While Bitcoin was the first major use case of blockchain, the technology has been nothing short of a FinTech revolution. Peer-to-peer payments evolved into new solutions for trade finance and financial audits, alongside new derivatives like cryptocurrency futures. It’s true that the much-anticipated Bitcoin ETF still seems to be far off gaining the regulatory approval it needs. However, blockchain mutual funds could provide a middle ground for investors wanting to cash in on the blockchain hype without risking their funds on the volatile cryptocurrency markets.

As well as an investment vehicle, blockchain also has the potential to shake up the administration of traditional mutual funds. Additionally, the introduction of blockchain-based digital identities could reduce the KYC/AML burden on fund managers.

Here, we look at all the ways that blockchain converges with mutual funds, and what may be possible in the future.

Blockchain Mutual Funds and ETFs – Investing in the Growth Potential of Blockchain

While many have a strong belief in the future of blockchain technology, investing in cryptocurrencies can be a risky business due to the volatility of the markets. Furthermore, the risks of investing in individual cryptocurrencies are comparable to investing in individual stocks – it’s like putting all your eggs into one basket. Most financial advisers recommend diversification as a means of reducing risk exposure. Therefore, blockchain mutual funds or ETFs are another way of investing in the future of the technology, and both offer potentially lower risk exposure than investing in individual cryptocurrencies.

There are several funds which hold blockchain or related tech stocks as part of their portfolio. Amplify Transformational Data Sharing ETF (ticker BLOK) is one of the biggest with $110m of assets under management. It’s an actively managed fund which commits to having 80 percent of its assets invested in equity securities of companies involved with blockchain. These aren’t blockchain startups though – the fund holds stock in companies such as Overstock, IBM, and Intel.

A similar fund is the Reality Shares NASDAQ NextGen Economy ETF (BLCN), which is more like an index fund and not actively managed. Another one is First Trust Indxx Innovative Transaction & Process ETF (LEGR). Both take a similar approach to the Amplify fund, investing in equities of companies which are focusing on blockchain use and development.

Of course, none of this is investment advice. However, it’s worth noting that the stocks of blockchain companies can fluctuate along with hype about the price of BTC so, as always, do your own research.

Current Model of Mutual Fund Administration

Like so many other financial processes, the administration of mutual funds currently relies on many parties and process steps.

Distribution agents are third-parties, not linked to the fund itself. They work to bring investors into the fund. Transfer agents may be a bank or other financial institution assigned to keep records of investors and their accounts. This role also includes overseeing the payments of dividends and the issuance of statements to investors. Any party who invests in the mutual fund must undergo KYC and AML checks, also performed by transfer agents.

Inevitably, with so many different parties involved in the process of signing up a new investor, there are lengthy transaction times. It usually takes around three to four working days from the point of a new subscription to the point of settlement.

A Blockchain-Enabled Mutual Fund

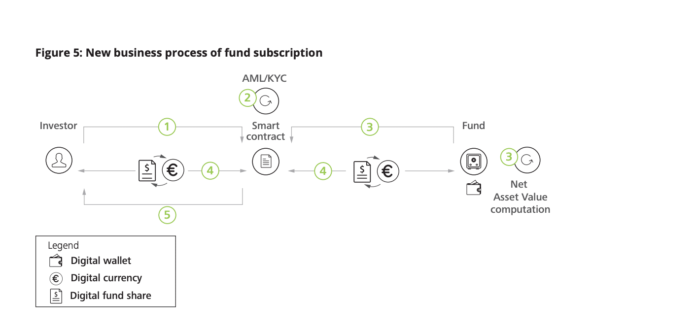

Deloitte has previously done some research into the impact of blockchain on mutual fund administration. The firm’s Luxembourg branch subsequently published a paper detailing how a blockchain mutual fund can eliminate many of the intermediate steps involved in fund subscription. In turn, this substantially reduces processing times.

In the first instance, an investor would need to have a digital wallet. This wallet would hold their digital identity and the digital currency they want to invest in the blockchain mutual fund.

Everyone who subscribes to a mutual fund must undergo a “know your customer” (KYC) and anti-money laundering (AML) check. With a blockchain-based digital identity, there is no need for an external third party to perform these checks. Smart contracts on a blockchain can conduct an electronic KYC/AML check, and then automatically subscribe those investors who successfully pass the check.

The rest of the sign-up can then happen virtually in real-time. The blockchain mutual fund smart contract can also compute the net asset value (NAV) of the investment and process the transfer of digital money in exchange for the fund investment. Customer account balances can be recorded on the blockchain, communicating with the smart contract as needed.

Diagram of the blockchain mutual fund model. Image credit: Deloitte

With a user interface via a smartphone app, the investor can watch their fund balance go up or down. When the time comes to pay out dividends, the smart contract executes the payment automatically, depositing proceeds into the customer’s digital wallet. There is no need for a third party to oversee or intermediate any of these processes because all actions take place automatically through the law of code.

Taking It Further

In a further step, the entire fund management process could eventually become automated using blockchain. The move to security and asset-backed tokens means that, soon, we could see a blockchain-based index fund which rebalances its portfolio all by itself. The blockchain fund could hold digital tokens backed by real-life equities. It would rebalance its portfolio of assets according to rules programmed into a smart contract.

Of course, there are some trade-offs in eliminating humans from the process. Black swan events can happen. Without human intervention, a machine will simply carry on executing regardless of whether markets are behaving unexpectedly.

However, automated fund management offers several potential benefits including very low-fee investing. Passive management of exchange-traded funds (ETFs) has become more prevalent with the evolution of technology.

ETFs have become an attractive investment vehicle precisely because they don’t involve paying a fund management team. This means they offer the potential for greater returns through lower fees. Calastone, a mutual fund transaction network, estimates that implementing blockchain could save over $1.9 billion in the global funds market.

Fully automated blockchain mutual funds are still a long way off. To get there, we need a significantly higher level of adoption than we see right now. However, the financial services industry is rightly excited about the potential that blockchain brings. Blockchain mutual funds are just one possible way in which the technology will transform the investment landscape.

Featured image courtesy of Pixabay

The post Are Blockchain Mutual Funds the Future of Investing? appeared first on CoinCentral.

Coincentral.com is author of this content, TheBitcoinNews.com is is not responsible for the content of external sites.

Our Social Networks: Facebook Instagram Pinterest Reddit Telegram Twitter Youtube