The United States SEC has rejected another attempt by Cameron and Tyler Winklevoss, founders of the Gemini cryptocurrency exchange and noted Bitcoin billionaires, to list shares of what would have been the world’s first Bitcoin exchange traded fund (ETF).

If passed, the Winklevoss’ proposal would have had commodity-based shares from the Winklevoss Bitcoin Trust traded on the BATS BZX Exchange. The SEC voted down the proposal three to one.

SEC Says Its Top Priority is Protecting Investors

The SEC originally rejected an application for the “Winklevoss Bitcoin Trust” last year. However, a new proposal with a few changes in rules was submitted in June.

The SEC has denied the Winklevoss CBOE bitcoin ETF application. Concerns on surveillance remain https://t.co/0p3uyrQ0XO pic.twitter.com/CRwDOZYKZo

— Anna Irrera (@annairrera) July 26, 2018

In a release published Thursday explaining the reasons for the second disapproval, the SEC stressed its position that the decision has nothing to do with whether or not bitcoin and blockchain technology have inherent value as investments. Rather, the Commission explained that it was mainly concerned with protecting investors from market manipulation.

The SEC Rejected Notions that Bitcoin Isn’t Susceptible to Market Manipulation

In January, the SEC published an open letter explaining that there are “significant investor protection issues that need to be examined” before cryptocurrency ETFs and similar products can be offered to the public.

Therefore, it’s not terribly surprising that the Commission rejected BZX’s notion that the “geographically diverse and continuous nature of bitcoin trading makes it difficult and prohibitively costly to manipulate the price of bitcoin.”

Suggested articles

Cryptos: What’s All the Hype About Block Size, Transaction Speed, & Scalability Bottlenecks?Go to article >>

#bitcoin breached 8k. Is ETFs approval by the SEC fueling its demand as it did back in 2016?

The SEC is asking for the public opinion regarding ETF decision and has received 10X the number of responses VS this past April.

What does August hold for Bitcoin? pic.twitter.com/4i587O3neE

— eToro (@eToro) July 24, 2018

The Commission also noted that it did not support the proposal’s claim that “[the bitcoin market is] generally is less susceptible to manipulation than the equity, fixed income, and commodity futures markets.”

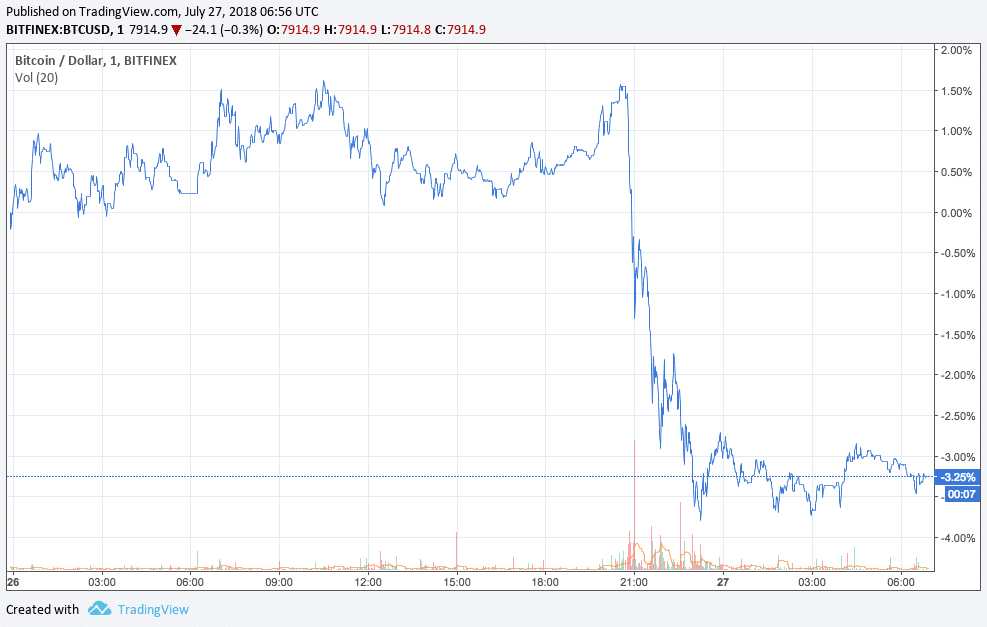

The price of Bitcoin on July 27th, 2018.

The price of Bitcoin on July 27th, 2018.

Earlier this week, analyst Brian Kelly said that he believed the hype around the possible approval of the ETF was driving the price of Bitcoin up. He explained that the denial of the ETF by the SEC could hurt the price of Bitcoin in the short-term. Indeed, BTC has dropped by nearly four percent in the last 24 hours (at press time.)

.@BKBrianKelly says we’re at the beginning of the next #bitcoin bull market but there’s a major hurdle ahead pic.twitter.com/XSIwnlrbmb

— CNBC’s Fast Money (@CNBCFastMoney) July 24, 2018

Financemagnates.com is author of this content, TheBitcoinNews.com is is not responsible for the content of external sites.

Our Social Networks: Facebook Instagram Pinterest Reddit Telegram Twitter Youtube