Cryptocurrency markets have been looking more optimistic but many digital assets are still struggling to surpass upper resistance in order to move forward. On Friday, March 8, trade volumes have increased, showing a quick spurt of renewed energy but market indicators suggest there a few more hurdles ahead.

Also read: An In-Depth Look at Ethereum’s Maker and Dai Stablecoin

Top Cryptocurrencies Wrestle With Sell Walls

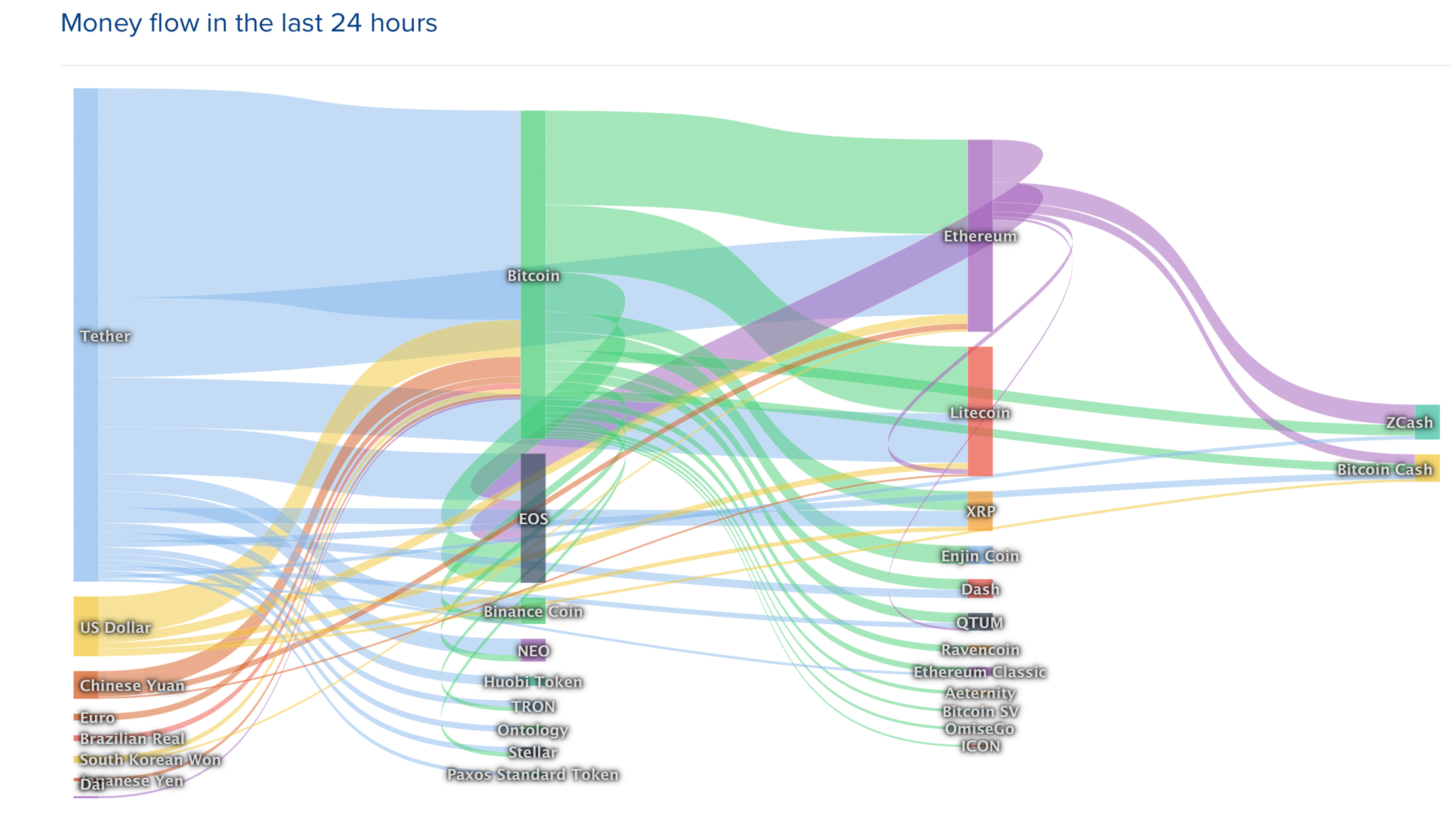

Crypto markets are showing some rigor during this morning’s trading sessions, leading up to the weekend, with many short-term outlooks still bullish. Overall trade volume for the crypto economy has increased today, spiking to $31.1 billion at the start of the day. At the time of publication, all 2,000+ digital assets have a market valuation of around $132.7 billion. Bitcoin core (BTC) markets show prices are hovering around $3,928 and a market capitalization of around $69 billion. BTC is up 1.4% for the week and up about 0.39% over the last 24 hours. The second highest market cap still belongs to ethereum (ETH) where each coin is swapping for $137.

