There’s no denying that blockchain and cryptocurrencies in Canada are on the rise as the industry continues to get footing worldwide. A recently updated survey from 2017, conducted by the Bank of Canada found the following:

- Cryptocurrency awareness among Canadians between 2016 and 2017 had increased from 64% to 85%.

- Ownership of Bitcoin among Canadians was up from 2.9% in 2016 to 5% in 2017.

- West Coast province of British Columbia was most aware of Bitcoin in both 2016 and 2017 as well as having the highest rates of ownership.

Bitcoin and cryptocurrencies in Canada are growing but there remains a lot of question marks circulating the space. Questions that may be preventing more people from taking the step between awareness and adoption.

In general, there are a couple key areas that need a little clarification for Canadians who want to buy and use Bitcoin. Namely, would be how to get your Canadian Dollars converted into Bitcoin and join the party. But what if you’re already in the party and already part of the 5% of Canadians who own Bitcoin? How much does the CRA care and what are the taxable events with your Bitcoin?

Where to Buy and Trade Bitcoin and Cryptocurrencies in Canada

Buying and selling cryptocurrencies like Bitcoin is largely similar from country to country. The majority of the difference is in how to convert your local fiat into crypto. For us Canadians, there are a few straightforward ways to exchange your dollars for Bitcoin.

Coinbase, for example, offers a super easy way to purchase Bitcoin but limits the altcoins they offer. So if your intentions are to trade a variety of crypto assets then you should be looking towards some more full-service exchanges like Vancouver’s QuadrigaCX. In either case, buying Bitcoin in Canada is not a complex operation, and remember wherever you do initially buy your Bitcoin it can be quickly and cheaply moved between wallets for future trading or serious hodling.

Online Buying and Selling

Coinsquare, QuadrigaCX and Kraken are a good sample of online services that accept Canadian Dollars directly. Although, if you have access to a credit card then the options widen pretty significantly.

Convert your Canadian dollars on these friendly crypto exchanges

Coinsquare was “Created for Canada” in 2014 and has a number of trading pairs to get you started including Bitcoin, Ethereum and Doge. Coinsquare proudly claims to have never lost a coin during its operation and has recently expanded into mining out of Quebec.

QuadrigaCX is a thoroughly Canadian exchange headquartered out of Vancouver. The exchange has a number of options for onboarding your Canadian bucks and offers trading pairs like CAD/BTC, CAD/LTC and CAD/ETH to name a few.

Kraken Bitcoin Exchange founded in the early days of Bitcoin after Jesse Powell saw a huge need for a safe and reliable exchange that would fill the vacuum of the then imploding MtGox. Kraken has been providing services to Canadians for a number of years now and has a number of CAD trading pairs.

