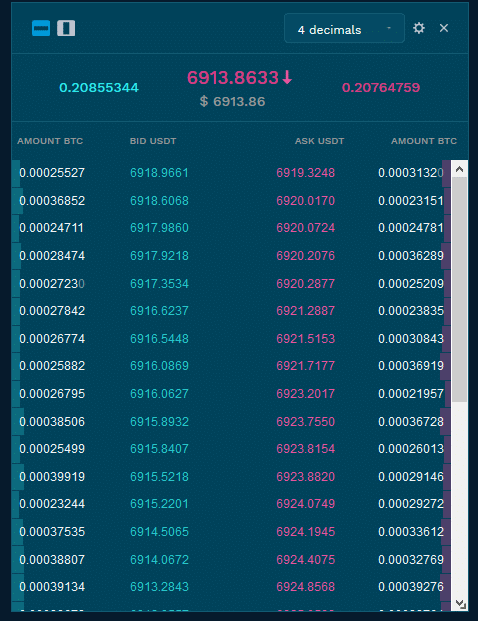

The institutional offering provides clients with 30 levels of depth of book which traders can view. The introduction of this additional liquidity to Trade.io enables its clients to access tighter spreads and better execution rates.

The new offering on Trade.io comes only a couple of months after the exchange launched its peer to peer matching engine. Over the past few months, the firm’s management team has been in consistent talks with several institutions dealing in cryptocurrencies globally.

Before and After

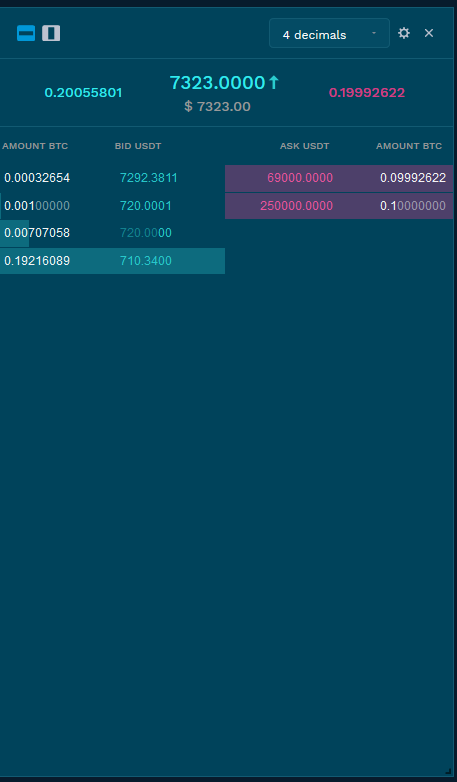

The result from the integration of institutional liquidity on the exchange can be seen on the screenshots below. The first one displays the depth of book picture before the addition of institutional liquidity.

Trade.io market depth before the the institutional liquidity launch

Trade.io market depth before the the institutional liquidity launch

The next screenshot shows the liquidity situation after the event.

Trade.io market depth after the the institutional liquidity launch

Trade.io market depth after the the institutional liquidity launch

The company has formalised its liquidity partnerships after diligently following compliance procedures, leading to a dramatic change in user experience when trading on the exchange.

Suggested articles

B2Broker’s Arthur Azizov: ‘Finteсh Startups Do Not Need to Reinvent the Wheel’Go to article >>

Institutions have been adding liquidity from their clients to the platform, thereby delivering a better market place for all clients of Trade.io. With the depth of book up to 30 levels deep on most of the major pairs, traders have more opportunities to execute deals and see a significant increase in liquidity.

The company is at present transacting between $1 and $3 million worth of trading volume per day.

Trade.io’s OTC Desk Business

The OTC desk is a complimentary offering to the exchange. The entity is focused on larger tickets which are above $25,000 in size. The company is processing trades for clients of the exchange and other customers which haven’t signed up with Trade.io.

The company has several liquidity partnerships aiming to bridge the gap for customers which are trading higher amounts. Clients are contacting the desk and request a quote, place limit or market orders, etc.

The OTC desk is also tasked with matching larger block ticket trades. This type of dealing is executed when both the buyer and the seller are matched together.

Trade.io’s business is therefore diversified between retail size transactions and medium sized orders executed by its OTC desk.

Financemagnates.com is author of this content, TheBitcoinNews.com is is not responsible for the content of external sites.

Our Social Networks: Facebook Instagram Pinterest Reddit Telegram Twitter Youtube