Blockchain has one new supporter: the UK finance minister Philip Hammond. Quizzed at the Conservative Party conference on how the UK government might solve Brexit’s UK-Irish border issue, he suggested that blockchain technology may be a solution.

“There is technology becoming available […] I don’t claim to be an expert on it but the most obvious technology is blockchain.”

He didn’t go into any further detail, but in raising distributed ledger technology (DLT) as one way of facilitating ‘frictionless’ movement between Northern Ireland and the Republic of Ireland, he sparked hope that blockchain could help ensure seamless post-Brexit trade between the UK and the EU, and all without requiring Britain to be part of the European Economic Area or the Customs Union.

However, while there is some potential for DLT to be used in a post-Brexit world, there’s still a very long way to go before solutions involving blockchain tech could be rolled out at scale. And more fundamentally, even though the best blockchains ensure an immutable ledger of transactions, there would still remain the eternal issue of the initial reliability of any data entered into them.

Blockchain borders

“In my assessment there is zero chance that blockchain technology will help deliver a ‘frictionless’ border between Northern and the Republic of Ireland,” Vili Lehdonvirta tells Cointelegraph. An associate professor and senior research fellow at the University of Oxford, Lehdonvirta’s recent research has focused on the application of blockchain to the wider global economy. And while he’s familiar with the promises that have been made on behalf of DLT, he’s sceptical as to whether most of these promises will be realized.

“Blockchain has become this magical buzzword that people like Philip Hammond who don’t know what they’re talking about are pinning all kinds of hopes and dreams on. I think the onus is on the proponents to explain how blockchain tech could possibly help here. For starters, we would need to know what exactly is meant by “blockchain” here. If it means a Bitcoin-style peer-to-peer proof-of-work system, then obviously throughput and latency will be big issues, against what expected benefit?”

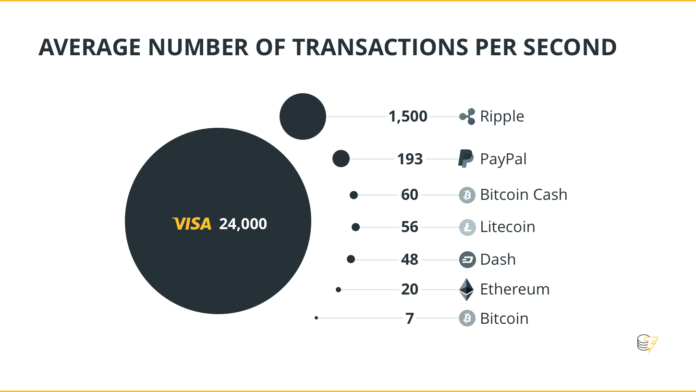

Indeed, scaling is still currently the nemesis of Bitcoin and other proof-of-work (PoW) blockchains (e.g. Ethereum, Bitcoin Cash, Litecoin, Monero), and while improvements have been made in recent months, it’s still hard to imagine a Bitcoin-style blockchain coping with the immense daily traffic the Irish (and every other EU-UK) border experiences. For instance, an average of around 30,000 people cross the North-South border every day for work, while 35% of Northern Ireland’s exports go to the Republic (worth around £4 billion in 2016). This is a hefty amount of traffic, yet peer-to-peer PoW blockchains aren’t particularly scalable compared to existing systems: Bitcoin can handle a maximum number of seven transactions per second (compared to Visa‘s 50,000+), while Ethereum was notoriously backlogged last December in the wake of CryptoKitties‘ popularity.

As for private, or ‘permissioned’ blockchains (which are centralized), Lehdonvirta doesn’t think they hold out much promise either. “If it means IBM-style permissioned blockchain, then that’s essentially just a shared database, nothing particularly groundbreaking about that.”

Not only is this not especially groundbreaking, but there’s currently no indication that a private blockchain is noticeably more efficient or effective than a shared database. “If we’re talking about permissioned blockchains, they have yet to prove that they have any benefits over centralized databases, so I don’t see any benefit there,” says Angus C. de Crespigny, EY’s former leader of blockchain and cryptocurrency.

The only good border is no border

This pessimistic assessment of blockchain’s applicability to cross-border trade is shared by other experts. Gary Barnett, Chief Analyst for GlobalData’s Technology Thematic Research Program says:

“Blockchain technology is not well suited to the processing of cross border trade. It is expensive, complex, and slow.”

