Mexico?

My parents were missionaries so I lived there as a kid. So as we started this project, I was based in New York with my brother and we said, we want to have an impact on emerging markets with connectivity. And New York is not the place to do that because everyone is connected. We have a team of 15 people for the salary of two developers in New York, so it’s a good place to try it out.

Mexico has never been an end goal, it’s been more like, this is a place that we can try it, see if it works. Once we had some traction there, we launched Columbia, now, we’re tokenizing it and we want to expand throughout Latin America and other emerging markets.

Well, it’s interesting, I think that the two countries were there’s probably the most blockchain adoption in Latin America, are Argentina and Venezuela. And those are two countries where there’s a real, real need for blockchain, because you’ve got hyperinflation, you’ve got governments you can’t trust.

So what happens, people need it. There’s no way to get capital in and out of Venezuela right now that’s nearly as efficient as Ethereum and Bitcoin.

I think that’s where you see needs driving adoption with Blockchain, as opposed to, oh wow, I can speculate on this and can potentially make 100X in the next three months.

Thank you!

To learn more about Siglo, check out their website and whitepaper.

The post Siglo’s Isaac Phillips on Blockchain’s Role in Emerging Markets appeared first on CoinCentral.

Coincentral.com is author of this content, TheBitcoinNews.com is is not responsible for the content of external sites.

Our Social Networks: Facebook Instagram Pinterest Reddit Telegram Twitter Youtube