Prices are down over the last 24 hours around 0.63% but ETH is up 0.07% over the last seven days. Ripple (XRP) markets are down 1.15% for the day and 2.55% for the week as each XRP is trading for $0.31 per coin. Litecoin (LTC) is still the week’s top contender as markets are still up over 18% for the week and 0.13% today. Each LTC is trading for $56 per coin and the market cap is roughly $3.4 billion, allowing LTC to command the fourth largest market cap. Lastly, eos (EOS) is up about 4.7% over the last seven days but today the currency is down 1%. At the moment, each EOS is trading for $3.76 per coin.

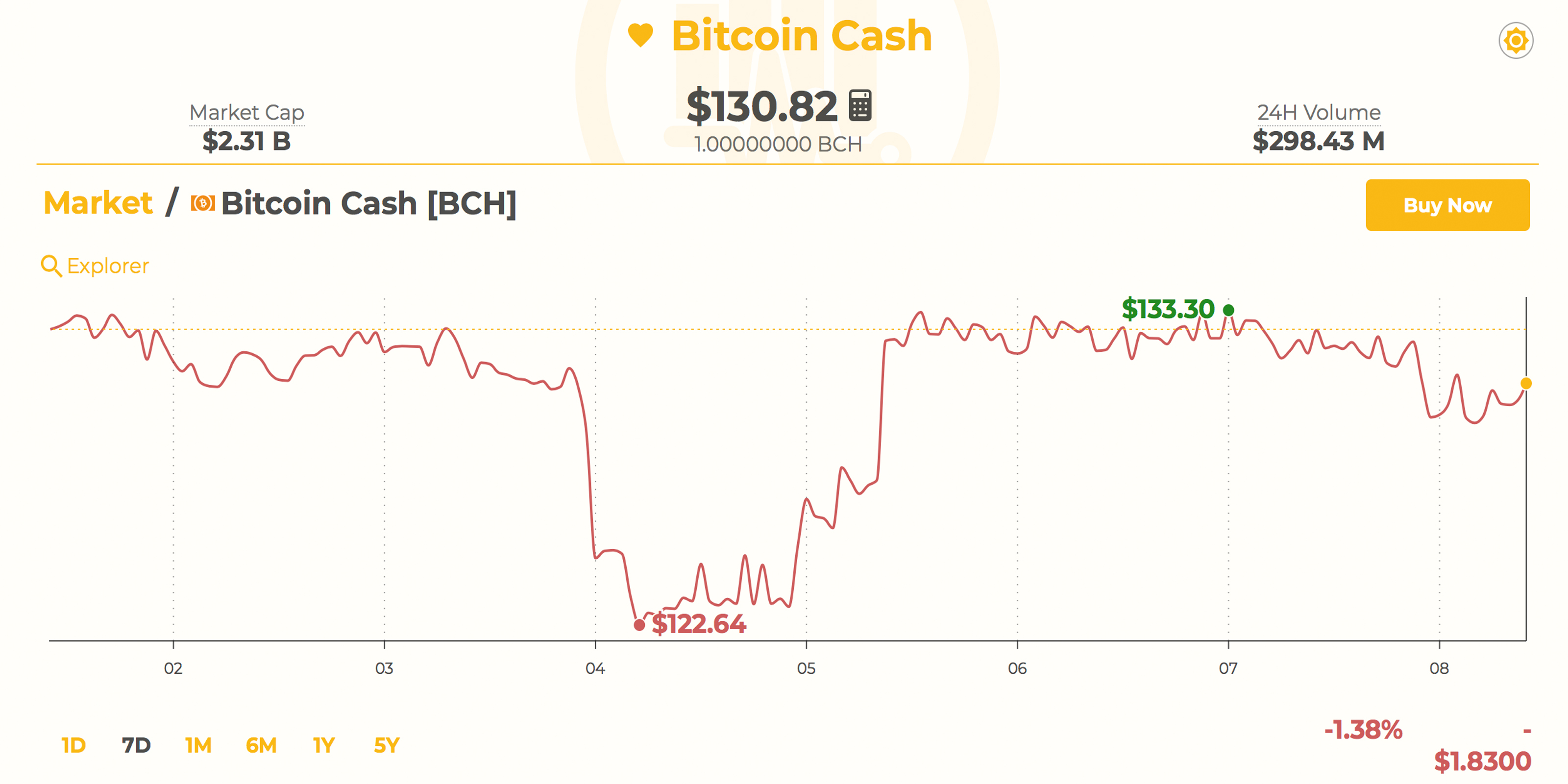

Bitcoin Cash (BCH) Market Action

Bitcoin cash (BCH) prices are hovering around $130 today and buyers are still struggling to break upper resistance above the $145 zone. Currently, BCH markets are down 1.5% over the last 24 hours and 2.2% for the week. BCH commands the sixth largest market cap with an overall valuation of about $2.3 billion this Friday. The top five BCH exchanges today swapping the most volume are Lbank, Bitmart, Binance, Hitbtc, and Upbit.

The trading platform Lbank is capturing the lion’s share of BCH trades with 33% today. ETH is still the dominant BCH pair on March 8 with 36.7% of all trades. This is followed by USDT (31.4%), BTC (24%), KRW (3.21%) and USD (2.98%). Overall, the South Korean won has seen a decent spike in BCH trade volume this week. Bitcoin cash has the eighth highest trade volume today just below neo and above zcash with $298.51 million traded in the last 24 hours.

BCH/USD Technical Indicators

Looking at the short term four-hour chart on Bitstamp and Kraken shows BCH bulls are trying relentlessly to wrestle past resistance but so far they’ve been unsuccessful. Still, the BCH short-term outlook remains bullish and a few indicators confirm some more attempts from persistent buyers on the way. Currently, the two Simple Moving Averages have a nice wide gap with the 100 SMA well above the long-term 200 SMA trendline. This gives traders a positive outlook as the path toward the least resistance is still the upside.

However, the four-hour Relative Strength Index (RSI -44.3) is meandering in the middle indicating uncertainty among traders. During the middle of last week, the moving average convergence divergence (MACd) indicated that a reversal was in the cards and the signal still stands. Looking at the order books show deep resistance up until the $145-155 range and from there BCH bulls could do well up until the $175 range before the next pitstop. We can see on the back side that if bears grabbed the reins they will be stopped at the current vantage point up until $110 per coin and will meet bigger buy walls again.