As Barnett explains to Cointelegraph, the problem isn’t simply one of technological capability, but of relevance:

“Blockchain only becomes useful or interesting in domains where no single participant in a network can take the role of transaction coordinator. In [cross-border trade], whether importers like it or not, the border authorities can take on that role and mandate that importers use whatever system they choose.”

And more fundamentally, there are deep political tensions which weaken the possibility of blockchain ‘solving’ the Irish border issue. Regardless of how efficient, inexpensive and reliable DLT could be become, Irish people on both sides of the divide are likely to be very unhappy with any kind of customs procedure, after having spent two decades (since the Good Friday Agreement in 1998) getting used to passing freely from one country to the other.

Nick Botton, an expert on trade affairs and digital economies at Landmark Public Affairs (and formerly at the European Center for International Political Economy), tells Cointelegraph:

“The Northern Ireland issue is sadly not one that will likely ever be solved via technology, it’s strictly a political issue at this stage. Even if a blockchain customs border were something that could be developed in the next 5 years, which would be able to handle all customs matters perfectly, a border in either Ireland or between Northern Ireland and the rest of the UK would still be impossible to sell to Ireland and Northern Ireland. A border, whether soft or hard, is still a border, which would require policing, so as to prevent fraud and smuggling. Such an arrangement, whether in Ireland or in the sea, would be rejected by both sides of the Irish Island.”

A border (hard or soft) would most likely revive the memory of living during the Troubles, which was defined by a period of violence and a military presence along the Irish border. “It’s dangerous on all sorts of terms,” Dr Katy Hayward said to Business Insider in April.. “Northern Ireland is a unique situation and its sensitivities need to be respected.”

Fundamental issues

When this issue is widened in scope to include the UK’s future trade and relations with the rest of the EU, the prognosis is slightly better, but there are still serious question marks hanging over just what blockchain can offer that existing solutions can’t.

Digital consultancy group Reply published a report in December called “Blockchain for Brexit,” in which it outlined the areas in which DLT could help with post-Brexit UK-EU trade. “The primary contribution of blockchain here is [to] establish a robust and watertight data trail for goods,” the report’s authors wrote, arguing that such a trail would “reduce the need for inspections at the border.”

However, in its report, Reply notes that several conditions and challenges must be met before such a role for blockchain could be realized:

“In other words, to use blockchain properly, it’s not enough to maintain a record of the origin of an item. You have to have a complete record of all transactions involving the item, including inspections. This means adding to the blockchain at every link in the supply chain.”

Maintaining a complete record like this could be labor-intensive, especially when it comes to processing goods. “For example, when a large animal or fish is cut up into pieces, to be sold to multiple consumers. Blockchain can be used to check that the total weight of the pieces is consistent with the original weight of the whole, but again this assumes that all the pieces are tracked.”

An even more serious issue revolves around the assumption that the data initially entered into a blockchain is reliable. For example, a blockchain could tell you that an orange has come from, say, Spain, and that it hasn’t been tampered with or swapped as it made its way across the supply chain, but it can’t guarantee on its own that the person who first registered it on that blockchain was being truthful about its Spanish provenance. It may have actually come from Portugal, which means that we still have to have additional systems in place for determining the trustworthiness of initial records and entries on a distributed ledger.

Angus C. de Crespigny concurs:

“If we’re looking at public blockchains, a blockchain is only as good as the data you put in it, and to come to an agreement on what data is put in, we need to coordinate people to begin with. Blockchains are regularly sold as ways to coordinate diverse groups of people, however this coordination is a people issue, not a technology issue. Once you can coordinate people, there is almost always a better technology to use than a blockchain.”

Irrespective of whether other technologies are better, they already appear to have a head start over blockchain, thereby reducing the likelihood that the UK government will seriously look into implementing DLT. “HMRC [Her Majesty’s Revenue & Customs, the UK’s tax service] is already in the process of rolling out the first phases of a major digitization program (the Customs Declaration Service),” concludes Gary Barnett, underlining the possibility that Philip Hammond’s remarks may be out of step with the rest of his government.

“[This] represents a multi-year investment of several million pounds, but which effectively extends the functionality of the already existing digital customs system. This could be adapted to cope with the increased volume of customs declarations […] At this stage, adding blockchain technology to the mix would effectively add to the risk and delay the project.”

For the latest cryptocurrency news, join our Telegram!

Cointelegraph.com is author of this content, TheBitcoinNews.com is is not responsible for the content of external sites.

Our Social Networks: Facebook Instagram Pinterest Reddit Telegram Twitter Youtube