From Friday when the evaluation of the cryptocurrency market cap was $132,557,154,676 at its highest point measured to the lowest level, the evaluation has been today at around $125B we have seen a depreciation of around 7.6 billion dollars.

Looking at the global chat you can see that the consolidative structure which turned out to be a symmetrical triangle was broken to the downside which could indicate that the next major move to the downside has started after some period of consolidation.

Bitcoin’s market dominance has increased consequently and it is currently sitting at 52.4% coming from 51.78% at its lowest point on Friday.

The Cryptocurrency Market

The market is in red today with an average percentage of change among top 100 coins in the last 24 hours ranging between 2-5%. The biggest losers are EOS with a decrease of 7.29% like most of the losers, while out of those who are in green are in double digits like Loom Network which increased by 10.78% in the last 24 hours and Ravencoin with an increase of 12.93%.

Bitcoin Price BTC/USD

From Friday high at $3942 which was the highest point the price has been over the weekend, measured to the lowest point the price has been today at $3782, we have seen a decrease of 4.08%.

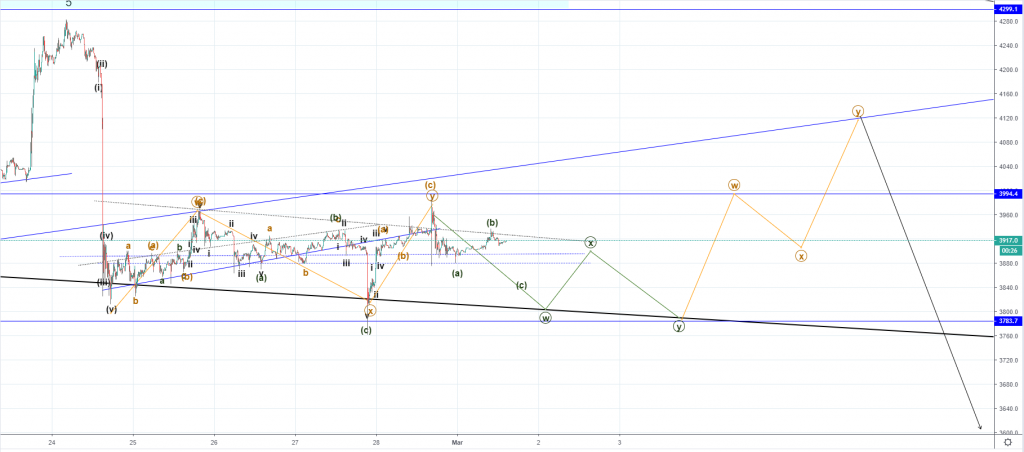

Looking at the hourly chart you can see that my primary count got validated as I was expecting a WXY correction to the downside to the baseline support for a retest of support. As the price has found support there at the intersection between the baseline support and the horizontal support at $3783 like expected we are now most likely going to see another third correction to the upside.

Friday’s projection, primary count:

As you can see from the chart above a third Minute correction which would be to the upside is expected and could push the price significantly higher than the current levels, although not very likely. This is expected as my count implies that this correctional move from the last Monday’s downfall would be the 2nd wave of a higher degree impulse after which further depreciation would occur.

Now that the price of Bitcoin has broken it range in which the correction occurred we could be seeing the start of the expected 3rd impulsive move, which would be trend continuation from the last Monday’s drop. The current wave structure doesn’t look impulsive still which is why I don’t believe that the mentioned 3rd wave has started but we are instead to see another increase before it does.

If the move to the downside did start and this was its first minor wave then we are to see the second corrective wave, which means that in either way from here I would be looking at some temporary upside for the price of Bitcoin before further downside.

Market sentiment

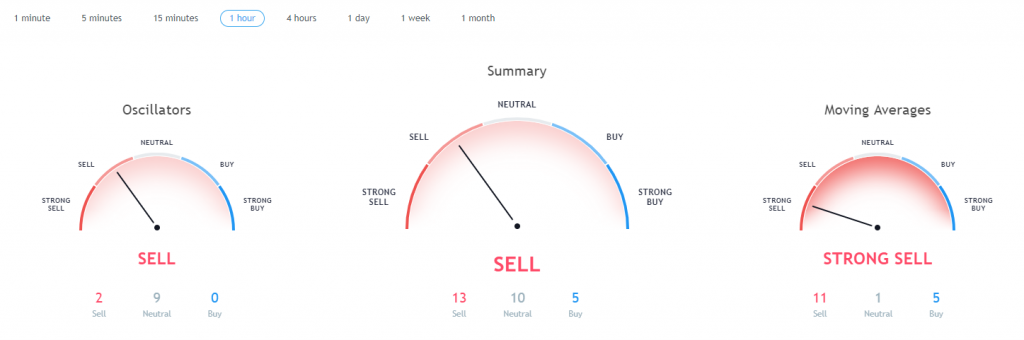

Bitcoin’s hourly chart technical are signaling a sell with moving averages signaling a strong one.

Pivot points

S3 2943.1

S2 3464.3

S1 3688.7

P 3985.5

R1 4209.9

R2 4506.7

R3 5027.9

Conclusion

Now that the price of Bitcoin has started moving again to the downside and is retesting its significant support levels we are going to see if the interaction with that support sets of another recovery or would it be a minor upside correction before the next drop below the significant support which would mark the beginning of another downtrend for the price of Bitcoin and in the market in general.

The post Bitcoin Price Prediction: After Recent Drop is a Larger One Coming? appeared first on Blockonomi.

Blockonomi.com is author of this content, TheBitcoinNews.com is is not responsible for the content of external sites.

Our Social Networks: Facebook Instagram Pinterest Reddit Telegram Twitter Youtube