The Verdict: Optimism in the Midst of Negative Outlooks

Most traders are optimistic things will head northbound for a short period of time but some believe the market will drop again after reaching a certain point. Perennial perma-bear Dr. Doom (Nouriel Roubini) explained in a recent interview with the CFA Institute that BTC will continue to plunge in value and claimed that crypto supporters are fanatical.

“I met some of these individuals, and I must say I’ve never seen in my life people who on one side are so arrogant in their views, who are total zealots and fanatics about this new asset class,” Roubini stated.

Despite some of the bullish indicators, market analyst Jani Ziedins told Marketwatch this week that if BTC continues to struggle below the $4K range, the case for a bull run may evaporate. “Bitcoin continues to hover underneath $4k resistance,” Ziedins wrote. “It wasn’t all that long ago we were talking about $9k support, then $8k and $7k. $6k and $5k followed not long after. Now $4k turned from a floor into a ceiling.”

Ziedins added:

Adoption of cryptocurrency for handling financial transactions is slowing, not accelerating, which puts a devastating dent in the bull case. If BTC turns out to be nothing more than a fad, then the $4k price tag is still incredibly expensive and there is still lots of room to fall.

Still, despite a few negative outlooks, cryptocurrency fans continue to believe another bull run is on the horizon. Just recently, Sharepost published a survey which indicated consumers and investors remain bullish on the future of cryptos.

Where do you see the price of BCH, BTC, and other coins heading from here? Let us know in the comments below.

Disclaimer: Price articles and markets updates are intended for informational purposes only and should not to be considered as trading advice. Neither Bitcoin.com nor the author is responsible for any losses or gains, as the ultimate decision to conduct a trade is made by the reader. Always remember that only those in possession of the private keys are in control of the “money.”

Images via Shutterstock, Trading View, Bitstamp, Coinlib.io, and Satoshi Pulse.

Want to create your own secure cold storage paper wallet? Check our tools section.

The post Markets Update: Cryptocurrencies Struggle to Surpass Upper Resistance appeared first on Bitcoin News.

Bitcoin.com is author of this content, TheBitcoinNews.com is is not responsible for the content of external sites.

Our Social Networks: Facebook Instagram Pinterest Reddit Telegram Twitter Youtube