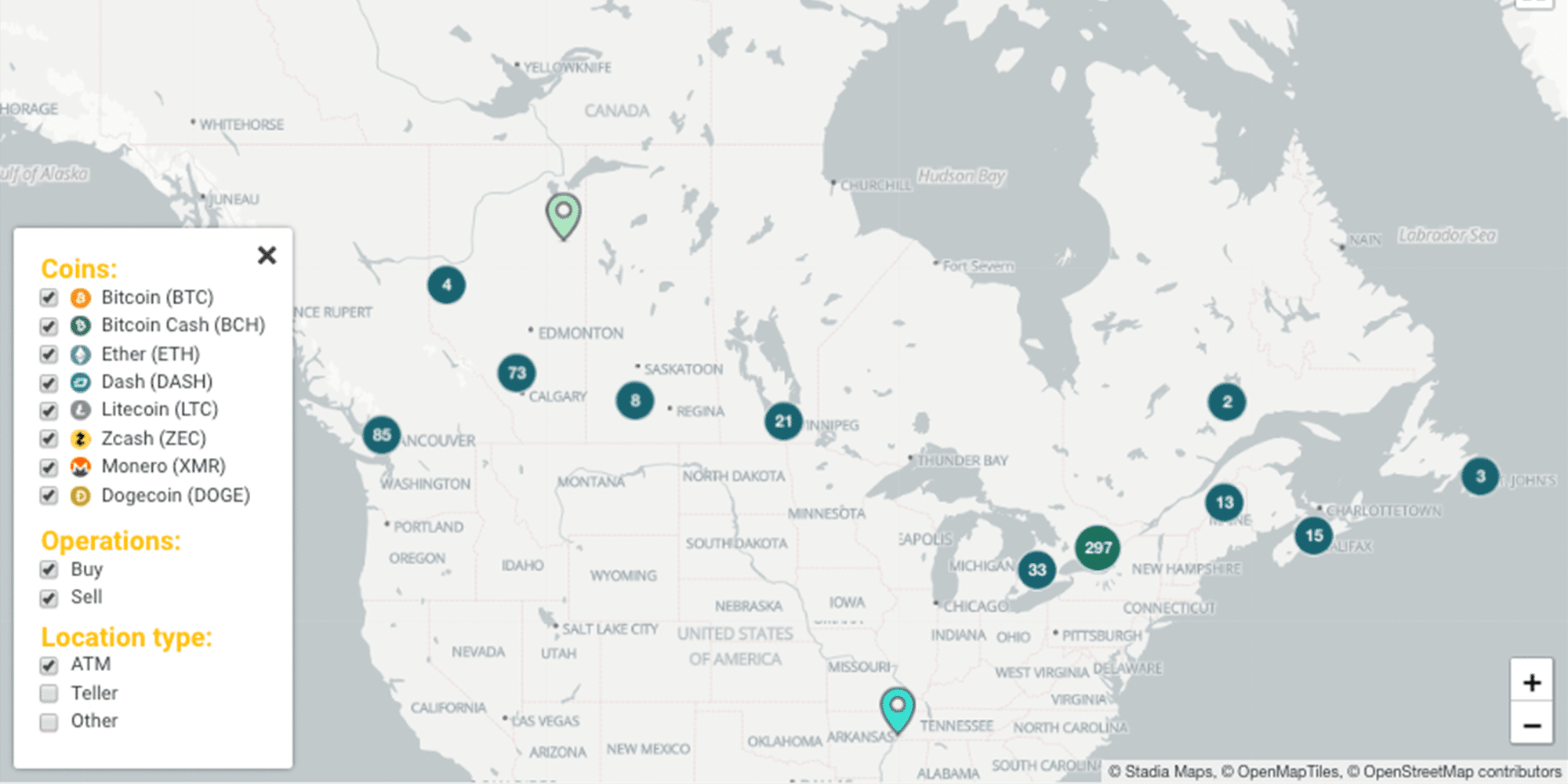

Offline Buying and Selling

In addition to buying Bitcoin online, you can opt to use one of the many Crypto ATM’s that are proliferating around Canada. At the time of writing, there were a total of 634 ATM options Canada-wide with the highest concentrations being in Vancouver (80), Montreal (89) and Toronto (205).

Buy your Bitcoin and Cryptocurrencies in Canada offline from crypto ATM’s

Use a Bitcoin ATM map to find the closest options to you, keeping in mind that ATM fees are often higher than that of an exchange and will require your own Bitcoin wallet to receive them. As well as buying your crypto through a specialized ATM, you can choose to get your Bitcoin person-to-person and use a service like LocalBitcoins.

Paying Taxes in Canada When Using Your Crypto

Taxes – a subject us Canadians are all too familiar with – but what about taxing these new digital assets. How much do you need to pay and when? Thankfully, the tax rules regarding cryptocurrencies in Canada are relatively straightforward right now for both using and storing your digital assets like Bitcoin.

Taxes When Spending Your Cryptocurrencies in Canada

So far, the Canada Revenue Agency has outlined that, using cryptocurrencies to buy and sell goods and services falls under the same rules as those for a standard barter transaction. This means that the relative market value of whichever good or service is purchased with your Bitcoin is to be declared in Canadian Dollars by the seller. For example, if you buy a bottle of maple syrup with Bitcoin, then the market price of that golden nectar is what would have to be recorded in the seller’s income for tax season in Canadian Dollars.

Taxes for the Traders and Speculators of Cryptocurrencies in Canada

In the most simple form, trading crypto to fiat is considered capital gains, or losses. This means that if you were to have bought a bag of Bitcoins at an investment of $15,000 CAD, then sold them all 4 months later for $23,000 CAD, you declare your capital gains of $8,000 CAD.

Obviously, this gets complicated quickly since actions like cross chain trades are possible. So the best advice until more specific tax regulations come about is to consult a professional if you are dealing with more than just fiat to crypto trades.

Mining Crypto in the Great White North

Recently, cryptocurrency mining has increased in pace in Canada largely due to Quebec’s lucrative energy prices. However, there are indications that this opportunity may be tightening. Quebec has begun to implement price increases and restrictions to slow the supply of energy.

Overall though, mining for crypto in Canada does have some lucrative merits.

- Not the highest, not the lowest, energy prices in the world. Canadian prices range from around $0.07 CAD to as high as $0.15 and $0.16 CAD depending on the province. The lowest prices are found in Quebec and Manitoba.

- The government up here is quite stable, and usually doesn’t move too quickly.

- It gets cold and stays cold. Mining gets warm with all those computers whizzing away. Being able to use more of the ambient temperatures to cool things down will alleviate the energy costs.

The tl/dr for Crypto in Canada

Firstly, Canada has a number of reputable services that can be used to convert your Canadian Dollars to Bitcoin and other cryptocurrencies. Secondly, buying things with your crypto is considered a barter and taxed as such. Buying and selling crypto directly is seen as capital gains and should be declared accordingly. Lastly, mining crypto in Canada has a good future, but the competition is bound to increase in the near future as regulations catch-up.

––––––––––––––––––––––––––––––––––––––––––––––

*** You should know! I am not an accountant or tax professional. The above is based on research and how I am personally, as a Canadian, navigating buying, trading, and selling cryptocurrencies in True North.

––––––––––––––––––––––––––––––––––––––––––––––

The post The True North Guide to Cryptocurrencies in Canada appeared first on CoinCentral.

Coincentral.com is author of this content, TheBitcoinNews.com is is not responsible for the content of external sites.

Our Social Networks: Facebook Instagram Pinterest Reddit Telegram Twitter Youtube